Image Credit: Kirt Edblom (Flickr)

How Covid and 2020 Investors Monkeyed with the Russell Reconstitution

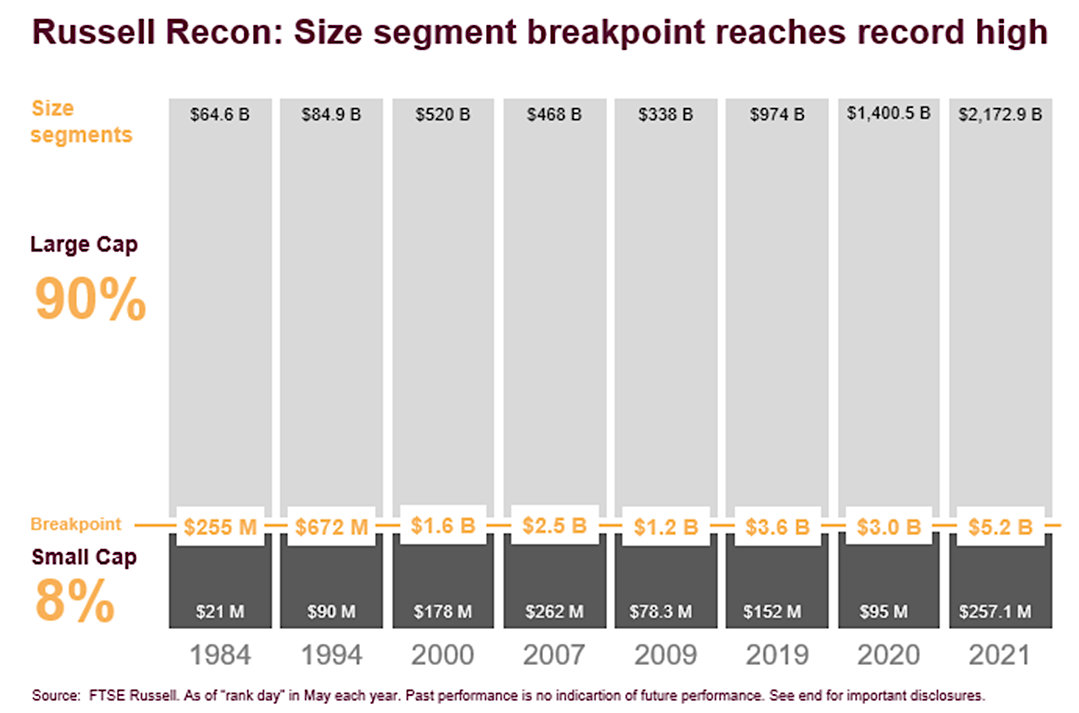

The annual Russell reconstitution redefines what the maximum capitalization amount is for a company to be listed as a small-cap stock and the minimum to be considered large-cap. At least within their indices. The more common Investopedia definition reads: “Small-cap stocks generally have a market cap of $300 million to $2 billion and have been known to outperform their large-cap peers.” Without getting into whether the definition of “small” changes if the average is larger, or if “small” is a constant, the year-over-year change within the Russell is drastic and says a lot about the historic market event, we all experienced beginning in 2020.

The Covid Effect on the Russell

In 2021, the dividing line between the Russell large-cap and small-cap size breakouts rose well above any previous high. The crossover from small to large had been $2 billion in 2020 (in line with textbook definitions) one year later (today); it has more than doubled to $5.2 billion. If we flashback to just a dozen years ago, the increase was over four times the dividing line in 2009.

Recovery on Steroids

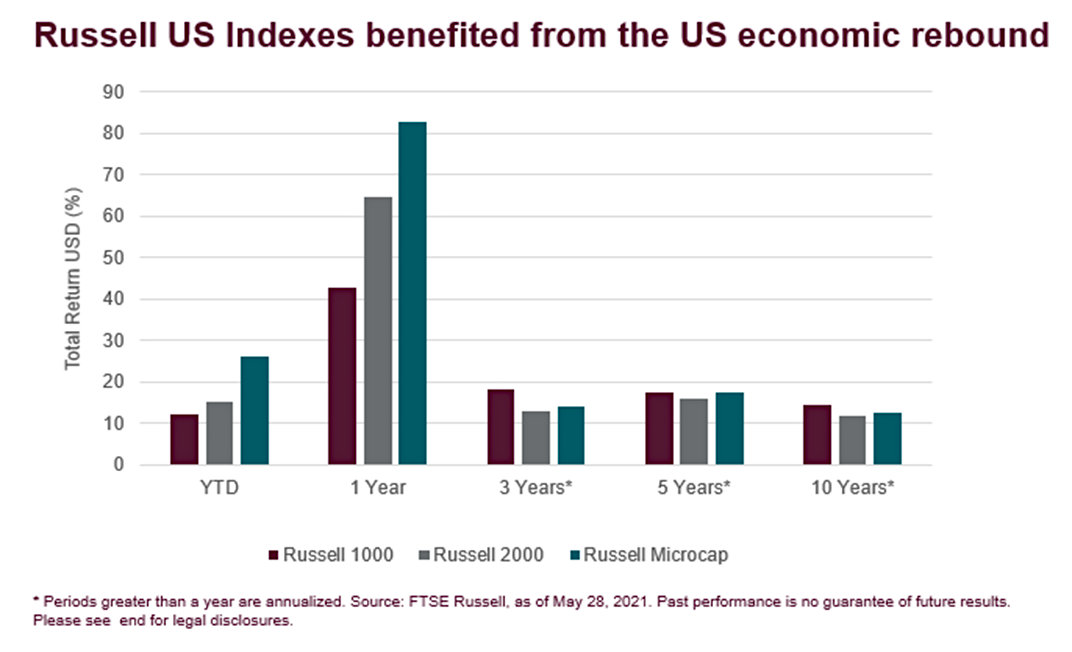

The obvious impetus for the growth of so many sectors is the strong US equity market after the fiscal and monetary stimulus. After the onset of the pandemic shook investors in March of 2020, the follow-up was for the Russell 1000 Index, the Russell 2000 Index, and the Russell Microcap Index to be lifted and deliver well above average returns for the year ending May 28, 2021 (Russell year). As shown in the graph below, the Russell 1000 rose 42.7%, and the Russell 2000 surged 64.6% for the 12-month period. The Russell Microcap index blasted even higher, clocking a return of 82.7%.

One data point of returns doesn’t tell the whole story. The way this played out, the Russell 2000 posted higher returns than the Russell 1000 for the 12-month period ending May 2021, Although the Russell 2000 fared worse than the Russell 1000 during the March 2020 downturn, and showed continued underperformance until the fourth quarter of 2020 when small-caps rallied to end the year challenging large-caps for the “win.” The Russell Microcap stocks have been on a tear since early 2021, reinforced by the January Reddit trading phenomenon.

Increase in Equity Issuance Impact

At close inspection, the preliminary list of additions to the Russell 3000 Index and Russell Microcap Index also uncovers increased equity issuance, this is another reason behind the record high large/small dividing line. For the 2021 reconstitution, the current list includes adding five IPOs to the Russell 1000, 38 IPOs to the Russell 2000, and 11 IPOs to the Russell Microcap Index. De-SPACs are also among the new names added to the indexes in 2021.

A year-over-year comparison of additions and deletions shows how the trend shifted from bifurcated markets to inclusive rapidly growing markets. On a net basis (additions minus deletions), the Russell 3000 will add 466 companies, compared to net deletions of 56 companies in 2020.

Take-Away

No other event during the year provides investors the opportunity to review a third-party breakdown of what occurred during the previous 12 months. Looking at the Russell Index Reconstitution after the historical pandemic year can help us understand where people run for safety, where they find value, and where the division between big and small is. It also helps us appreciate micro-caps, and that when it comes to investing, value matters, not size.

The newly reconstituted Russell indexes will be in effect after the market closes on June 25.

Suggested Reading:

|

|

Can the Market Continue to Defy Gravity?

|

Is Zero-Trust Architecture Enough?

|

|

|

Trading Accounts for Children

|

Do Analysts Price Targets Matter?

|

Sources:

https://www.ftserussell.com/resources/russell-reconstitution

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|