Is There Opportunity in the Suez Predicament?

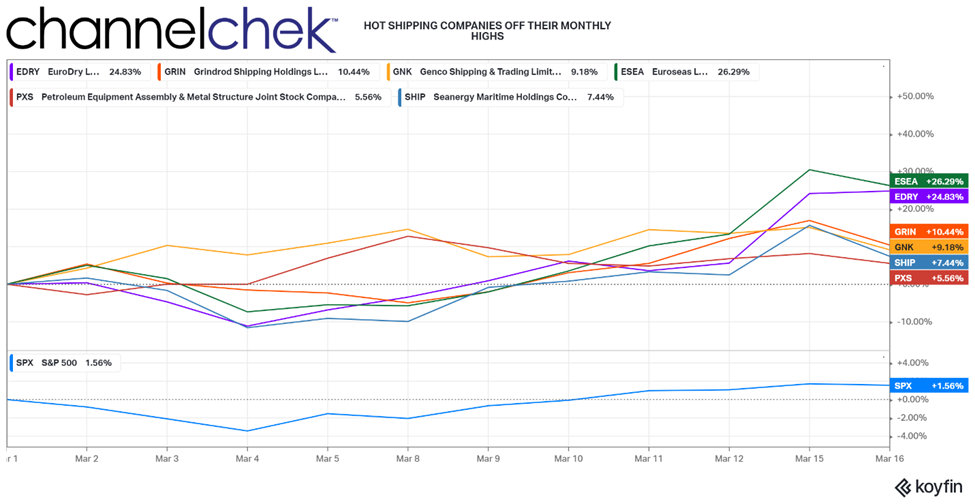

Just shy of a week after its becoming lodged in the Suez Canal, teams have made some progress on the 1,300-foot ship owned by the Taiwanese company Evergreen Marine Corp. This has brought needed hope that the busy trade route could soon reopen. Clearing the stranded ship would help take its owners out of what has been a harsh global reaction. And it’s no wonder why it has been so pointed; although the shipping industry is expected to recover from the Suez incident, shipping is considered one of the important post-pandemic recovery sectors as global commerce builds to a more normal pace. The industry had a nightmarish 2020, that was coming to an end. In fact, two weeks before the ships grounding on March 23rd, many shipping companies began to rally, outperforming the S&P 500. They have dipped since the mishap. This dip may open an opportunity for investors that missed the initial run.

Notable companies whose research is available here on Channelchek are Pyxis Tankers (PXS) up 5.56% over the past month. Seanergy (SHIP) is off its highs but still up 7.44%, Genco Shipping (GNK) is up 9.18% after this incident, Grindrod Shipping (GRIN) 10.44%, Euroseas (ESEA) is down from its 2021 peak on March 15th but still up a sizeable 26.69% on the month, and Eurodry’s (EDRY) ascent seems to have slowed with a current gain of 24.83% month over month.

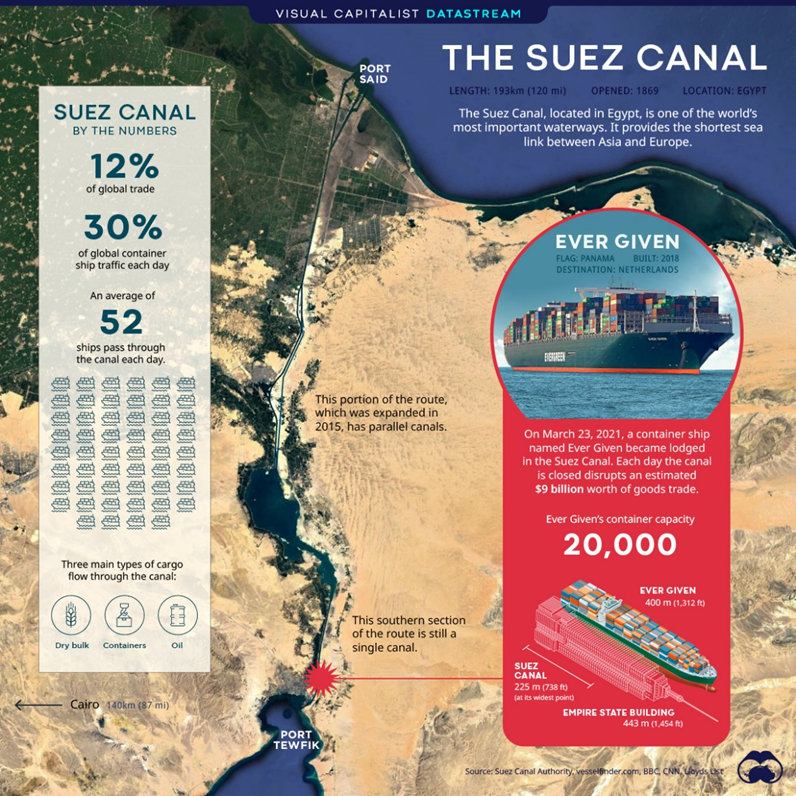

The below info-graphic provided by Visual

Capitalist shows the disruption this temporary event has on global shipping as 12% of all physical global trade passes through the Suez Canal.

Feel free to share this information.

Questions/comments can be directed to the Channelchek Team.

Related Investor Information:

|

|

NobleCon17 Transportation Panel VideoD |

Why Oil Prices Can Continue Going Up

|