What Do Banks and Financial Executives Think of Blockchain and Digital Assets?

The accounting firm Deloitte Touche Tomatsu surveyed a global array of senior executives during the early Spring of 2021. The intent was to gather information on their thoughts of blockchain and digital assets and make available perceptions and expectations that could shape the future. A total of 1,280 senior business leaders worldwide were surveyed; all had at least a general understanding of blockchain. The 28-page report focuses on how organizations are harnessing blockchain’s capabilities with a further emphasis on financial applications such as crypto assets, industry value, and banking services. From this data, a trend and clearer picture of the future is painted.

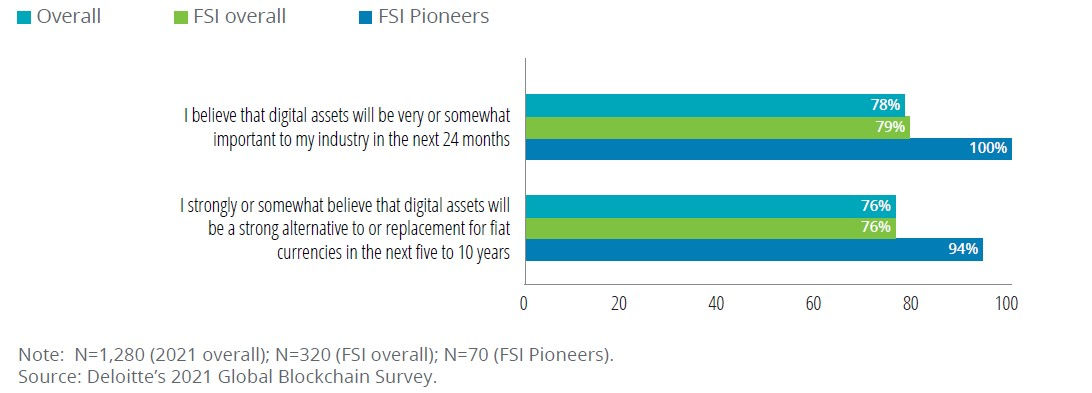

The overall finding was that among the financial services industry (FSI) respondents, about 80% say digital assets will be “very/somewhat important” to their industry over the next 24 months. More than 75% of all respondents feel they’ll be at a disadvantage competitively if they fail to adopt blockchain and digital assets.

The 2021 Global Blockchain Survey was Conducted in 10 Locations (1,280 Respondents)

Source: Deloitte’s 2021 Global Blockchain Survey

How Do Financial Executives View Blockchain and Digital

Assets?

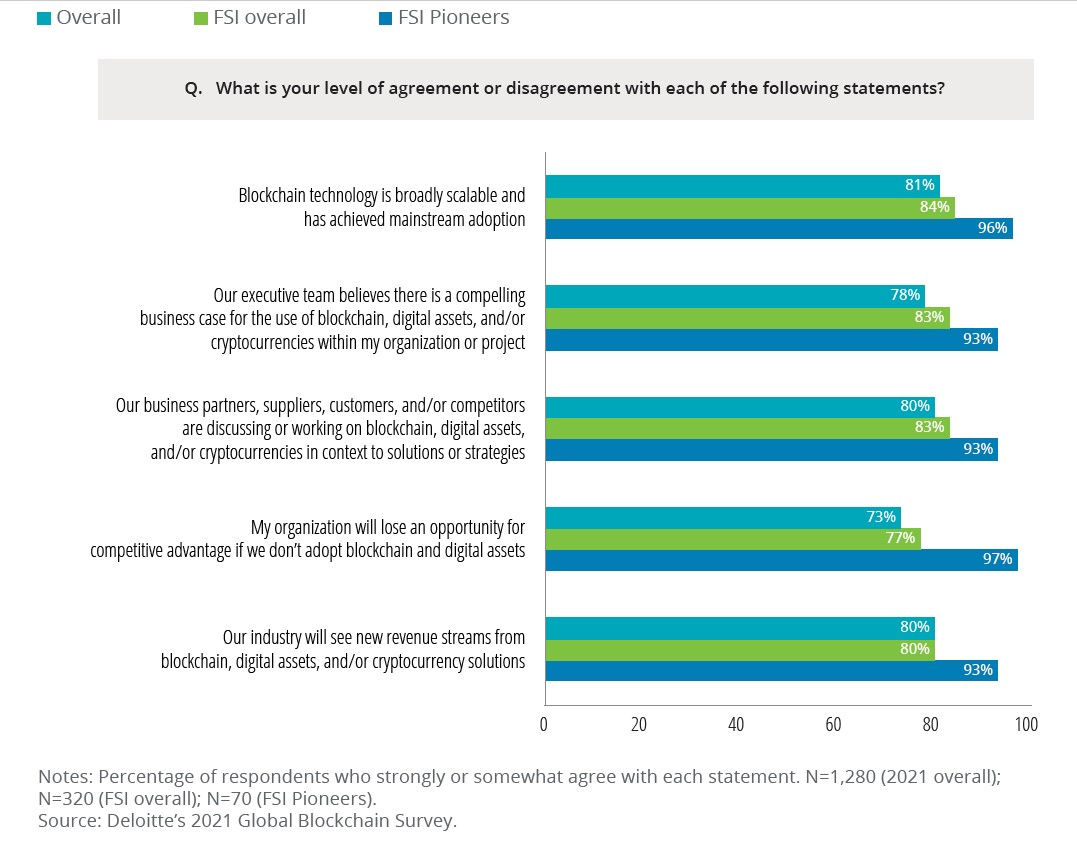

The respondent categories are broken out into three segments. The Overall includes everyone, FSI Overall, and FSI Pioneers. Deloitte defined the FSI Pioneers this way, “…have deep convictions about the potential that blockchain and digital assets offer.” Across all three groupings, there was strong agreement of the importance of blockchain and digital assets.

Source: Deloitte’s 2021 Global Blockchain Survey

The Future of Digital Assets

It would make sense that the FSI Pioneer category would be near “all in” on their convictions. When it comes to importance to the industry or whether digital assets will be an alternative fiat, the Overall and FSI Overall demonstrated only 76% agreed.

Source: Deloitte’s 2021 Global Blockchain Survey

Barriers

Approximately 60% of the overall respondents and 70% of the FSI Pioneer category pointed to regulatory barriers as the largest obstacle of digital assets. Cybersecurity is also of great concern to the larger Overall group, with 71% responding that it is a big obstacle. Privacy was of least concern to the overall group, with 59% considering it a big concern, whereas almost 70% of the FSI Pioneers had privacy concerns.

Greatest Impact

The survey reflected optimism about future revenue opportunities from providing solutions for digital assets and blockchain. FSI Pioneers once again are strong believers, with 93% strongly/somewhat agreeing versus 80% of Overall respondents. In order to capture these revenues, financial services firms can’t sit idle; they must adapt and reinvent how they do business. If they don’t, the concern is they won’t capture the potential for revenue, and they will instead see a drain on old business lines.

The evolution of the financial services industry is picking up speed. Blockchain is seen as a way among many business leaders, particularly those the survey categorized as pioneers, as a way to gain a competitive advantage. The winners will be those most flexible, they don’t have to invent any new path, but quick adaptation could be the difference between thriving and not.

Suggested Reading:

Decentralized Finance, Is It the Future

|

Decentralized Apps (“Dapps”) Using Blockchain to Change the Internet

|

The Coinbase Nasdaq Listing Offers a Diversified Equity Investment in Crypto-Growth

|

Cryptocurrency Gaining Acceptance by Banks

|

Source:

Deloitte’s 2021 Global Blockchain Survey

Stay up to date. Follow us:

|