|

|

|

|

Paper Gold, Physical Gold, and Miners

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

When countries finance their way around a problem, they open the door to inflation. The current global “stay at home” economic environment has caused the U.S. and countries across the globe to find creative financing to help soften the financial burden on their citizens. In most cases, this involves “creating money.” Countries recently began creating money in many different forms, and they are creating a lot of it.

This increase in currency circulating means there is a much larger supply. Basic economics says when the supply of something goes up, unless it’s met with an equal increase in demand, its value goes down. In this case, the demand for what we purchase with cash is not expected to rise substantially. This could lead to a devaluing of currencies, which means it buys fewer goods and services. This is the definition of inflation.

During periods when the forecast of a currencies value is down, investors often hold a portion of their money in gold. This increased demand pushes gold prices higher. Therefore, when inflation remains high over a more extended period, there’s increased demand as gold becomes a tool to hedge against inflationary conditions.

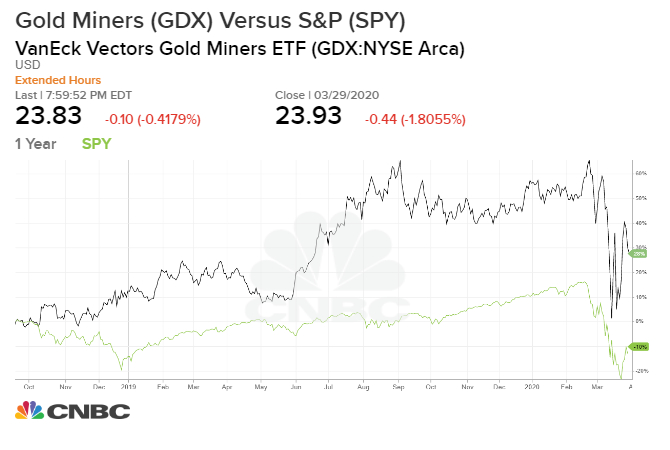

We had seen this scenario begin to take place earlier this month and then reverse. According to a recent industry report by Noble Capital Markets, Inc., “ Year-to-date through March 23, the gold futures price increased 3.0% from $1,529.30 per ounce at year-end 2019 to finish at $1,575.55. During the same period, the Van Eck Vectors Gold Miners ETF (GDX) and Junior Gold Miners ETF (GDXJ) were down 25.1% and 35.9%, respectively, while the S&P 500 index was down 30.8%.” the report goes on to describe, “ On March 9, gold reached a high of $1,704.30 before reaching a low of $1,450.90 on March 16.”

Considering the monumental uncertainty in other asset classes, the continued low-interest rate environment, and inflationary ingredients, one would ordinarily expect gold to have not backed-off its March 9 highs. Some forecasts were for the metal to continue upward. The decline from its high has been attributed to institutional investors who held paper representing gold. This paper could include futures contracts, ETFs, or any other contractual certificate backed by physical gold. The traders were selling their paper to meet liquidity needs, reduce leverage in their portfolios, or take profits. Demand for gold actually was increasing, but there was a problem. The reason for physical gold to have dipped was likely the ability to physically deliver. Unlike wireable securities or shares in a fund, gold can’t be “zapped” into your account via any type of wire or electronic transmission. The problem with transacting in physical gold then is availability, finding it in the place, and the form, that the investor requires. All indications are that there is ample gold. The problem lies in buying a bar, or settling a futures contract with so many industries on lockdown; this created a new hurdle. Recent demand is up significantly, the Noble Report states, “Total U.S. Mint gold sales in March 2020 increased to 120,500 ounces compared with 7,000 ounces in February and 60,000 ounces in January.” Compared with the previous year, “In 2019, gold sales amounted to 65,000 ounces in January, 13,000 ounces in February, and 11,500 ounces in March.”

Although not back to it’s high,

gold (GDX as proxy) has rebounded as the stock market has rebounded.

An article in Forbes magazine dated March 26, 2020, points out that the stocks of gold miners, which went down with the overall market, rather than track gold investments more closely, should rebound. “…the fact that the miners got crushed when gold didn’t is an unusual event and one that could be a useful moment for investors who want gold stocks in their portfolio.” There are two other considerations that investors who are looking at the mining sector should consider. ETFs of gold miners are designed to hold a broad array of companies, including some with operations shut down temporarily. Investors are forward-looking and should not necessarily shy away from companies presently idle due to CoVID-19; however, being aware of what is in any ETF is essential. An alternative is to develop a portfolio with individual stocks designed to minimize this issue. This may take more time plowing through research reports and company investor websites but may yield better results.

The price swings of mining stocks (GDX-ETF) have been

more pronounced than gold itself.

For mining companies, an increase in gold prices translates to more revenue per ounce, at the same time lower fuel costs per ounce decreases production costs. In an economic environment with less noise, this would be considered very bullish for miners.

Uncertainty leads to less interest in equities and a movement

toward safe harbor assets such as cash, gold, and US treasuries.

The price of gold and share price of companies mining precious metals have certainly not escaped volatility. As with other asset classes, the pandemic provides its own unique set of headwinds. At the same time, they do stand to benefit from talk of inflation and concern investors have surrounding the overall markets.

Long after the current turmoil is over, investors will have vivid memories of what could happen, they should consider owning gold investments as part of the core of their portfolio.

Suggested Reading:

Current

Efforts to Combat Coronavirus Pandemic

Will

Interest Rates Test Negative for Coronavirus?

Sources: