image credit: William Stewart (flickr.com)

Prices are Rising on Rare Earth Elements – Companies Scrambling to Take Advantage

What are Rare Earth Elements (REEs)?

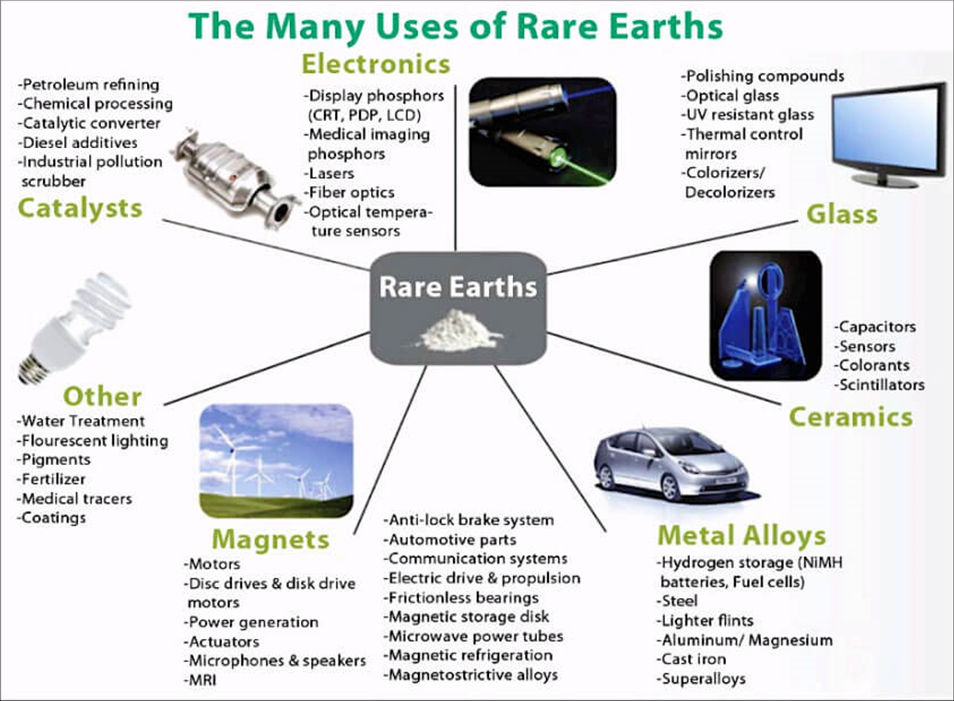

Rare Earth Elements are 17 silvery-white heavy metals with special magnetic capabilities. REEs have diverse applications and are commonly used in lasers, glass, superconductors, hard drives, wind turbine generators, and magnetic materials. Despite the name, REEs are abundant in the world, often found underground alongside uranium in sand structures called monazite. REEs concentrate must first be separated from the sand. Neodymium and praseodymium (NdPr) represent about 80% of the value of REE concentrate. Demand for these elements is growing because of their use in electric vehicles, wind turbines, and appliances. Adams Intelligence expects the demand for NdPr to double in the next five years. Removing REEs from monazite and then separating REEs into individual components is a complicated process.

Who is Processing REE Concentrate?

Monazite represents 60% of the world’s REE supply and is readily available. A handful of companies are currently involved in the removal of REE concentrate from monazite. The Mountain Pass Mine, an open-pit mine located southwest of Las Vegas and owned by MP Materials, supplied 16% of the world’s RRE concentration production. It ships 50,000 tonnes of concentrate per year to China. Energy Fuel’s White Mesa Mill in Utah began processing REE concentrate last November and is in the process of ramping up operations. The company has signed an intake agreement to acquire 2,500 tonnes of monazite sands from Chemours Company and another intake agreement with Hyperion to purchase an undetermined amount of sand. The company has stated a goal of processing 15,000 tonnes annually. Energy Fuels has also signed an outtake agreement to provide REE concentrate to NEO Performance Materials and expects to supply 840 tonnes of REE oxides per year (80% of Energy Fuel’s contract with Chemours) which implies that REE concentrate represents approximately 40% of the monazite sand.

Who is separating REEs?

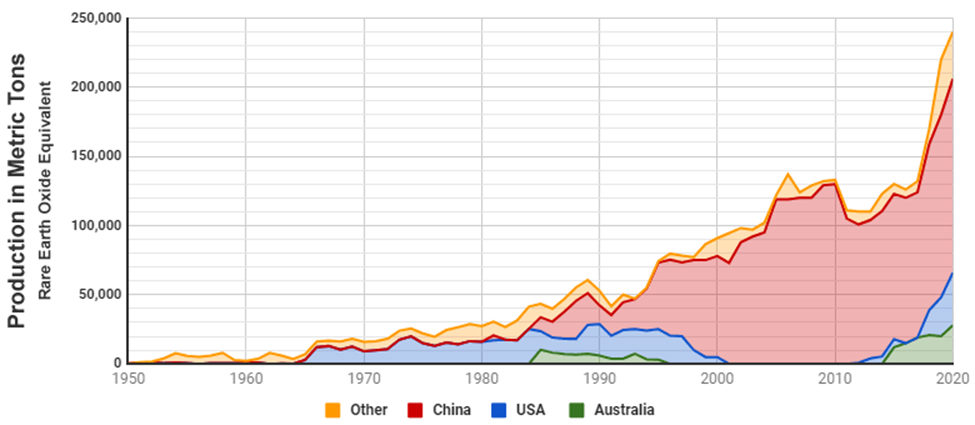

China is responsible for 80% of the REE produced in the world. Most of the world’s separation is done by a single plant in China owned by Shenghe Resources. The United States dominated the REE market as recently as the eighties but has fallen back in recent years. China has advantages over other REE producers because of lesser environmental restrictions. Lynas Corporation, an Australian mining company, owns a separation facility in Malaysia and is planning to build plants in Australia near its Mt. Weld mine and the United States. NEO Performance Materials owns an REE separations facility in Estonia (Silmet), which also supplies uranium and enriched uranium to Russia. Several other participants have recently announced plans to begin separating REE. MP Materials plans to produce 5,000 tonnes of the two most common rare earth metals at its mill near Las Vegas. Medallion Resources has announced plans to build a plant that would produce approximately 3,500 tonnes of rare-earth products. Australian Strategic Metals has announced plans for a plant in Dubbo, Australia. Energy Fuels has stated its intent to separate REE and recently engaged Carester SAS, a leading expert in REE separation, to develop extraction operations at its White Mesa Mill in Utah. In March 2021, the Department of Energy announced a $30 million initiative to research and secure the U.S. supply chain for REE and recently awarded a $1.75 million grant to Energy Fuels for a rare earth feasibility study.

Financial Impacts of Mining, Milling, and Separating REEs?

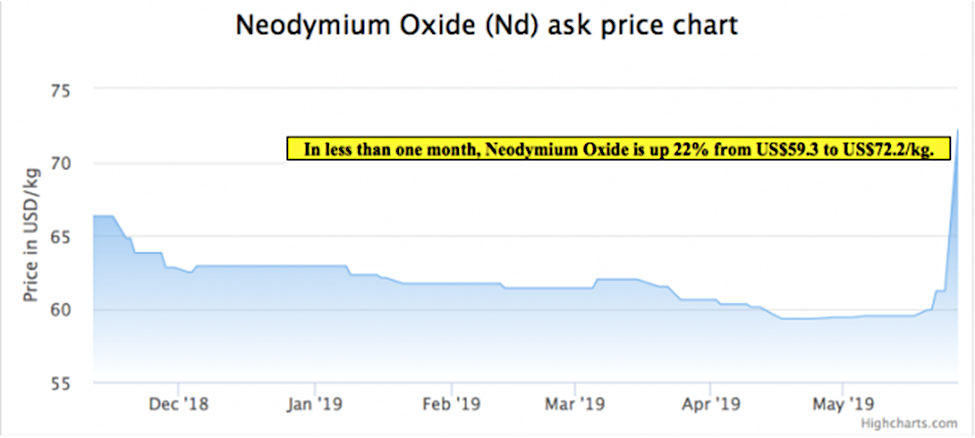

Putting financial numbers into operations is difficult. Many companies report REE operations as a subsidiary and do not provide full financial results. Other companies are private or government entities. Finally, both REE pricing and input costs can be very volatile and subject to trader influence. Still, some very vague generalizations can be made. Lynas financial reports show that REE prices have risen in recent quarters to a level near US$50/kg, or US$50,000/tonnes. With demand growing for REE with the growth of electric vehicles, wind power, and other products that use REE, it is reasonable to believe prices could continue to rise. Estimating the input and operating costs to separate REEs is more difficult because the concentration of REE in monazite is not consistent. Lynas reports Cost of Sales that are close to 75% of revenues implying concentrate costs of US$37,500/tonnes at current REE concentrate prices near $50,000. If one extends the reported financial results of Lynas to REE separating, in general, that will imply that a separator could generate $12,750 per tonnes of REE separated.

Suggested Content:

|

|

Supply and Demand Fundamentals for Platinum and Palladium

|

How do Gold Royalty Companies Work?

|

|

|

Natural Resources Panel – NobleCon Video (January 2021)

|

US Rare Earth Mining Gets Boost From Government (August 2020)

|

Sources

https://www.mining.com/a-new-magnetic-way-to-separate-rare-earths/, Valentina Ruiz Leotaud, Mining.com, November 3, 2019

https://en.wikipedia.org/wiki/Mountain_Pass_mine

https://en.wikipedia.org/wiki/Rare-earth_element

https://www.cnbc.com/2021/04/17/the-new-us-plan-to-rival-chinas-dominance-in-rare-earth-metals.html, Samantha Subin, CNBC, April 17, 2021

https://www.reuters.com/article/us-usa-rareearths-insight/american-quandary-how-to-secure-weapons-grade-minerals-without-china-idUSKCN2241KF, Ernest Scheyder, Reuters, April 22, 2020

https://en.wikipedia.org/wiki/Silmet

https://medallionresources.com/wp-content/uploads/2019/03/MDL-FactSheet-March-2019.pdf

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|