Is Opportunity Being Signaled by the Price Spread of Precious Metals?

The quiet tug-of-war between supply and demand in the silver market may be worth investors’ attention. With the largest economies of the world suddenly operating at a small fraction of capacity, industrial demand for silver is low, and inventories are higher than needed. At the same time, the quantity of new silver production is low. The recent rise of gold prices would typically suggest that silver prices should also rise. That has not happened yet.

Silver

Demand

About half of all silver production is used to supply industrial applications. The remainder is split between jewelry, investment, and coin creation. Today demand for jewelry is paltry, the economy is on lockdown, most stores are closed, and people are not going out where they would first add to their jewelry collection. As an industrial metal, silver is used in solder, car windshields, electrical contacts, touch screens, water purification, and solar panels. Any demand from these industries is also running well below the normal pace and is not likely to change soon.

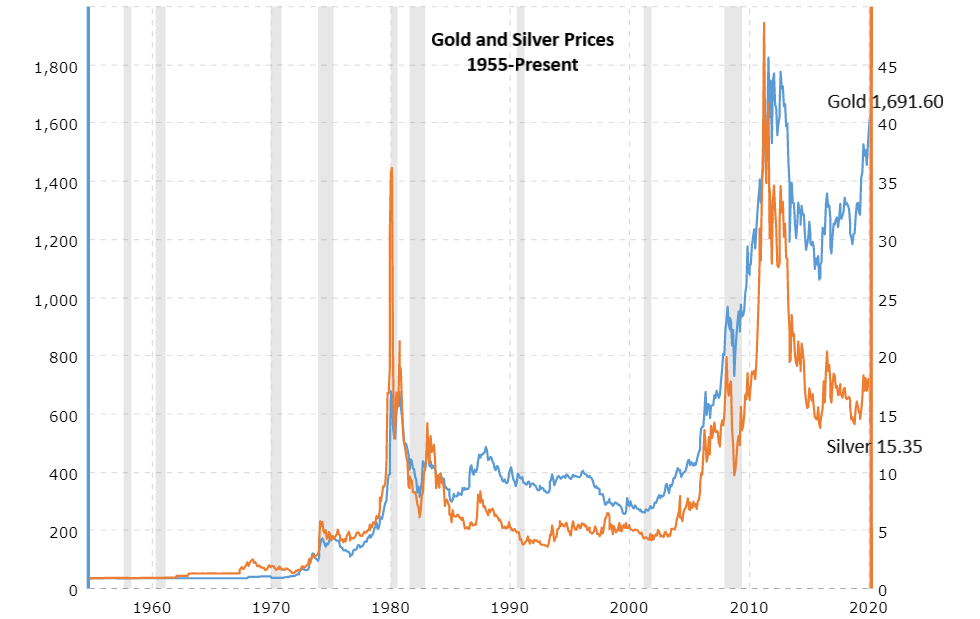

The bulk of today’s interest for silver is from investors. There is some increased interest in silver and gold because of their safe-haven reputations. These two precious metals have been accepted as a store of value longer than any other unit of exchange. They both tend to track each other over time and, as hard currencies, both outperform paper currency relative to inflation.

If demand for silver is going to rise during the pandemic, it will likely be the result of those looking for its hard-currency, safety attributes. We are in a period of rapid asset price declines and potential currency devaluation as a result of aggressive liquidity measures used by the U.S. and others. Historically, this is when silver demand spikes upward.

Silver

Supply

According to The World Silver Survey – 2019, 74% of all new silver is unearthed from non-silver producers. For example, a large copper deposit might also contain silver. The company will separate this additional metal and use it to generate additional mining revenue. In only 26% of mining operations is the white metal specifically targeted. Instead, it is an extra from semi-precious and base metal mining.

Since the bulk of silver that gets processed each year is mainly dependent on what other miners seperate, if those mines slow or stop production, for any reason, the amount of silver that is found also stops. Mines all over the world have stopped or slowed production in response to the coronavirus outbreak.

New supply of silver coming to market is almost at a standstill.

Source: Macrotrends

Gold Silver Ratio

In a quarterly report on the mining industry (April 6, 2020), Noble Capital Markets Senior Research Analyst, Mark Reichman wrote: “In our view, a combination of fiscal and monetary stimulus, rising U.S. government deficits, debt and lower-for-longer interest rates are supportive of gold prices. While silver is increasingly viewed as an industrial metal, we think its wide discount to gold as a monetary metal will narrow.” Today, when expressed as how much silver does it take to purchase the same value of gold, the current cost is 110 ounces of silver to each ounce of gold. As the chart above indicates, that is extremely wide by historical standards.

Although demand for silver as an industrial metal has slowed, the supply has also stalled. Increased demand may arise from the wide price differential between the two most common hard currency options. This increased demand could narrow the gap between gold and silver by putting upward pressure on silver prices. Looking forward, shorter-term demand may rise as a result of gold prices. Longer-term it could rise as a result of infrastructure stimulus.

Additional Thoughts

Today’s front page headlines are filled with disease, proposed cures and death tolls which are drowning out other stories. News dominating the financial markets displays the dramatic swings of stock prices and the magnitude of financial recovery packages. Its times such as these that focused investors could do well to look beyond what they are being bombarded with. It is by discovering opportunities others overlook early on where rewards are greatest. Avoiding distraction is a skill, if you have not registered for access to Channelchek’s research and reports ,(no cost), now would be an ideal time.

Suggested Reading:

Paper Gold, Physical Gold, and Miners

Minerals Industry Report – Metals

& Mining: 2020-1Q Review and Outlook

Minerals Industry Report – What Is Going on With Gold?

Sources:

Minerals Industry Report – Metals

& Mining: 2020-1Q Review and Outlook

Macrotrends.net Gold v. Silver