Why S&P Global Ratings Dropped Its Alphanumeric ESG Ratings

As evidence that new concepts need to go through a cycle and find their place, S&P Global Ratings has stopped including environmental, social, and governance (ESG) ratings on its reports. S&P Global Ratings is the credit ratings division of Standard & Poor’s. The division specializes in providing company-sponsored research, analysis, credit ratings, and data to assist investors in evaluating the creditworthiness and risk associated with financial instruments and entities.

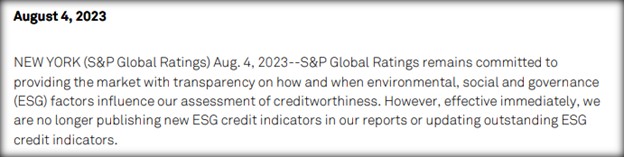

In an official press release titled, S&P Global Ratings Update On ESG Credit Indicators released this month. The prominent and perhaps best-known Nationally Recognized Statistical Ratings Organization (NRSRO) revealed its decision to discontinue the publication of new ESG credit indicators, and will not be updating those ESG scores previously determined.

S&P defines ESG credit indicators as “those ESG factors that can materially influence the creditworthiness of a rated entity or issue.” The rating agency said in the release that it had initially begun publishing alphanumeric ESG credit indicators for publicly rated entities in some sectors and asset classes in 2021. “These indicators were intended to illustrate and summarize the relevance of ESG credit factors on our rating analysis through the use of an alphanumerical scale,” the agency added, “They supplemented the narrative paragraphs in our credit rating reports where we describe the impact of ESG credit factors on creditworthiness.”

It has been just two years, and S&P has changed its reporting, if not its methodology. The release explained that after further review the “dedicated analytical narrative paragraphs in our credit rating reports are most effective at providing detail and transparency on ESG credit factors material to our rating analysis, and these will remain integral to our reports.” So there is no separate breakout rating, but to the extent that an ESG related factor could impact creditworthiness, S&P will include the discussion in its write-ups, and it will be reflected when appropriate in an institutions’ security ranking.

S&P Global was clear that the immediately implemented policy does not affect its ESG principles criteria or its research and commentary on ESG-related topics, including the influence that ESG factors may have on a companies ability to pay interest and return principal.

Fitch Ratings, chief credit officer, Richard Hunter told Pension and Investments that: “Fitch believes that there are profound limits to what text disclosures can do for investors monitoring an entire portfolio of hundreds of serviced issuers and bonds. This is the second time in less than amonth that the two NRSROs demonstrated very different methodologies. After Fitch Ratings downgraded U.S. backed Treasuries and other obligations, S&P said they would not unless the U.S. was going to miss a payment.

To round out the big three institutional rating agencies, Moody’s said in a statement that it “incorporates all risks, including those related to ESG, into its credit ratings when they are material, and also publishes ESG scores on a 1 to 5 scale.”

Take Away

The definitions, overall landscape, and actions taken to support sustainability are evolving. S&P Global Ratings’ decision to not separately rank obligors is a strategic recalibration in its presentation of ESG factors that may impact an entities ability to pay. It believes the credit factors don’t warrant a separate carve-out within their reports – and that clarity and assessing creditworthiness is best discussed and not boiled down to an alphanumeric rating for use by investors.

Managing Editor, Channelchek

Sources

https://www.spglobal.com/_assets/documents/ratings/esg_credit_indicators_mr.pdf

https://www.pionline.com/esg/esg-scores-ended-sp

https://www.marketplace.spglobal.com/en/datasets/s-p-global-esg-scores-(171)?