image credit: Esther Vargas (flickr.com)

Tweets, Tips, and Taxes

It isn’t news at this point that Twitter instituted what they’re calling a “Tip Jar.” This was announced on Twitter’s Blog on May 6, by Esther Crawford. Ms. Crawford wrote, “You drive the conversation on Twitter, and we want to make it easier for you to support each other beyond Follows, Retweets, and Likes. Today, we’re introducing Tip Jar – a new way for people to send and receive tips.”

About the

Feature

This new tipping feature has been rolled out in English to a test group to start. It invites users to enable a tipping method (Spaces, Bandcamp, Cash App, Patreon, PayPal, or Venmo). This opens the door for those that have a reason or desire to financially support a Twitter account owner to do so if that owner has invited payment by opening a “tip jar” the method of payment is already orchestrated by Twitter.

Shortly after launching this feature, there were a few bugs to work out regarding privacy and disclosure of the tipper’s information. That has been adjusted — this is why companies choose slow rollouts and only invite some customers to test new features or products.

How Tippees May

Be Taxed

One possible impact Twitter users should understand is; if the account owners are opening this window with the expectation of getting paid for “driving the conversation,” this money may be subject to income taxation? If it is, it has the potential to alter users’ tax brackets, perhaps reduce or disallow any new stimulus payment, impact Social Security, break employers rules on outside work, child support, and a long list of others.

My primary interest is, under what circumstances could this be a taxable event. I reached out and asked Thomas W. Aldous Jr., JD, of Fennemore Law. Mr. Aldous practices Trust and Estate law and holds a Master of Laws (in taxation) from NYU. My question was simple “Are payments over a certain amount to the new Twitter Tip jar taxable?” Like most everything involving the IRS and relevant laws, the answer was not simple.

The Tipping Point

Mr. Aldous response to Channelchek is worth every taxpayer understanding. He explained:

“Amounts you receive for services are taxable. It does not matter whether you are self-employed or if you are an employee.

Amounts received as a gift are not income.

The motivation of the person giving money must be considered. Yet, if someone looking objectively at the circumstances can see that a “gift” is not really a gift, it does not matter what the parties claim. Per the US Supreme Court, a judge or jury can use ‘informed

experience with human affairs’ to determine what is or is not actually a gift.

For example, Friend and Businessman are friends. Friend occasionally gives Businessman the names of persons who might be interested in Businessman’s products. Friend’s referrals benefit Businessman’s business. After a while, Businessman tells Friend that he wants to give Friend a new car as a gift. Friend does not want or need another car. He initially rejects the car, but with Businessman’s insistence Friend eventually accepts the car. Businessman deducts the gift as a business expense. Friend believes the car is a gift. In this situation, informed experience with human affairs indicates that Businessman’s gift to Friend was actually compensation for the referrals. The car is income to Friend.

Tips may look like gifts. They are given voluntarily for a service rendered. They are over and above an obligation. However, in practice, tips are often customary and expected. Per the IRS regulations, tips are taxable income.

If L tips his barber X dollars each time he gets a haircut, L’s barber would include the tip in his income. If L gives his barber an additional Y dollars for the barber’s birthday (on top of L’s regular tip), that should be treated as a gift and not taxable income.

Twitter uses the term “Tip Jar”. With a payment through the Twitter Tip Jar, one should start with the assumption that any amounts received are taxable. There is no hard and fast rule, but if someone is requesting and receiving tips on Twitter to support their efforts, most likely any tips that person receives will be taxable income. Unless there is some type of charitable purpose, saying “this Tip Jar is for gifts only” is probably not going to turn “tips” into “gifts.”

Take-Away

We don’t live in a vacuum; everything has consequences. The internet and social media have created brand new sets of circumstances we never had to consider before. In the case of Twitter’s add-on feature, an innocent acceptance of payments from those who appreciate what you provide may alter your income in ways that have unintended consequences.

I now wish I had followed up my question with Thomas Aldous, I’d have asked, “if I receive tips from those that appreciate the value of my tweets, might I take write-offs on the cost of my computer and office space?”

Managing Editor, Channelchek

Suggested Reading:

|

|

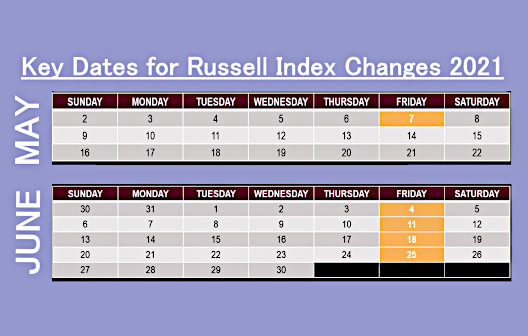

The Russell Index Reconstitution, What to Know

|

A Look at Real Estate Risks to the Stock Market

|

|

|

TAXES – Do You Pay More Than Your Fair Share?

|

Long Term Retirement Money and Fledgling Companies

|

Stay up to date. Follow us:

|

|

|

|

|

|

Sources:

https://blog.twitter.com/en_us/topics/product/2021/introducing-tip-jar.html

Special Thanks and appreciation to Thomas

Aldous of Fennemore Law.