Image Credit: Alphatradez (Pexels)

Does “Buy the Rumor, Sell the News” Apply to Today’s Markets?

Is the current market selloff a case of “Buy the rumor, sell the news”? The expectation that the upcoming Fed announcement is going to surprise investors with an even more hawkish stance than previously declared is the impetus for the current selloff. The presumed certainty is so great that the market may be positioned for the worst, and have this expectation already priced it in. If the Fed’s position is instead unchanged or otherwise less severe than feared, it could lead to a relief rally.

Background

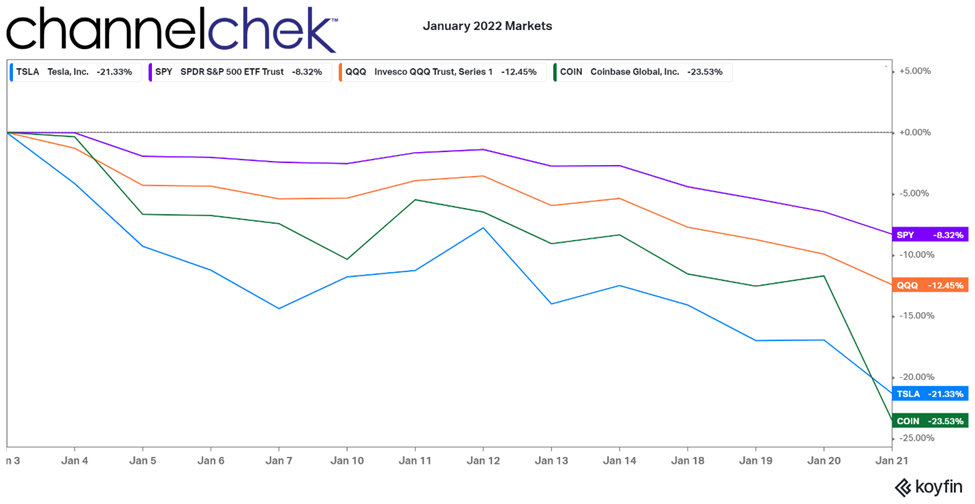

The S&P 500 is down over 8% over the first 24 days of the year, the Nasdaq Index is down 12%, and both have fallen several more percentage points from their highs attained last year. Many highly followed tech stocks have fallen even further. Much of the selloff has been attributed to a hawkish Fed that is planning to raise interest rates to combat rising inflation. A modest increase in rates was expected heading into the new year. The market’s concern is now that the Fed will act with more resolve. The current selloff appears to be fear of the worst case for many sectors of the market, especially those that are impacted most by borrowing costs.

Is Relief on the Way?

If the market’s fears are correct and the Fed ramps up its hawkish rhetoric, will the markets have much further to fall? This risk may have already been substantially reduced with the current price action. If instead, the Fed sets a less aggressive timeline than priced in, many traders will wish they bought at current prices. And for those that are contemplating selling, they may be handed a better opportunity.

JP Morgan’s top equity strategist, Marko Kolanovic says the market correction could be approaching its “final stages.” In a note released this week, Kolanovic said the recent bearishness in stocks is out of line with momentum in economic activity, easing supply bottlenecks, and what JP Morgan expects will be a strong earnings season. “While some are concerned that rising input prices will eat into margins, we expect margins to remain resilient thanks to strong activity and prices outpacing wage inflation,” Kolanovic wrote.

Investor sentiment has turned bearish, causing technical indicators to suggest oversold conditions, “we could be in the final stages of this correction. While the market struggles to digest the rotation forced on it by raising rates, we expect the earnings season to reassure,” Kolanovic explained.

According to the latest AAII Sentiment Survey, bullish sentiment fell to a low not seen since the coronavirus selloff. At the same time, bearish sentiment rose to a 16 month high. For many contrarian investors, that bearish sentiment suggests something between incremental buying and loading up on favorite sectors.

The Fed is in a tough spot and may again use unconventional tools to navigate. If the market continues to decline, it has implications for the overall economy and employment. Should the selloff continue, Kolanovic sees the Fed potentially stepping in with policy changes to stem the decline. “In a worst-case scenario, we could see a return of the ‘Fed

put,'” Kolanovic said.

Fed thinking could be altered by a continued steep market correction which may translate into fewer and smaller interest rate hikes in 2022 or a return to a longer-term tapering. Just as when a quarterback calls a play, the movement on the field may quickly dictate other means of moving the ball toward the goal line. If the Feds plan to fight inflation and maintain a strong economy runs afoul, it certainly has other less aggressive offensive options to implement toward its goal.

Take-Away

As with all things related to predicting economic trends (or even forecasting weather), the expectations never match what is actually experienced. If the Fed is predicting one set of conditions, and it appears that another set is unfolding, they can turn on a dime. The Fed has done this unannounced before. It has also pulled tools from its quiver that have previously gone unused.

The most recent selloff appears to be based on the worst-case scenario; as JP Morgan’s top strategist has written, the economy is growing with very strong momentum.

Is there a better sell opportunity in the near future, is this a buying opportunity? Time will tell.

Managing Editor, Channelchek

Suggested Reading

Will the Fed “Put” Become Worthless?

|

Climbing a “Wall of Worry”

|

The Correlation of Passive Ownership and Underperformance

|

Safe Haven Comparison During Downturns, Bitcoin vs. Gold

|

Sources

https://www.nasdaq.com/articles/vix-etfs-surge-as-stocks-continue-to-tumble

https://www.cnbc.com/2022/01/24/jpmorgans-kolanovic-says-selling-is-overdone-as-stocks-tumble.html

https://www.aaii.com/sentimentsurvey

https://www.thebalance.com/what-does-buy-the-rumor-sell-the-news-mean-1344971

Stay up to date. Follow us:

|