Image Credit: dfirecop (Flickr)

In Nine Years, Nearly All Boomers Will Have Retired, Is This Good for Stock Pickers?

Individual investors have it better than ever. Better in terms of available investment types. Better in terms of charting software. Better in terms of trading on the go. Better access to information. And, far lower costs. But, with all of this, some people are still investing like it’s 1971.

Are Index Funds More Prudent Individual Stocks?

In 1971, William Fouse and John McQuown of Wells Fargo started the first indexed fund. John Bogle used this as a foundation to build The Vanguard Group, the mutual fund provider. Mutual funds based on an index made a good deal of sense. The original idea behind indexing is that the larger group of active traders and professional investors would dictate how the market behaves, and that a small number of passive investors (index funds) would simply go along for the ride. Back then, it was a more diversified ride with professionals generating direction.

The idea was a good one; investors could avoid paying a $200 or more commission to a broker to buy a stock and could get market exposure along with diversification in ways a $200 commission had been preventing.

The mutual fund industry expanded, and from it grew many active funds. In the late 70’s the Revenue act of 1978 included a section 401(k), this allowed for deferred compensation. From it grew the entire institution of 401(k)s and brought the concept of mutual funds into many more homes than would have ever considered them.

While all types of funds quickly were developed, index funds were and remain the popular option for mutual fund investors, whether pre-tax retirement or part of an after-tax savings portfolio.

In 1990 Exchange Traded Funds or ETFs were brought to market as a way to provide individuals access to passive, indexed funds at a much lower cost than mutual funds. The assets of these funds swelled. As they swelled, the underlying stocks did better; as they did better, more investors, particularly those that are in or near retirement, got on board.

Does this Create a Problem?

Not all concerns become problems, but this concern is easy to understand. At present, the largest pool of investments sits with baby boomers who have a large portion of their money in the indexed funds that have served them well. They are in or approaching retirement which is when they move from accumulation of assets to distribution for living costs. They do this by selling off their portfolios slowly, portfolios including the indexed funds. As these funds are sold off, the stocks being held are in less demand.

|

“The simple theses and the models that get people into sectors, factors, indexes, or ETFs and mutual funds mimicking those strategies – these do not require the security-level analysis that is required for true price discovery,” Michael Burry, Bloomberg Interview, September 2019 |

The second largest group of investors in terms of bodies, not wealth, are their children and grandchildren. This group began to become aware of the stock market during the boom years from 2008. They invest in index funds, but they are also more likely to also make self-directed investments than their parents or grandparents. Since 2008 the market has rewarded their participation. They aren’t expected to be investing like the generations before them. The new online tools and apps and zero commission structure, plus a wealth of information from online sources including Channelchek and others give them more confidence to make their own decisions.

The original idea behind indexing is that professional traders and actively managed funds will dictate how the market behaves, and take a small number of passive investors (e.g. index funds) along for the ride. But, here is where concern for what may happen on that ride comes into play. If you’re visual, think of it like this: Actively managed funds are a 60’ yacht. You’re an individual investor on a raft and decide to attach a line to the 60-footer to have it take you where it’s going. A free ride from someone who must know more based on the comparative power of your boats. The yacht is completely unchanged, course and speed are not impacted. This huge and small relationship was the original assumption behind passive investing. Market behavior is dictated by the active majority, and the passive minority gets a free ride.

What has happened since is more and more people have hooked their rafts to the back of the yacht to catch a ride, at some point there will be an impact to the maneuverability and economies of the yacht. As the passive riders outnumber the active managers, the free ride may fall apart.

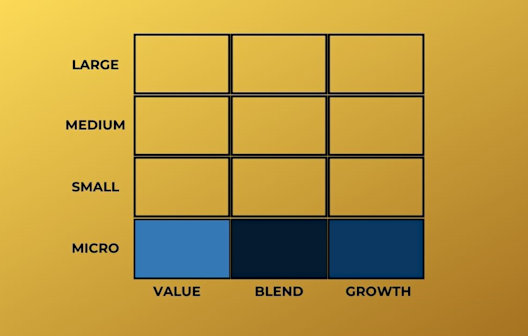

We are now at the point where valuations in stocks are higher because they are in an index, and all the money in index funds has to compete for the same securities. We also see where stocks that are not in major indexes are not as highly valued because they get less attention. This two-class system isn’t healthy either.

Take-Away

The past 30-40 years have seen index funds grow to a height that has distorted valuations. One would think nothing can continue on indefinitely. The retirement or even death of baby boomers will put money that has been tied up in index funds in the hands of shopkeepers, grasscutters, and others they pay out of retirement funds. Upon death, some of this money will wind up in the hands of the next of kin and, in many cases, an entirely different account with different investment criteria. I picture an ACAT from the Vanguard 500 Index fund (VFIAX) into a more self-directed environment of a Robinhood account where the liquidated fund is reworked into Dogecoin (DOGE) and Gamestop (GME).

No one has an accurate crystal ball. This unintended consequence to index funds is worth paying attention to because it is a concern of professionals who have been very good at spotting trends – well in advance. If it does unfold, the younger generations may cause the unwinding of index funds as the go-to and replace it with directing their own stock picks.

Paul Hoffman

Channelchek, Managing Editor

Suggested Reading:

|

|

Should Investors Listen to Influencers?

|

Norton Crypto Debuts for Home Mining

|

|

|

Trading Accounts for Children

|

Do Microcap Stocks Provide Better Diversification?

|

Sources:

https://www.investopedia.com/articles/exchangetradedfunds/12/brief-history-exchange-traded-funds.asp

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|