|

|

|

|

A Primer On The Indonesian Energy Industry

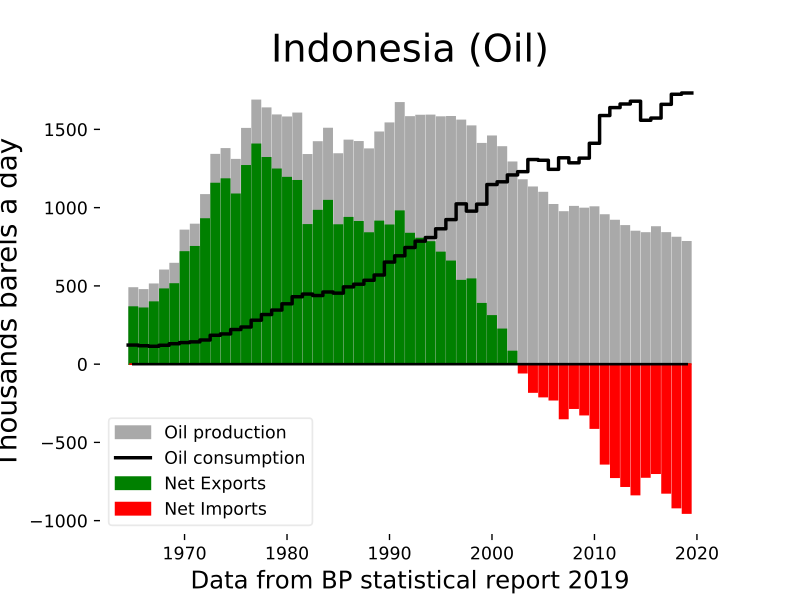

Indonesia has a long history of energy production, dating back to the first oil discovery in 1883. Indonesia’s oil and gas output is contracting as aging fields, and project delays keep production levels below government targets. The largest fields in Indonesia (Chevron’s Rokan PSC and Pertamina’s Mahakam block) are prime examples of the decline. At the same time, demand is growing as the Indonesian economy continues to grow at a rate of twice the global average. The result is a growing reliance on oil imports. A similar story can be told regarding Indonesian gas production and demand at a time when gas imports are being pressured by a more competitive LNG market.

The impact on the government is significant

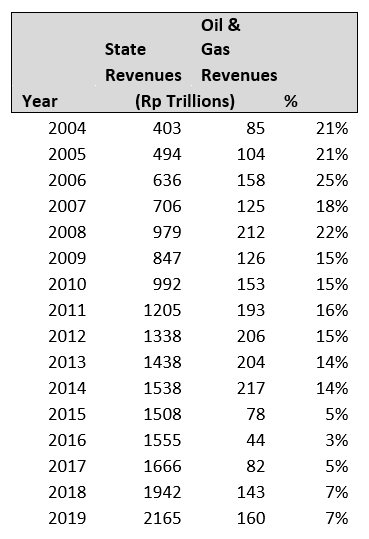

The Indonesian government is reliant on the energy industry to support its budget. Traditionally, the energy industry has contributed around 20% of revenues, but that number has fallen into the single digits in recent years in response to decreased production and lower energy prices. Government officials are well aware of the risks it faces from decreased energy investment and is very supportive of future investments.

The Government is Responding.

Price Waterhouse Coopers (PWC) says existing contractors are losing interest in further exploration in Indonesia due to regulatory instability and an uncertain investment climate. The state oil and gas company, PT Pertamina, is working to reduce the red tape. In addition, it has introduced a “Gross Split Scheme” that improves the economics of investing in new energy fields. The Gross Split Scheme replaces Law No. 22, which allowed for cost recoveries but allowed investors recovery of costs but mandated government control of upstream and downstream activities. The Gross Split Scheme will enable producers to earn higher returns if production levels surpass mandated levels or if energy prices rise.

What Does the Future Hold for the Energy Industry in Indonesia?

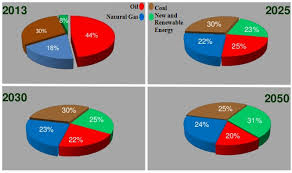

Forecasts call for the overall demand for energy to continue to grow at a rapid pace. Indonesia’s population growth is 1.1%, and the GDP is growing at a 5.6% rate. The government continues to pursue the expansion of the country’s electric grid, and that is resulting in strong energy demand. Renewable energy will increase in importance as it will in most countries. Projections show renewables largely eating into oil’s market share as coal and natural gas hold market share.

Source: www-pub.iaea.org

What does this mean for investors?

To support a diversified energy portfolio without becoming overly reliant on oil imports, Indonesia will need the oil industry to continue to expand. It is supporting the industry but still somewhat wary of outside investors. Local companies directly investing in Indonesian energy assets are in a good position to benefit from recent government changes.

Suggested:

Attend

Channelchek’s Indonesia Energy Corp.(INDO)

Virtual Road Show on Wednesday July 8, 1:00PM EST

Sources:

https://www.reuters.com/article/indonesia-oil-gas-production/indonesias-new-law-to-take-years-to-reverse-oil-and-gas-output-slump-idUSL4N2AL0OF, Fathin Ungku, Reuters, February 24, 2020

https://www.pwc.com/id/en/energy-utilities-mining/assets/oil-and-gas/oil-gas-guide-2019.pdf, PWC, September 2019

https://www.indonesia-investments.com/business/commodities/crude-oil/item267, Indonesia-Investments,

https://theenergyyear.com/market/indonesia/, The Energy Year

https://www.trade.gov/energy-resource-guide-indonesia-oil-and-gas, International Trade Administration, 2020

https://www.iea.org/countries/Indonesia, iea, June 2020

https://www.esdm.go.id/assets/media/content/content-indonesia-energy-outlook-2019-english-version.pdf, Secretariat General National Energy Council, Indonesia Energy Outlook 2019.