Image Credit: YoVenice (Flickr)

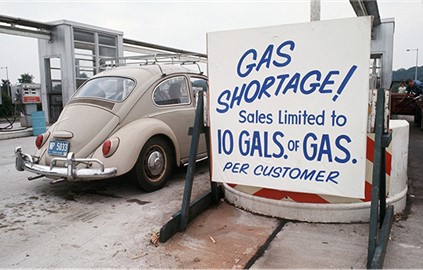

Has Summer Driving Season Been Cancelled by High Gas Prices?

Some products are very sensitive to price changes. When the price rises, consumption is reduced. Others, will be consumed at or near the same rate regardless of price. Gasoline has always been considered a product where price has very little influence over demand – until now. The current rise in fuel prices has economists scratching their heads as drivers forgo trips, travel, and even commuting to work.

Destruction of Demand

In economics 101, students learn about elasticity of demand. If a product’s consumption is impacted greatly by price changes, it is considered elastic, if demand is slightly or not impacted, it is considered inelastic. Medicines, non-substitutable food products, and fuel for automobiles have been understood to be inelastic – people buy them even when prices rise. Professors may have to rewrite the eco 101 textbooks because gasoline consumption isn’t following the old rule in 2022.

As the summer driving season begins in the U.S., the pain of filling up the tank has gotten high enough for gasoline consumption to be dropping.

Seasonally, demand on a four-week rolling basis has hit its lowest level since 2013, (excluding the pandemic-forced lockdown in 2020). And compared to just one year ago, demand is down about 5%. This is according to data from the Energy Information Administration (EIA).

Where are prices headed? Some fuel stations are upgrading their pumps to double-digit readouts (exceeding $9.99) as prices at gas stations continue to rise. Across the U.S., fuel costs have hit yet another record over the past two weeks. This is running counter to the expected increase in driving post-pandemic fears.

Regular gas prices have never before hit the highs they are today in the U.S. The average gallon of gas hit $4.59 on Tuesday (May 27), about 51% higher than a year ago. And in California, AAA data shows, that prices are exceeding $6.

Demand Destruction

In economics, demand destruction refers to a permanent or sustained decline in the demand for a product in reaction to an increase in price. The demand destruction apparently caused by the high gas prices could alter earlier forecasts for gasoline prices. The reduced demand was not built into models forecasting demand and related prices. If the trajectory of consumption continues to fall, the impact on producers may follow.

Take-Away

In economics, nothing exists in a vacuum and its mechanisms are in constant flux. Even products with consistent demand can be impacted by substitutes. Up until recently substitutes for being in the office, meeting face to face with friends, or shopping barely existed. Today one can do all of these to one degree or another. Also, the populace has been retrained to enjoy their home surroundings. What may have once seemed like an imperative, like a drive to the park or visit with friends across town, is less critical now.

Will fuel prices come down as result? An equilibrium will be reached as demand would also pick up if prices retreat.

Managing Editor, Channelchek

Suggested Content

Uranium and Natural Gas Investments Turn Green in 2023

|

ESG Growing Pains Include Greenwashing

|

Cryptocurrencies in the Hot Seat at World Economic Forum

|

Is Crumbling Trust in the Financial System Leading to a Flight to Real Assets?

|

Sources

https://www.eia.gov/petroleum/gasdiesel/

Stay up to date. Follow us:

|