Variables That Will Affect Energy Production Growth Through 2021

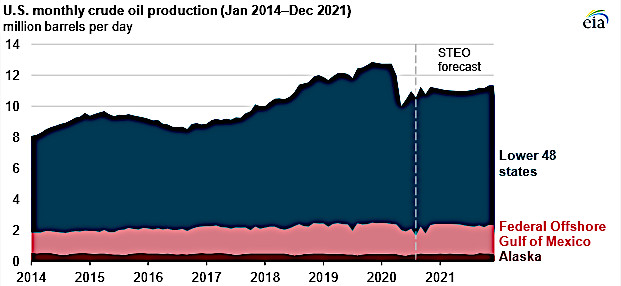

Energy prices may be less volatile than in the past, based upon the U.S. Energy Information Administration (EIA) Short-Term Energy Outlook (November release). The report calls for domestic oil production to remain at current levels through 2021. Current levels are near 11.0 million barrels per day (mmbd) and significantly below the peak levels of 12.9 mmbd of November 2019 and pre-COVID levels of 12.7 mmbd.

At the same time, the EIA is projecting flat production; it expects West Texas Intermediate (WTI) oil prices to increase from a 2020 average of $41 per barrel to a 2021 average of $47 per barrel. Expectations are for domestic energy companies to have shortened their time frame for making drilling decisions and production levels to react to price changes quicker. Of course, making long-term predictions is difficult and depends on several “best-guess” variables. Here are some of the variables that will have an impact on 2021 oil prices and production levels.

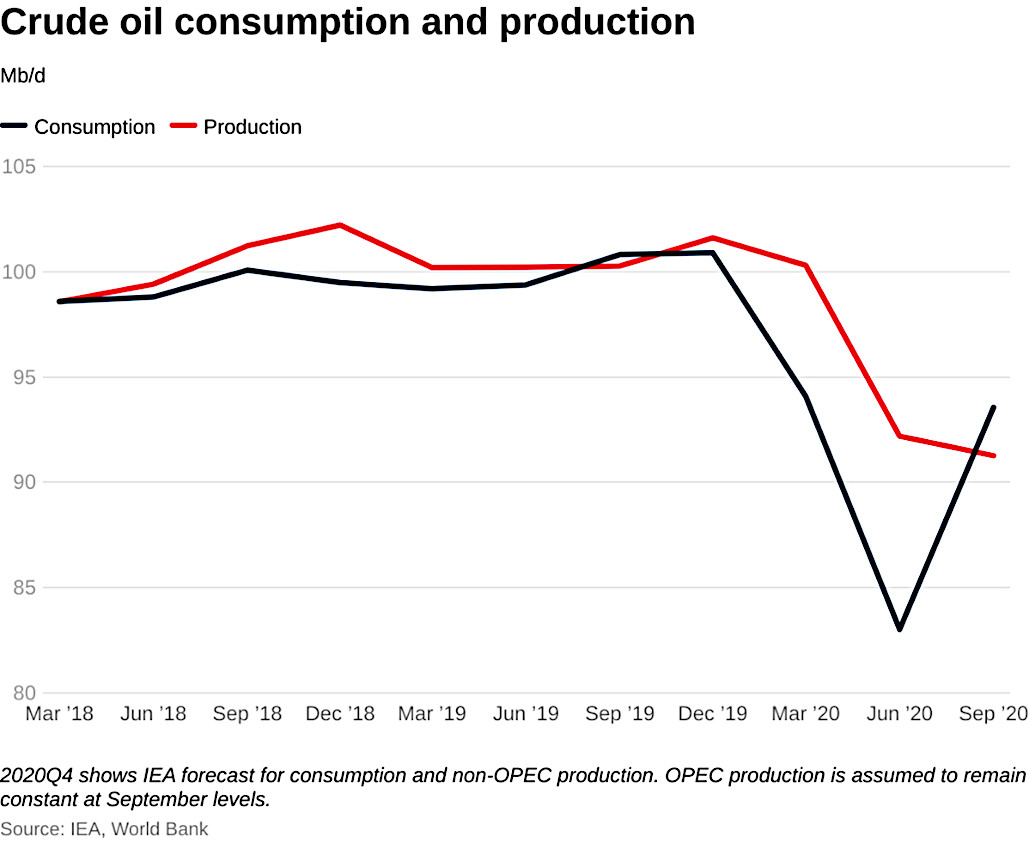

COVID-19. The pandemic has a significant impact on both the demand and supply of oil. Analytical firms such as Rystad Energy AS and Trafigura Group estimate that global economic weakness associated with COVID-19 has reduced world oil demand by 27-33 mmbd (27-33%). The reasons are clear. People are not driving cars as much to commute to work or shop. Vacation and business travel have been put on hold, so there is less demand for jet fuel. The figure below shows that the largest demand declines are being seen in the United States and Europe. The pandemic also affects oil supply. Restrictions on gatherings and curfews can delay drilling and the ability to build the infrastructure (roads, electricity, water transportation) needed to drill.

OPEC Plus. When oil demand vanished last spring, OPEC Plus reduced production to offset the drop in demand. The latest pronouncements by OPEC call for supply cuts to begin to ease, although there is talk that they will be extended at the November 17 meeting in response to growing global COVID concerns. That said, OPEC Plus is tired of restricting production and could release supply in response to the rise in demand that occurred in the September quarter.

Domestic Producers. U.S. and Canadian producers have also cut back production in response to lower prices. Historically, management set their drilling budgets at year-end and had the budgets approved by their board of directors. In recent years, boards have become more flexible and granted management the ability to ramp up or ramp down drilling depending on prevailing energy prices. Most energy management has a long list of wells they would like to drill and are chomping at the bit to drill if energy prices justify the drilling costs. Consequently, domestic energy companies have become more reactive to energy prices. In addition, the use of horizontal drilling and fracking have accelerated the rate of extracting energy. This has moved production to the earlier years of a well’s life, making the supply response to energy price changes more pronounced.

Conclusion. There are many variables coming into play that will affect production levels. We believe those variables have become more sensitive to changes in energy prices and any significant change in energy prices will be quickly met with a supply response. The result will be that energy prices, especially oil prices, will be less volatile than in the past. That stability will translate into flatter production levels, both domestically and globally.

Suggested Reading:

Energy Industry Report 3Q 2020

Will There be Mergers in the Utility Industry

Interest

Rates Impact on Investment Sectors

Sources:

https://www.eia.gov/todayinenergy/detail.php?id=45916#, U.S. Energy Information Administration, November 17, 2020

https://www.eia.gov/outlooks/steo/report/global_oil.php, U.S. Energy Information Administration, November 10, 2020

https://economictimes.indiatimes.com/markets/stocks/news/how-the-pandemic-wiped-out-oil-demand-around-the-world/massive-impact/slideshow/75091835.cms, Bloomberg, April 11, 2020

https://blogs.worldbank.org/opendata/oil-market-outlook-lasting-scars-pandemic, Peter Nagle, World Bank Blogs, October 27, 2020