$1.9 Trillion in Terms we can Better Relate To

Whether one finds the new $1.9 Trillion Covid Relief Bill heartwarming or blood-boiling is a matter of personal philosophy. What we can all agree on related to the stimulus package, The American Rescue Plan, is that it is a lot of money – a trillion is a very big number that most of us can not even fathom.

Two Ways to

Better Comprehend a Trillion

Rather than just use the word “huge” to describe a trillion, or even $1.9 trillion, I want to put it in terms that are better understood. Using my trusted HP 12c, I began entering the number one trillion and quickly found that my 20-year-old calculator only allowed for nine zeros — not the required 12 places after the number one. The number I tried to input was a thousand times higher. I adapted by using 1 x 1012.

We’ve all seen graphics with stacks of money on football fields or bills placed end to end, circling the globe, or to the moon and back; none of those measurements resonated with me. I wanted to try measurements that myself and others are more experienced with, like how long is a year, and more personal and down-to-earth such as heartbeats.

How many dollars a day is a trillion since the year One? The year 1AD was a long time ago. We’ll call it 2020 years ago because rounding down a touch barely changes the end result. Multiplying years by 365, we get 737,700. Channelchek readers are sharp and would know this is wrong, so I went back and multiplied by 365.25 to account for leap years (which certainly existed then). So the number of days since the year one, before Jesus learned to walk, is 737,805. That’s a lot of days! The question is, how much money per day would you have to collect each day since the calendar switched from BC to AD to hit a trillion? Simple division tells us $1,355,371.68 per day, each and every day (anno domini).

That result, for my digestion, is easier to comprehend; I have a sense of how long a year is and understand millions better than trillions or even billions. Multiplying by 1.9 I learn, the amount of the current stimulus package, if paid back without interest, over 2020 years would equate to daily installments of $2,575,206.19. Wow!

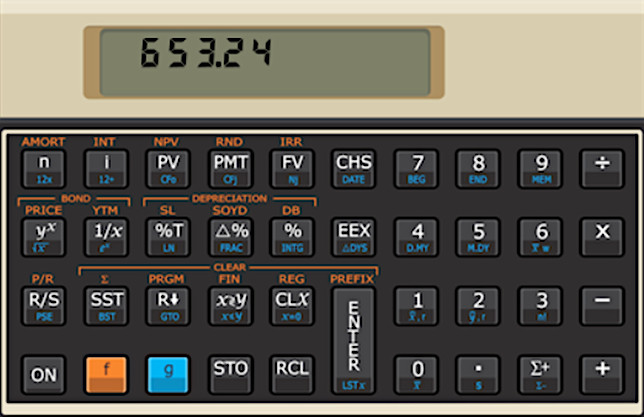

A second way I looked at one trillion is how many dollars per heartbeat over a lifetime would you have to receive in order to have a trillion dollars and also $1.9 trillion. The CDC lists the average life span as 79 years (rounded up from 78.7). The average healthy heartbeat averages 70 per minute. 70 per minute is 4200 per hour, and in 24 hours, 100,800 over a day. Again allowing for leap years, 100,800 x 365.25 is 36,817,200 beats per year.

If you live for only 79 years, you will have had about 2,908,558,800 heart beats according to this math. A quick search around the medical sites tells me that our non-exact science (fuzzy math) largely agrees with theirs. Dividing one trillion into almost 3 billion heartbeats equals 343.81, or by this example, you’d have to receive $343.81 for every heartbeat from your first breath until your last to reach $1 trillion.

In stimulus package terms (*1.9), The American Rescue Plan is the same dollar amount as an individual’s lifetime of heartbeats at $653.24 per beat.

Take-Away

There’s a line in the movie Austin Powers where, after being frozen since the 1960s, the villain, Dr. Evil is thawed and declares he wants to hold the world ransom for “One Million Dollars.” He’s quickly reminded that $1 million is not that big of a deal anymore. He quickly upped the number. When we hear or see something often, we begin to become numb to what it means, or in the case of large numbers, the true magnitude. Today, billionaires are the new millionaires, and a trillion doesn’t sound like much now that the US is in debt by tens-of-trillions.

Becoming grounded often means understanding what we’re actually looking at. Although the above was fun and surprising for me in some ways, I prefer to look at these large numbers, particularly as it relates to debt in this way. Suppose the full US national debt is $28 trillion while US GDP (the size of the economy) is $22 trillion. That is a debt-to-GDP ratio of 127%, which exceeds World War II levels. The trend in the US, even during the booming Trump years, was not paying down debt but increasing it. This trend is not economically sustainable.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading

| The Correlation Between Stocks and Unemployment | Who Gets to Participate in Private Offerings? |

|

|

| What is the Future of Entertainment Consumption? | Small Cap Names in a Big Crypto Market |

|

|