Image Credit: T.Y. (Flickr)

Strong Dollar Investments and the Unique Variables in the Second Half 2022

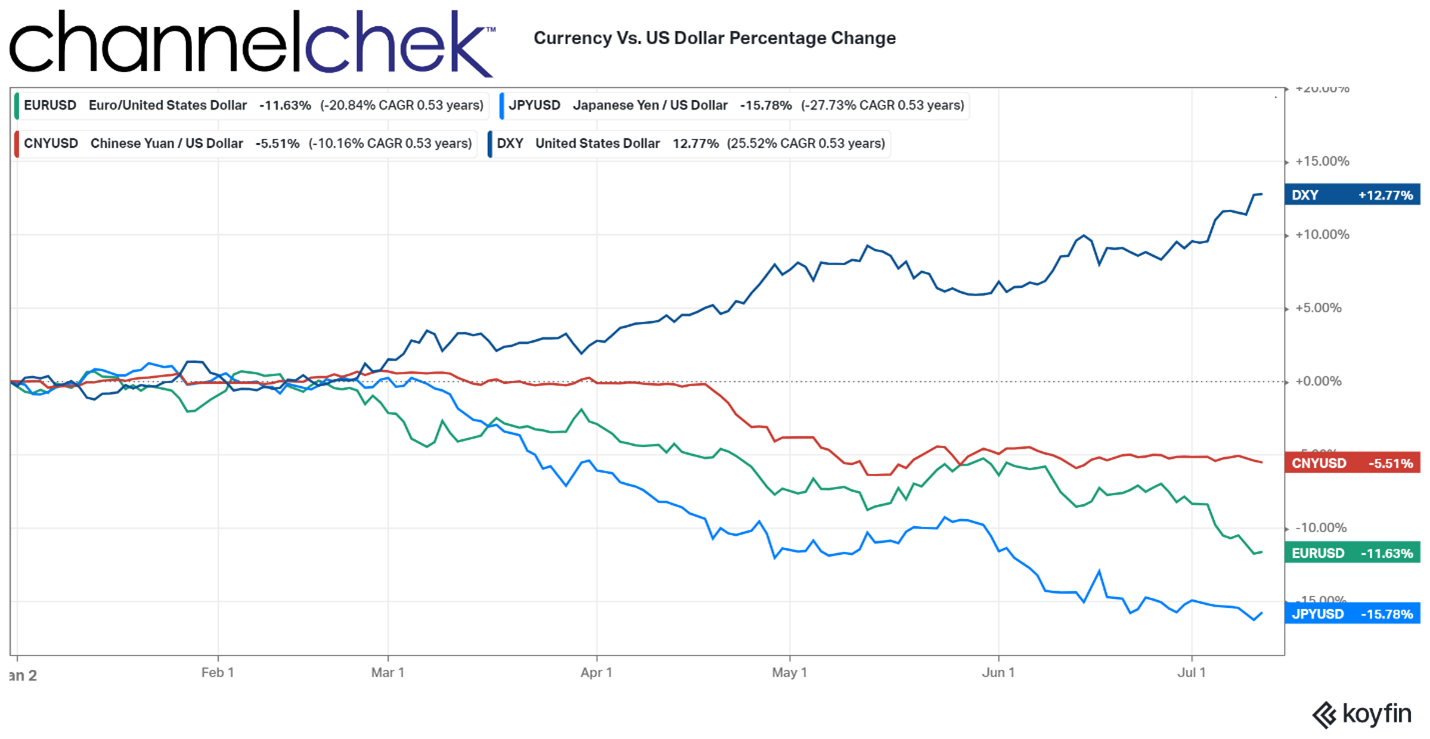

The U.S. dollar has reached parity with the Euro for the first time in 20 years. The 1:1 exchange rate is the result of substantial strengthening of the U.S. currency against much of the world’s mediums of exchange. Year-to date the dollar is up 12.8% against a basket of currencies. This includes the Japanese Yen, which lost 15.8% against the dollar, and the Chinese Yuan, down 5.5%.

Much of the dollar strength can be attributed to the U.S. being more determined to raise interest rates in an effort to stave off inflation. Assets tend to move toward higher interest rates which then tend to fuel a currency’s strength. The Fed has been raising interest rates and has indicated it is resolved to do what it takes to break the inflation trend before it becomes embedded longer term. This is at least the abbreviated explanation I tell friends booking trips overseas this summer. The longer-winded answer is probably more complicated. These complications impact whether investments that normally do well in an upward rate environment should be embraced by investors in today’s rising rate, stronger dollar scenario.

Source: Koyfin

What Else is Behind Worldwide Asset Flows?

There is a lot of uncertainty around the globe. Historically the dollar and dollar-denominated U.S. markets have been considered the relative safest. This safe-haven status brings in money during uncertain periods.

Europe has been slower to tighten policy than the U.S. despite inflation rates. This has been one of the chief causes of Euro weakness. The region has more factors pushing it toward a recession as economic activity is being stunted by the Russia-Ukraine war. This has caused the European Central Bank to delay monetary tightening, thus producing imbalances between holding Euros vs. holding dollars.

Japan, has been using YCC or yield-curve

control as a way to actively manage its borrowing costs across different maturities. At the same time, they are expanding currency in circulation in order to engineer higher inflation to counter their nearly 40 years of deflation. As one of the consequences, the yen recently hit a 20-year low against the dollar.

China, Recurring implementation of a zero-Covid policy continues to dampen any economic gains and weaken expectations of economic growth in the future for the manufacturing powerhouse. This has caused its central bank to further ease policy which has had a depreciative effect on the yuan.

Investors Looking at Unique Variables

What stocks do best with a strong dollar? Well, it may

be different this time. For instance, commodities such as oil most often move in the opposite direction of the dollar. But since late February, the beginning of the European war, the dollar and oil have both been on an uptrend. Commodities-based inflation remains in large part to the impact of the war coupled with commodity supply problems caused by steps taken to reduce Covid19 spread.

A strong U.S. dollar also tends to negatively impact international emerging markets that rely on dollar-denominated debt. These borrowers then have to service this debt in dollar-denominated payments – while the dollar becomes more expensive. The unique set of circumstances today has many emerging market regions in comfortable shape, with ample non-native currency reserves. For example, much of Latin America which supplies fuel, food fertilizer, and metals actually stand to benefit from the global supply shortages.

The uncertain economy and leariness of a recession in the U.S. has caused many U.S. market investors to gravitate toward defensive stocks, retailers, particularly those that are big importers, are seeing more activity.

The Fed Faces with New Challenges

The soaring dollar creates additional confusion for the Fed which is charged with guiding monetary policy. Money flowing into U.S. markets and being parked in U.S. treasuries serves to bring rates down at a time when higher rates are deemed needed.

From an inflation standpoint, imported goods will have reduced price pressure after the currency translation for Americans. The increased purchasing power of consumers and businesses when it comes to imports serves to ease inflationary pressures. But the dollar’s strength will slow U.S. exports and the translation of overseas profits by U.S companies.

Take Away

The old standbys for investors when the dollar is strengthening may not be the best moves this time around. The factors creating the strength are different than most cycles. There appear to be opportunities in companies with operations in Latin America that supply goods being thwarted from other regions.

Cycles always give way to a new phase and the current U.S. dollar strength will eventually give way to a new set of circumstances. Stay in touch with the markets with insight and research you find no place else. Sign-up for daily Channelchek updates in your email.

Managing Editor, Channelchek

Suggested Content

Using Current Dollar Strength to Refine Your Watch List

|

What Stocks do you Buy When the Dollar Goes Down?

|

Michael Burry Uses Burgernomic’s logic to Evaluate the U.S. Dollar

|

The World is Hot Right Now – Panel Presentation NobleCon18

|

Sources

https://www.cnn.com/2022/07/12/investing/euro-dollar-parity/index.html

https://www.morganstanley.com/ideas/thoughts-on-the-market-sheets

https://www.morganstanley.com/ideas/strong-dollar-investing-risks-mount

Stay up to date. Follow us:

|