No-Cost Brokers Like Robinhood May be the Big Winners with Rising Rates

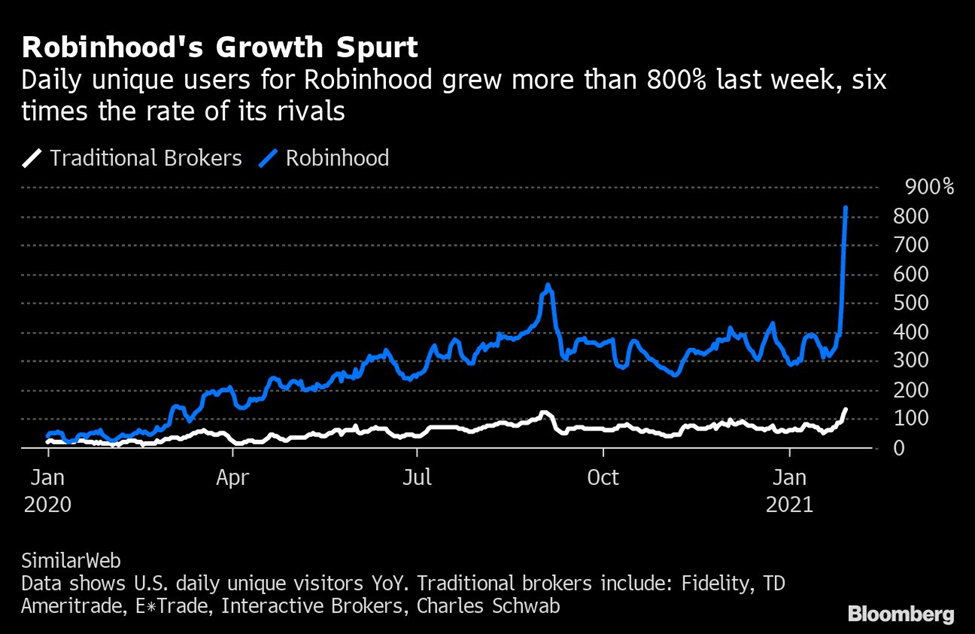

Robinhood’s IPO is expected to happen in July. The timing would seem to be ideal. Much of the mishaps

with meme stock’s orders have been forgotten or forgiven, and business growth which far outpaced its envious rivals in 2020, widened the gap even further in 2021. The company is hitting on all cylinders and likely to close during a period when money has been readily flowing into new public deals. As if Robinhood’s timing didn’t already have the “perfect storm” ingredients to do well, yesterday’s Fed announcement on interest rate policy could cause their going public to fetch even more.

Robinhood and Interest Rates

As we’ve learned, online “low-touch” brokerage firms don’t need to charge per transaction to make money. Taken directly from the Robinhood blog, this is how they earn the bulk of their income: Rebates from market makers and trading venues – Robinhood Gold, Stock loan – Income generated from cash – Cash

Management. The last three they mention; Stock loan, income from cash balances, and cash management, are likely to rise when rates increase. The current low rate environment, although it may be ideal for attracting customers to trade, hasn’t been ideal to maximize revenue on those accounts. Should rates rise sooner rather than later, particularly if it occurs with a steeper yield curve, and nothing else changes, businesses like Robinhood, Schwab (SCHW), Interactive Brokers (IBKR), and others will experience wider margins and can collect from their business customers higher rates.

Stock Loan — Stock loan, or securities lending is the practice of using stocks (or bonds) that accounts are long as a means for other customers to short securities to make good delivery on their sale. Behind the scenes, the broker executing the transaction locates a long position and, with the right agreements in place, “borrows” the securities. The broker lending the securities earns an interest rate that will rise as rates rise. This bodes well for Robinhood and other brokers that do a large number of stock loan transactions.

Cash Balances — It’s easy to understand how brokers make money on your cash balances. Robinhood’s website explains it like this: “Robinhood Securities generates income on uninvested cash that isn’t swept to the Cash Management network of program banks, primarily by depositing this cash in interest-bearing bank accounts.” With rates near zero, the next move by the Fed could double earnings on short-term deposits. As cost-free balances begin to earn more with no extra effort, revenue from this important source will immediately make an impact.

Cash Management — The debit card held by many Robinhood customers is part of the companies Cash Management service. This is also a source of revenue that may benefit if fees rise as rates rise. Mastercard® International Incorporated receives an interchange fee that is passed directly to Robinhood Financial. According to their website, Robinhood Securities and Robinhood Financial also receive fees from banks for sweeping funds to them.

Outcome of the June FOMC Meeting

In an outcome that suggests higher U.S. interest rates sooner than originally planned from the Fed, its “dot plot chart” showed 11 of 18 officials expect at least two rate hikes in 2023. In March, only seven expected one hike. Seven officials now see the first hike next year, up from four in March. This is a dramatic change in expectations from those that set interest rate policy.

Just as importantly, Chairman Powell announced the Fed held its first discussion about slowing down its bond purchases. In addition to targeting 0-.25% overnight rates, the Fed has been buying $80 billion of Treasurys and $40 billion of mortgage-backed securities each month. Slower bond purchases will allow rates beyond overnight maturity to move up as they’ll need to find other (non-Fed) owners.

Take-Away

Robinhood filed for a confidential IPO in March. The securities broker has not made the details of the offering public yet. It has raised $5.6 billion from private investors and was reportedly valued at $40 billion at its funding round in February. The potential for brokerage firms that earn a large part of their income on cash balances, securities lending, and other interest-rate-sensitive businesses are likely beneficiaries of any upward movement in rates over the coming years. As rates have been very low, a small change could have a large impact.

In April Coinbase (COIN) went public and its value shot to $86 billion. This summer Robinhood, with the advantage of a swelling account base, money readily flowing into large and small public offerings, the ability to offer part of the IPO to customers, and a positive interest rate backdrop, could generate a very strong result.

Suggested Reading:

|

|

Class Action Suit Against Robinhood

|

Bill Ackman’s Most Unusual SPAC Deal

|

|

|

Can Brokers Level the Playing Field for Individual Investors?

|

Has Robinhood, the Online Brokerage Disruptor, Been Disrupted?

|

Sources:

https://robinhood.com/us/en/support/articles/how-robinhood-makes-money/

https://www.federalreserve.gov/newsevents/pressreleases/monetary20210616a.htm

https://www.cmcmarkets.com/en-gb/news-and-analysis/will-the-robinhood-ipo-attract-investors

https://apnews.com/article/coinbase-stock-ipo-price-c3b802074ce4349b5bccf9ba43022800

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|