The Better Reason to Pay Attention to Paid Order Flow

Payment for order flow (PFOF), often characterized as brokers selling customer orders to receive kickbacks from market makers, has become a hot topic. The same subject had surfaced occasionally in the past, after brokers like Robinhood reduced transaction fees to zero, but with far less emotion. The intensity of the recent discussion has been heightened by the attention given to the self-directed traders that coordinated on the subreddit, Wall Street Bets (WallStreetBets), and then traded unexpectedly contrary to individual investors’ normal patterns.

One important part of the PFOF conversation, not usually included, is the value, over time, of cost-effective execution. Payment for order flow is an established and integral part of the investment brokerage business. It’s not very far off from tipping wait staff, a golf caddy, or the person you regularly trust to cut your hair. Promoting exceptional service for your own benefit or those you’re responsible for often includes a financial incentive. And a smart broker will try to promote exceptional service for those they’re responsible for. Individuals should maximize this. Opening a brokerage account should include the due-diligence of asking: what’s the broker’s track record of filling orders better than “market?” Fortunately, you can find publicly reported metrics that allow a look back to know if a broker brought additional value filling orders relative to best price. With some digging and comparing, you can assess past performance in this category and then apply this performance forward and determine what this better execution could mean to you in dollars and cents. We already know that compounding mere pennies over time adds up; it’s why low fee ETFs became more popular than mutual funds, why mortgages take forever to pay off, and may be why you were attracted to a no-fee broker, to begin with. The time value of money suggests every slice of profit you give away costs you more than that slice over time.

The Market Makers Role

We understand what a broker is; one of their jobs is to take your market order and fill it at the best-posted price (or better). But, what’s a market maker? Most people have a vision of stock exchanges that includes frantic brokers in colorful smocks all piled in a room giving hand signals and screaming in the same direction. Well, the opening bell for most stock trading venues doesn’t look anything like that. The transactions are done by electronic exchanges with traders at computers watching bids and offers come in and matching them up or temporarily positioning some so as to fill mismatched size orders. The open outcry style pictured in movies, I dare say, is almost non-essential to the process. In fact, Wall Street trading activity actually experienced an uptick in volume during the two months that the NYSE was closed in 2020.

So, who are these people we don’t see? What is the alternative trading system (ATS)? The electronic communications network (ECN) are computer-based systems that are part of a network that uses a “maker-taker” model for the securities it specializes in. This model sees ECNs paying money for orders that add liquidity (makes the price) and charging for orders that remove liquidity (takes the price). One example of an ECN market maker is the NYSE Arca (formerly Archipeligo) which is the volume leader in ETFs. However, there are dozens of these ECNs, Arca is just one. I’ve listed their fee schedule as a source after this article.

| SEC Rule 605 requires that market makers publish their execution stats every month. Looking at the recent data, it indicates that the system saves customers money—$3.57 billion of price improvement in 2020 alone. |

The Regulation National Market System, (RegNMS), an SEC law requires brokers to obtain “best execution” for their clients, that is, fills at the best bid/best offer. How does your broker get the best bid or best offer when speed is critical and there may be many ECNs making a market in a stock and prices are always in flux? If they use a market maker that is able to improve the price above the published best price, there need not be the necessity to search through the various ECNs and trading venues. RegNMS, by the SEC, requires a best-published price, if you’re filled better than the published price, this meets the requirement. The easiest way a market maker can do this is by having plenty of volume to help match buyers with sellers. Paying for order flow, or as I suggested earlier, “tipping,” helps them fill at better prices and also speeds execution because they have higher volume. Most transactions aren’t matched because someone came in selling 150 shares of XYZ while another came in to buy 150 XYZ. A market maker bridges this mismatch by warehousing (holding) the risk of the position it just bought on its balance sheet using its own capital. As compensation for taking this risk, the market maker earns a small bid/offer spread, often less than a penny per share. Paying for order flow helps cut the risk of them getting caught holding a position too long.

What to Know About Your Broker

Many brokers voluntarily publish exactly how much their price improvement has been so customers can better judge how well they’re being served. Brokers are not uniform in their presentation, but enough similar information can be found to compare, one to another.

The below table is the Retail Execution Quality Statistics (Q4 2020) from Charles Schwab (CSIM).

Above table of retail execution quality statistics from Schwab.com

Execution and Compounding Numbers

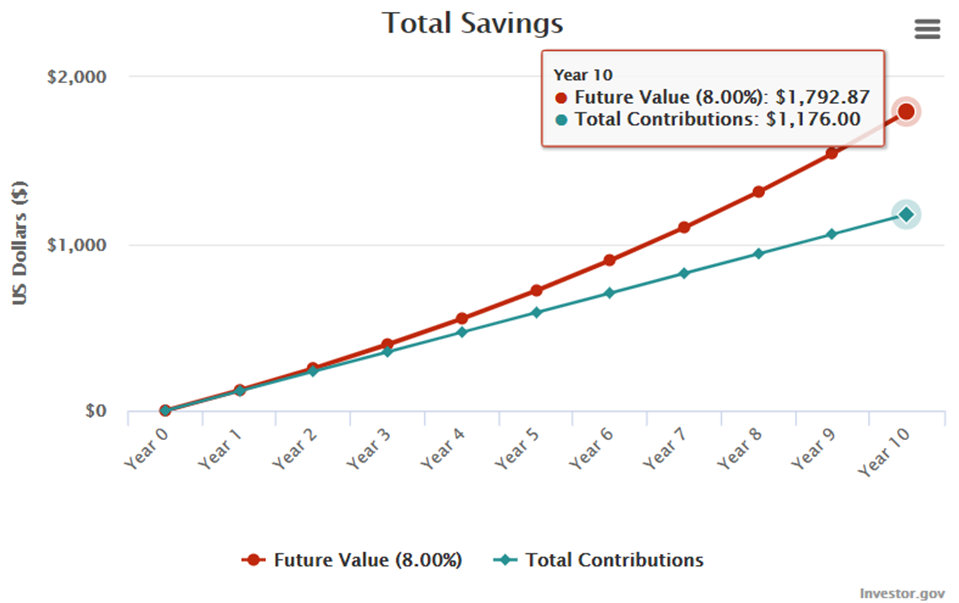

This is where it gets fun. All we have is past performance as an indicator of which broker will perform better in the future, there are no guarantees. But, if we keep the math simple and make some presumptions, we can see what price improvement (helped by PFOF) does for us. We can also compare one broker’s track record to another. Here’s how: Presume (in this case) Schwab will continue to perform at this rate for the next ten years, and we have an account with them where we send $1500 a month and then place two trades for 100 – 499 shares (each trade), and our expected yearly portfolio performance is 8%. We can figure, with this conservative scenario, what the value of the $4.95 (average) saved per order is to your Schwab account.

Using the compound interest calculator found at Investor.gov and inputting the variables presumed above shows a total benefit to the account after ten years of $1,792.87. This would be invisible to you as an account owner using most broker platforms.

Founder and CEO of online brokerage All of Us Financial, Alan Grujic has as his companies business model what he calls radical transparency. He strongly advocates for retail investors and believes there should be an open book as to what the self-directed trader is worth to the broker. In the case of All of Us, it will even rebate a portion back. They essentially undercut the price of the no trading fee brokers. Grujic supports PFOF as a system that isn’t necessarily broken. He weighed in on the subject of PFOF with unabashed clarity that his company does pay for order flow, he had this to say, “As a startup founder, I understand the desire and attractiveness of tearing down legacy institutions. However, we owe it to ourselves to shoot straight with our investors. For us, the enemy is not PFOF, it’s the lack of transparency in how brokers share information and money. In fact, we think PFOF is a good deal for investors, and we are not alone.”

Take-Away

Retail investors benefit from their trades being executed at better prices than are publicly available ($3.57 billion in 2020). The varied trading venues and competition maintains relentless price improvement pressure for market makers to bring consumers good execution. As with many areas of the financial markets that are not well understood, or are oversimplified by investment TV shows, there can be a knee-jerk reaction to get “up-in-arms” and want to “fix” something based on a misunderstanding of how it works. This could add unnecessary regulation that may add to costly inefficiencies.

More liquidity in our public markets is a win for everyone, and the complex system that we have today provides more liquidity than at any time in history — this brings a more level playing field to retail investors. It may be imperfect, but the reduction in trading costs to zero or below demonstrates the system is extraordinarily effective.

PFOF is part of the system which leads to efficiencies that have been shown to lead to price improvement for the end customer. This price improvement has real value. Even an individual brokerage account that places only 2 relatively small buys per month over ten years can experience measurable enrichment.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

|

|

| Seeking Alpha Paywall Causes Frustration | Blockchain, Beverages, and Baloney |

|

|

| Are Meme Stocks Improving Flawed Markets? | Can Brokers Level the Playing Field for Individual Investors? |

Sources:

https://www.banking.senate.gov/imo/media/doc/Piwowar%20Testimony%203-9-21.pdf

https://www.sec.gov/news/press-release/2018-253

https://www.hsgac.senate.gov/imo/media/doc/STMT%20-%20Robert%20Battalio%20(20140612)1.pdf

https://www.finra.org/rules-guidance/guidance/sec-rule-605

https://www.sec.gov/reportspubs/investor-publications/investorpubsexqualityhtm.html

https://centerpointsecurities.com/payment-for-order-flow-guide/

https://www.nyse.com/publicdocs/nyse/markets/nyse-arca/NYSE_Arca_Marketplace_Fees.pdf

https://www.theguardian.com/us-news/2020/may/26/nyse-reopens-two-months-closing-covid-19

https://www.allofusfinancial.com/post/mythbusting-about-payment-for-order-flow-tipping

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|