Image Credit: Forsaken Fotos (Flickr)

Stock Market Performance – Looking Forward and Looking Back

The stock market performance for June and July could hinge on a number of questions investors are considering right now. What they’d like to know is: Will inflation numbers continue to indicate an uptrend of the cost of goods and services? And, will the Fed continue a policy to keep interest rates steady in the face of what may be an economy stimulated to the point of demand-driven price increases?

The first scheduled opportunity the markets will have this month to hear from the Fed and weigh each word is Friday, June 4. Federal Reserve Chairman Jerome Powell is scheduled to speak at a global conference about central banks and climate change. The U.S. Fed’s mandate is specifically employment and inflation and has not concerned itself with environmental or political issues. Other central banks around the world have increasingly expanded their role to include the climate and environmental topics. The slightest step for the U.S. central bank in that direction would indicate a significant departure from its stated role.

Look Back

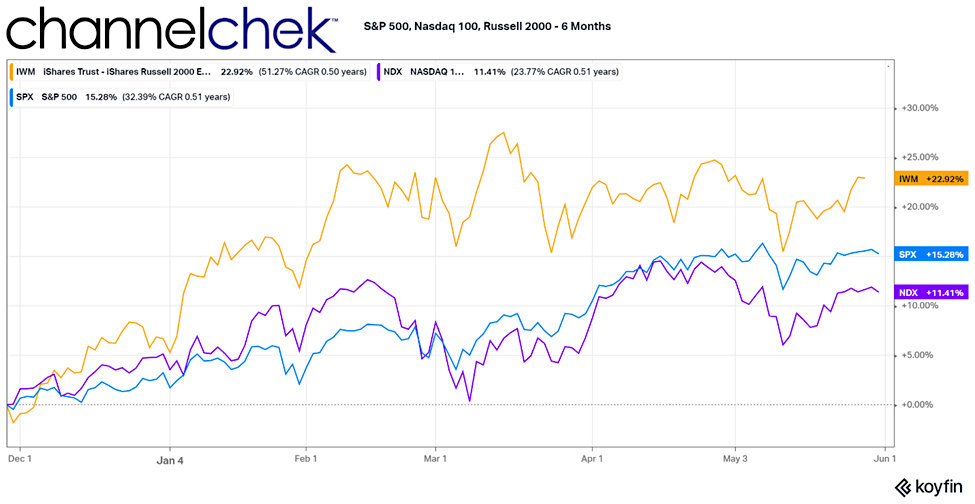

Two of the three broader stock market indices, (S&P 500, Nasdaq 100, and Russell 2000) were positive during May. The S&P 500 gained .88%, the Russell 2000 was up 1.21% and Nasdaq 100 lost 1.62% of its value. When annualized, the S&P 500 and Russell 2000 are both at a pace above the historical average annual return of the market. After 2020, some equity investors may have become velocitized with the pace and climb experienced after the initial March selloff. Those investors may find this above-average pace still disappointing. The Nasdaq 100 “breather” during May, could also concern some – others understand that slower growth is healthier and more sustainable.

Viewing the indices from the longer six-month perspective, all three are well above their historical average pace. The top performer is the Russell 2000 small-cap stock index. Over the six months, this measure of smaller companies increased by 22.92%. The S&P 500 which measures a broad base of large-cap companies was up 15.28% for the half-year period. And the Nasdaq 100 which was the overall outperformer for much of 2020 lagged the other two indices with a still-respectable 11.41% increase.

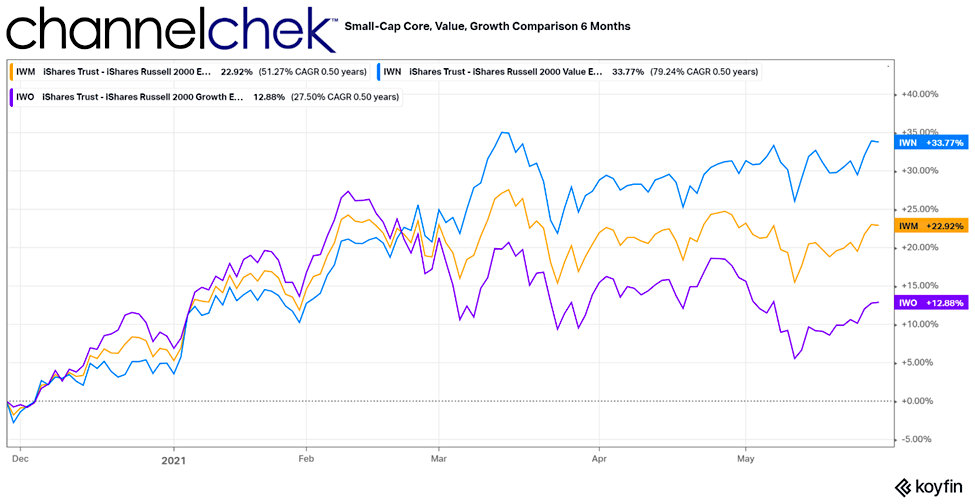

Further segmenting the better performing (6-months) Russell 2000 small-cap index, the better performing small-cap stocks was small-cap value (IWN) which returned 33.77%. Small-cap growth (which was down modestly in May) has returned 12.88% over six months.

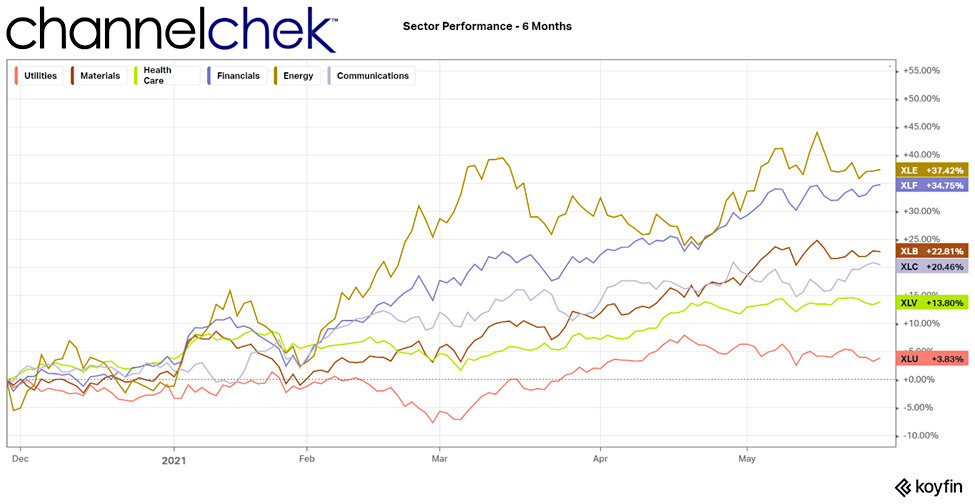

Hottest Market Sectors

Over the measured six months (December – May), the industry sectors have rotated positions from late 2020. Energy, which had been beaten up and left for dead through much of last year, rose 37.42%. Financials are benefitting from expectations of a steepening yield curve and a large supply of cash in the system. Financials are up 34.75.% in just six months’ time. Materials are up 22.81% as plans for infrastructure projects are being put in place with mega budgets behind them. Communications companies turned in 20.46% for the period. Health care is up 13.80% and materials 3.61%. Utility stocks that are popular for their dividend payments are up by only 3.83%, as higher interest rates would provide alternatives for income/dividend investors.

Take-Away

The word investors are going to be attuned to most in June and through the Summer months is “Taper.” Some voting and non-voting members have used the “T” word in various speeches recently, and it appeared as a discussion item in minutes from the last FOMC meeting. Notching up rates at any time this year would happen well in advance of the expectations the Fed set for the markets through last year.

With this, the most intense volatility could surround the afternoon of June 16 when the FOMC wraps up its two-day June meeting, and Fed Chair Powell will address reporters. While Powell speaking always gets the market’s attention, minutes from the April FOMC meeting suggested the Fed may begin to taper if the economy continues to make great growth strides. He’ll be expected to explain how the Fed defines that growth.

Other dates worth noting include Thursday, June 10, when CPI will be reported by the BLS, and each Thursday’s unemployment report, then Consumer Confidence on June 29.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading

|

|

Inflation’s Impact on Stocks – Four Scenarios

|

The Sustainability of Growing Margin Debt

|

|

|

What Stocks do You Buy When the Dollar Goes Down?

|

Managing Investment Portfolio Risk

|

Sources:

https://www.newyorkfed.org/research/calendars/nationalecon_cal.html

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|