Step Schwarz - Uranium Search Vehicle (flickr)

There Seems to be a Perfect Storm in Favor of Uranium Investors

As children, we may have dreamt of one day growing up to own diamonds or gold, perhaps even emeralds, but, only the “weird kids” wanted to own uranium. Flash-forward to today and times have changed. Uranium is trading near its nine-year high and appears to have a “perfect storm” of

variables catapulting it higher.

The variables providing upward

price movement include reduced output as many mining operations were discontinued, increased demand as new reactors are in the planning stages, and large physical investments in uranium, which take it off the market to generate electricity.

Output Problems

Worldwide uranium production fell to 123 million pounds in 2020, the lowest level since 2008. Current production falls short of global uranium demand, which is around 180 million lbs and expected to grow. The demand is still being met by drawing from inventories, downgrading weapon-grade sources, and uranium underfeeding (re-enriching uranium tailing). These strategies are unsustainable.

Major uranium mines are closing which removes 5.6 million lbs. of production. On January 8, 2021, the Ranger uranium mine in Australia stopped production lessening annual production by 3 million lbs. The Cominak mine in Niger also stopped production on March 31, 2021, this removes an additional 2.8 million lbs. of production.

Bringing new mines online, particularly within this highly regulated industry, with dangerous materials, and heightened environmental consciousness will be slow.

Increased Demand

As fossil fuel generating plants go off-line to meet environmental goals, wind and solar depend on perfect weather conditions to meet “as-needed” demand for power. The need for additional, high output, on-demand energy sources increases with each fossil fuel plant that goes closes. Adding to the demand are electric vehicles that are expected to substantially add to the burden, even if we were not reducing fossil fuel generation.

So the demand is high on at least two fronts. New sources to replace old plants and even greater electric output to serve vehicles tapping into the grid.

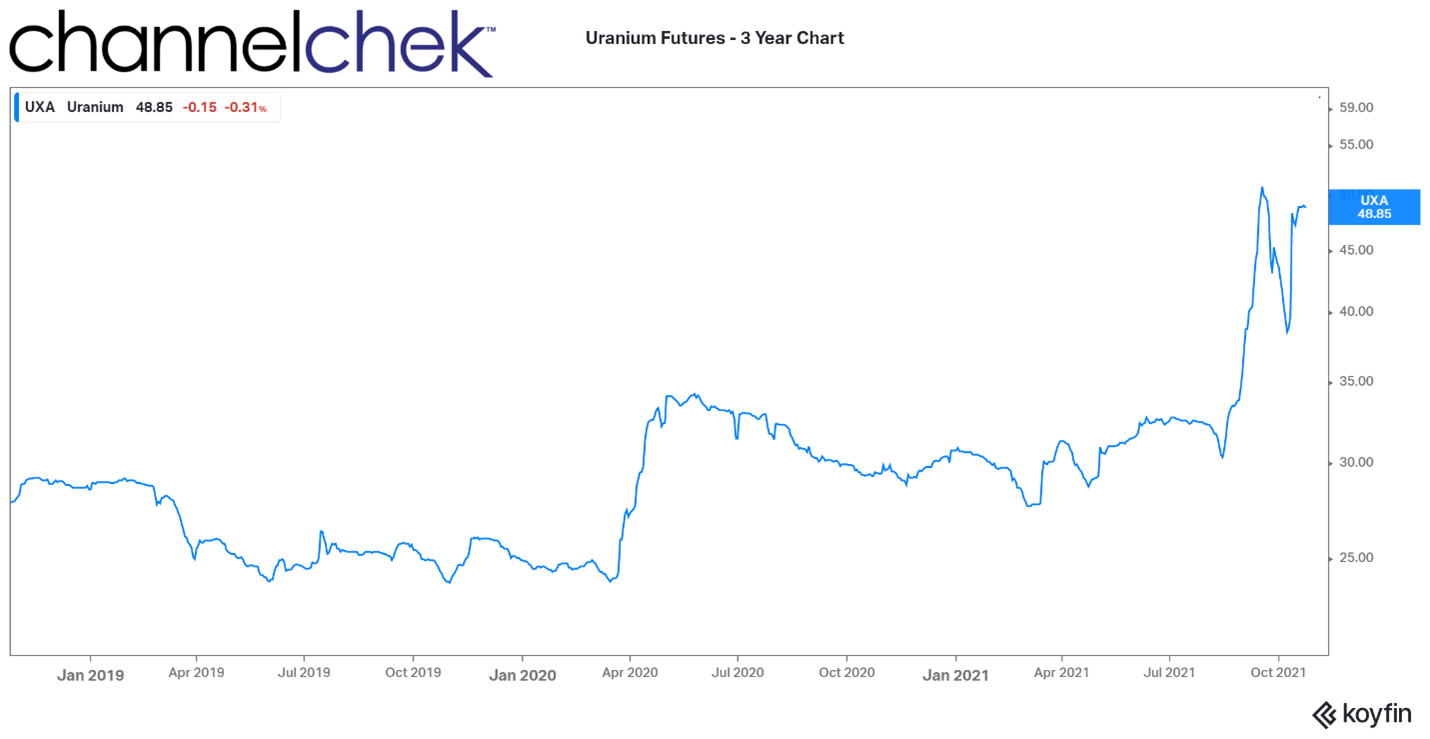

Source: koyfin.com

Investments in Uranium

There’s a relatively new uranium trust that purchases physical uranium, holds it in an investible trust and sells shares of the trust. Not much different than a gold trust. If you’re registered to receive Channelchek’s daily emails, you may be aware that this is the Sprott Physical Uranium Trust (OTC:SRUU.F). This alternative to investing in the yellow metal rather than uranium futures, or uranium mining stocks like Energy Fuels (UUUU), Encore Energy (ENCUF), is becoming popular alongside U308 stocks and futures. One big difference is the uranium placed in the trust reduces available uranium for energy. The investors in all three types of uranium investments benefit from the trust as it reduces usable supply. Conversely, investors in mining stocks understand they are in their own way helping provide capital, potentially assisting more uranium production.

Look at the chart above, it shows three years of uranium futures price movement. Uranium prices quickly rose from Oct. 8 of this year onwards. At the same time, the Sprott Physical Uranium Trust announced it had bought 300,000 lbs of uranium. Three days earlier they had purchased 500,000 lbs.

Additionally, the U.S. is investing in a strategic uranium reserve. This is expected to pull U308 from mining production in the U.S. The 2021 proposed federal budget includes $150 million for the creation of a U.S. uranium reserve over the next ten years. While this can serve to stabilize prices down the road, initially, it will be competing for a scarce resource from U.S. based mining companies

Take-Away

There are three main factors providing a bullish market in uranium. Supply, from the standpoint, that high production mines across the globe have been shut and there is a long lag time in finding new locations and opening new mines by itself would keep prices steady. From the demand side, the move away from fossil fuels leaves a need gap that must be filled with high output generation similar to nuclear energy. From a demand perspective, new plants will create a growing need, especially as the need for electricity grows. And physical ownership now available through trust ownership has taken supply off the market, while the U.S. strategic uranium reserve may also begin to compete with all other purchasers of the mineral that is back in favor.

Managing Editor, Channelchek

Suggested Viewing:

|

Noble Capital Markets Uranium Power Players Investor Forum

|

Sources:

Can You Invest in Uranium Directly?

|

The Case for Higher Uranium Prices

|

Uranium Mining Stocks are on Fire, Here’s Why

|

Overview of Uranium Stocks Within Three Industry Segments

|

Stay up to date. Follow us:

|