Image Credit: Amtec Photos (Flickr)

Great Economic News is Spooking the Stock Market, Here’s Why

Any concern that Fed governors may have harbored that they might overtighten at an inopportune time with an already weakening economy probably ended today. The Labor Department’s employment report released Friday gave them the green light. In fact, the Fed may be even more motivated to stick to its aggressive “back-to-the-future” mindset.

Background

The BLS posted its employment report (June 3), which showed the U.S. economy created 390,000 jobs in May. The unemployment rate held steady at 3.6%. Economists had expected fewer jobs created. This provides evidence for them to work from. It confirms that demand for employees is still outpacing supply and hiring remains competitive.

We’re in a period of stock market history where good economic news is bad news for stocks and bonds and bad news provides relief for markets. In the case of this report, it likely means the Federal Reserve remains on track to raise its key interest rate by 0.50% in June, July, and possibly September.

While job growth has slowed from the 500,000-plus average pace year-over-year, the Consumer Price Index is running at over 8%. There is agreement both from the current Administration in Washington and among market pundits that soaring prices are a huge concern for the nation. President Biden went on record this week in an op-ed posted in the Wall Street Journal and a meeting he had with Fed chair Powell that price increases have caught the attention of the White House.

Good vs. Bad Definitions

Payrolls are still 822,000 below their pre-Covid 19 levels, and the overall jobless rate is only 0.1 percentage point above where it stood in March 2020. At any other time, monthly payroll gains over 200,000 would be considered a strong labor market. In addition, the latest Job Openings and Labor Turnover Survey for April, reported earlier this week, showed 1.9 job vacancies for every unemployed person. This means there are almost two jobs for every job seeker.

The markets sold off on this news. Both the Nasdaq dropped by well over 2%, the S&P by 1.5% and the small-cap Russell 2000, and large Dow Industrials by less than 1%. The reason they are selling off on economic strength is it means rising interest rates becomes more certain. The higher rates will provide better fixed income choices for investors and increase costs for many businesses that will be borrowing at the higher rates.

Other Concerns

At the same time, the Fed has begun the process of winding down its $8.5 trillion dollar balance sheet. The employment data suggests monetary tightening is only just beginning, and businesses face greater headwinds.

The reduction of the balance sheet requires the Fed to allow bonds it owns to mature without the Fed reinvesting alike amount. For June (already accomplished) and July, the Fed is letting $47.5 billion mature without reinvesting. The needs of the U.S. Treasury have changed little so it will have to find new buyers for new bonds near this amount.

Take-Away

Bad economic news is usually bad for equities. Currently, the market is looking for the Fed to have a reason not to raise rates and drain money from the economy. Today’s unemployment number may have emboldened the Fed to act aggressively. The stock and bond markets also are mindful that less money in the economy means fewer investment dollars. The price of anything is a balance of scarcity. As dollars become more scarce asset prices may also retreat.

Managing Editor, Channelchek

Suggested Content

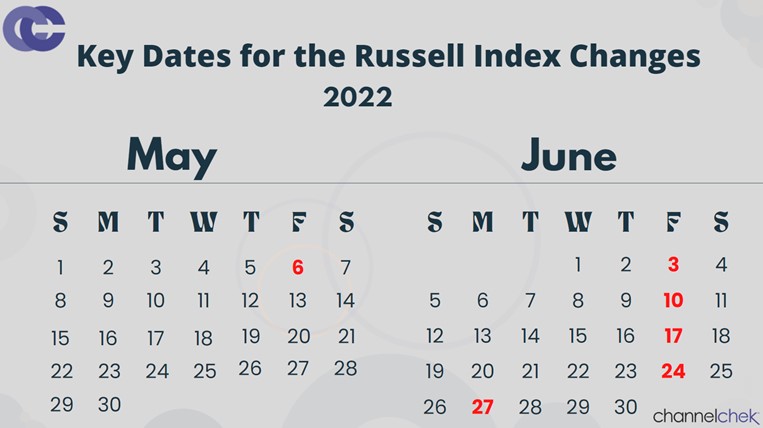

Investors Keeping Their Eye on Fridays in June

|

The Annual Russell Index Revision and Dates to Watch (2022)

|

The Battle Between Bull and Bear Has Become Intense

|

Has the Fed Run Out of Good Options?

|

Sources

https://www.bls.gov/news.release/empsit.nr0.htm

Stay up to date. Follow us:

|