Noble Capital Markets Metals and Mining Newsletter – Q1 2022

Source: Capital IQ as of 03/31/2022

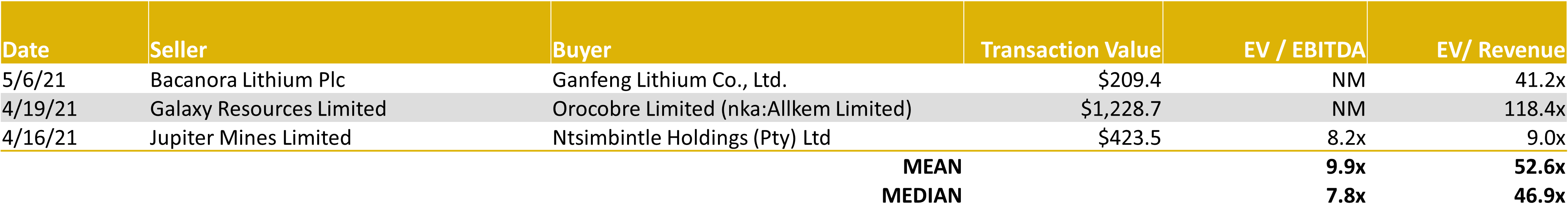

Source: Capital IQ as of 03/31/2022; Company Filings

METALS AND MINING INDUSTRY OUTLOOK

Metals & Mining First Quarter 2022 Review and Outlook

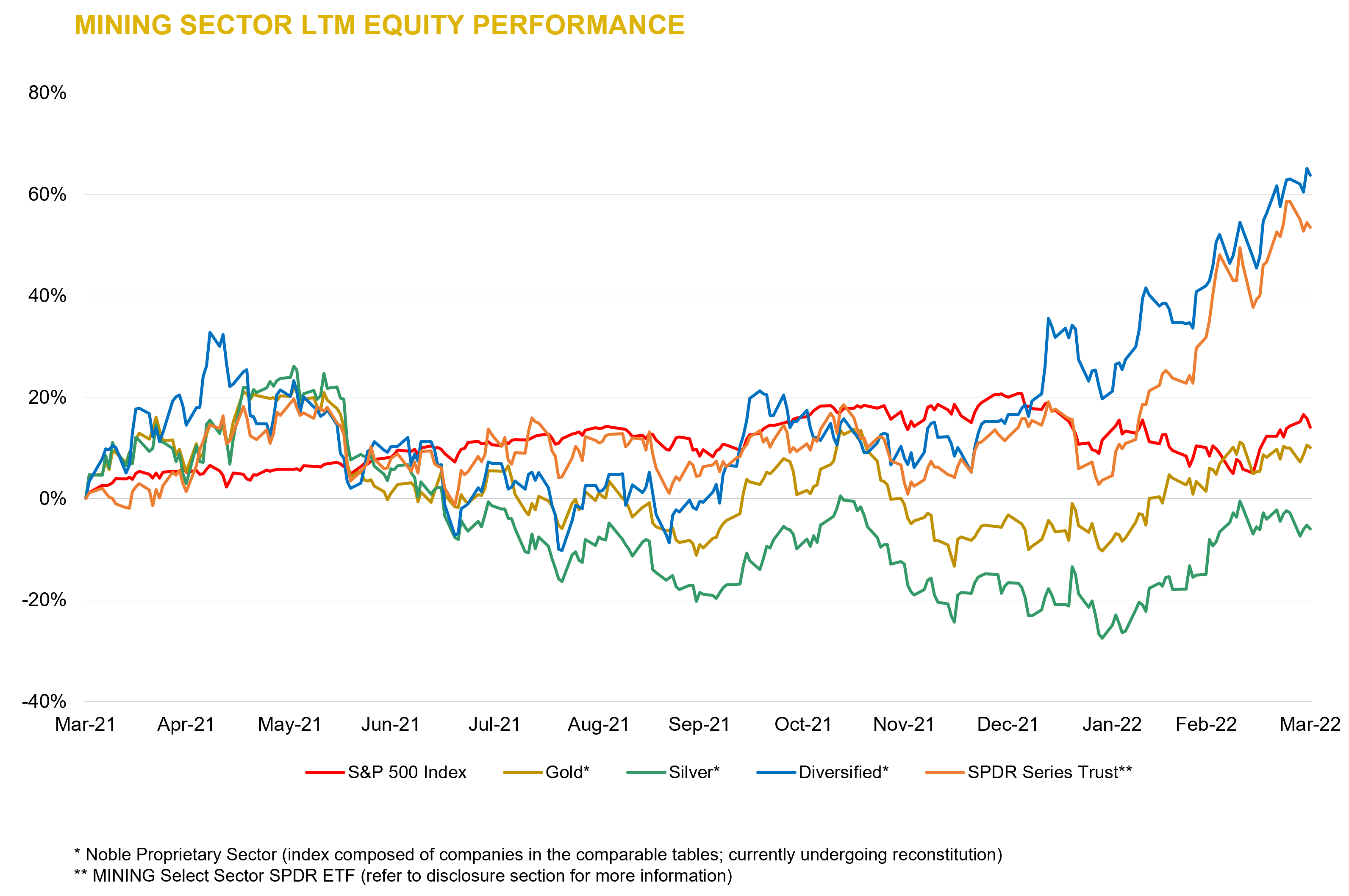

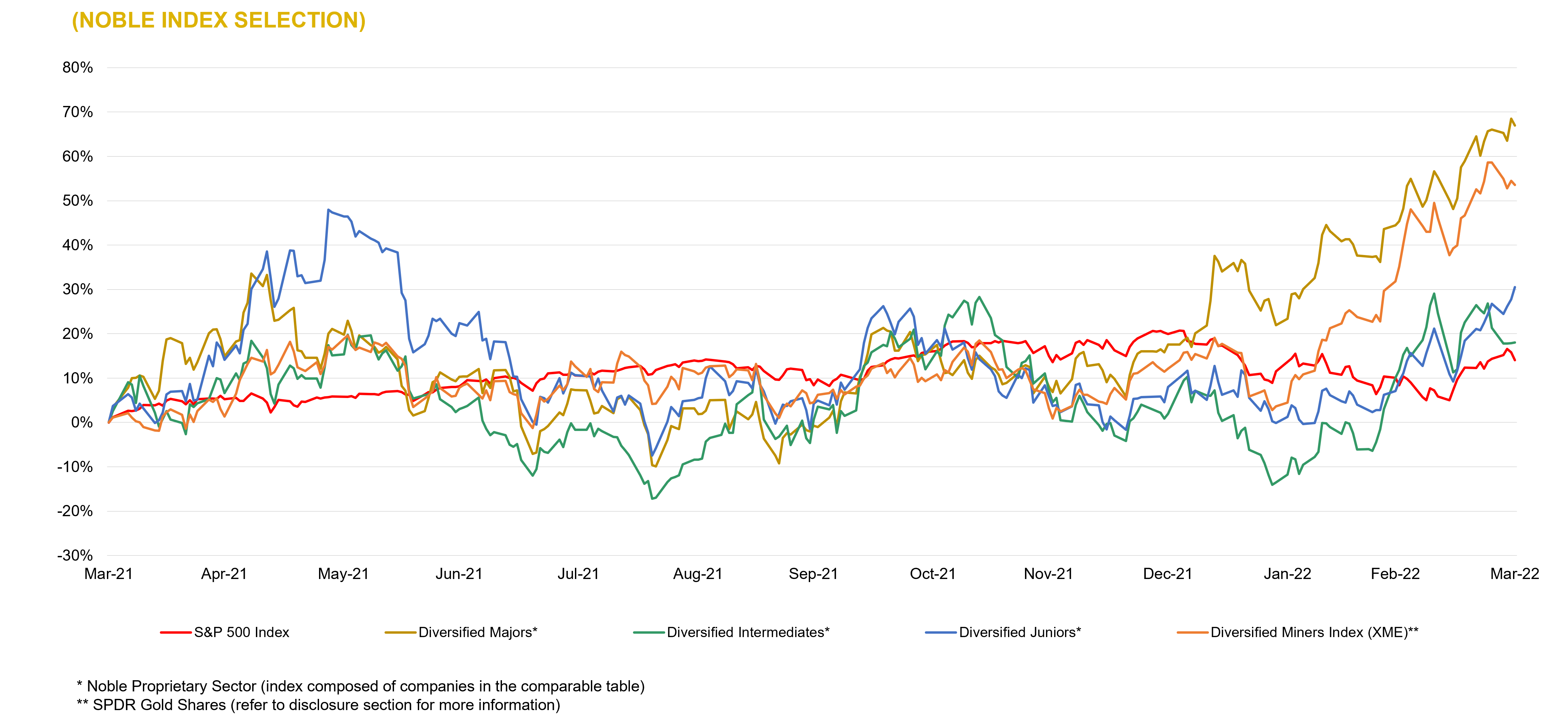

Mining companies outperform broader market.

During the first quarter, mining companies (as measured by the XME) appreciated 36.9% compared to a loss of 4.9% for the S&P 500 index. The VanEck Vectors Gold Miners (GDX) and Junior Gold Miners (GDXJ) ETFs were up 19.7% and 11.8%, respectively. Gold, silver, copper, and zinc futures prices rose 6.5%, 7.5%, 6.7%, and 20.9%, respectively, while lead was down 0.3%. The war in Ukraine has constrained supplies of commodities, everything from fertilizer, grain, oil, natural gas, and metals, and magnified inflationary trends. How long this will continue is uncertain.

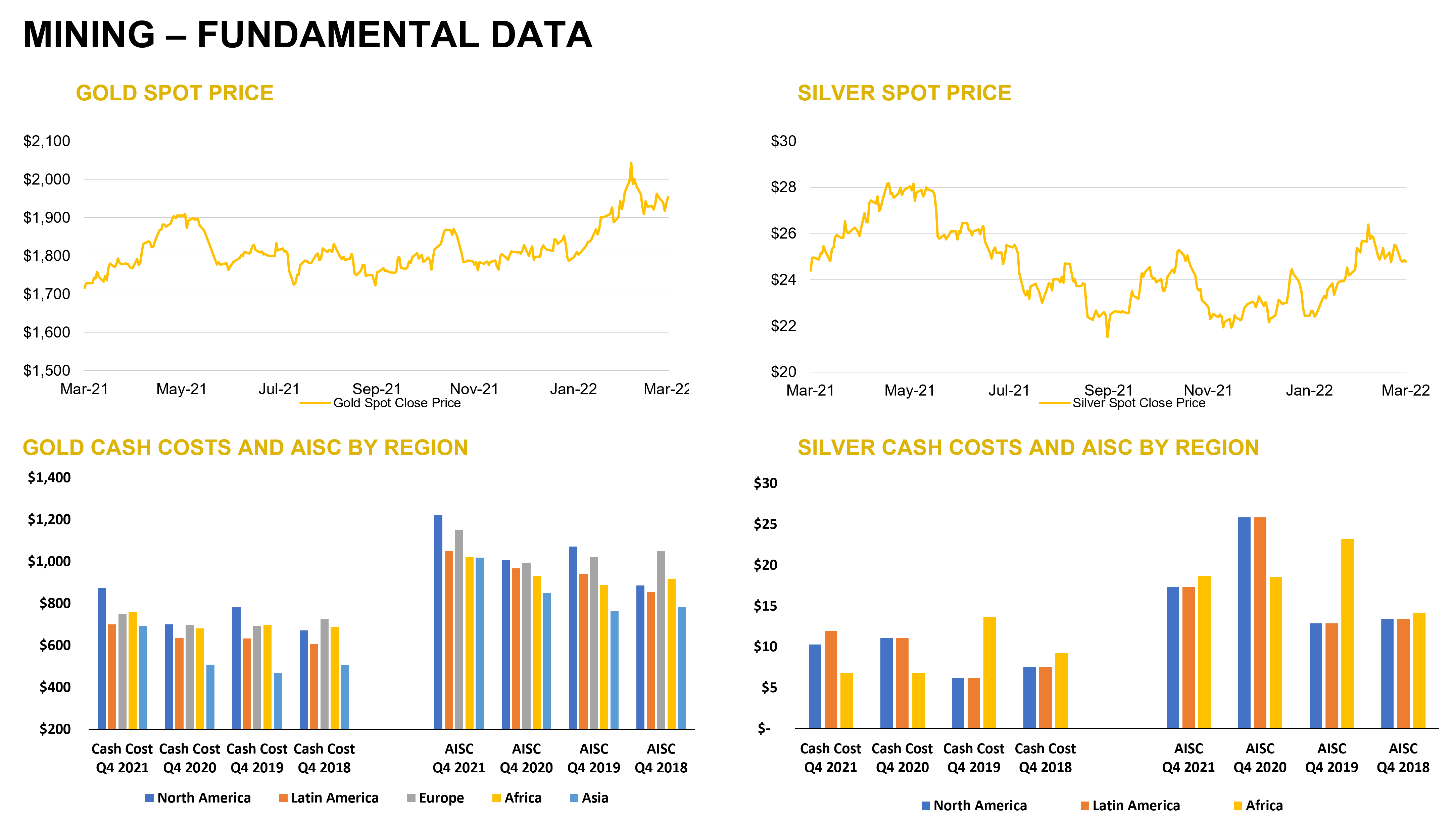

Outlook for precious metals.

The U.S. Dollar Index rose 2.4% during the first quarter, while the yield on a 10-year treasury note rose to 2.33% from 1.51% at year-end 2020. With the U.S. Federal Reserve signaling more aggressive action to combat inflation, further gains for gold may be challenged for the remainder of the year in the face of higher rates and a stronger dollar. However, with consumer and core inflation at 7.9% and 6.4% through February, respectively, real interest rates remain negative and enhance gold’s appeal as a store of value. Moreover, precious metals may be viewed as insurance against expected market volatility and economic uncertainty.

Risk of slowing economic growth may impact industrial metals.

With the Federal Reserve behind the curve on inflation and an unanticipated war stressing commodity markets, choking back demand and growth may be an obvious choice to combat inflation and supply shortages. A key worry is the risk of recession in the U.S. and abroad versus a softer landing. However, improving supply chains, inventory re-stocking, and greater capital spending could be supportive of pricing, and we believe the long-term investment case for owning industrial metals mining companies remains favorable. However, industrial metals may also be challenged to post further gains into the latter part of the year.

Putting it all together.

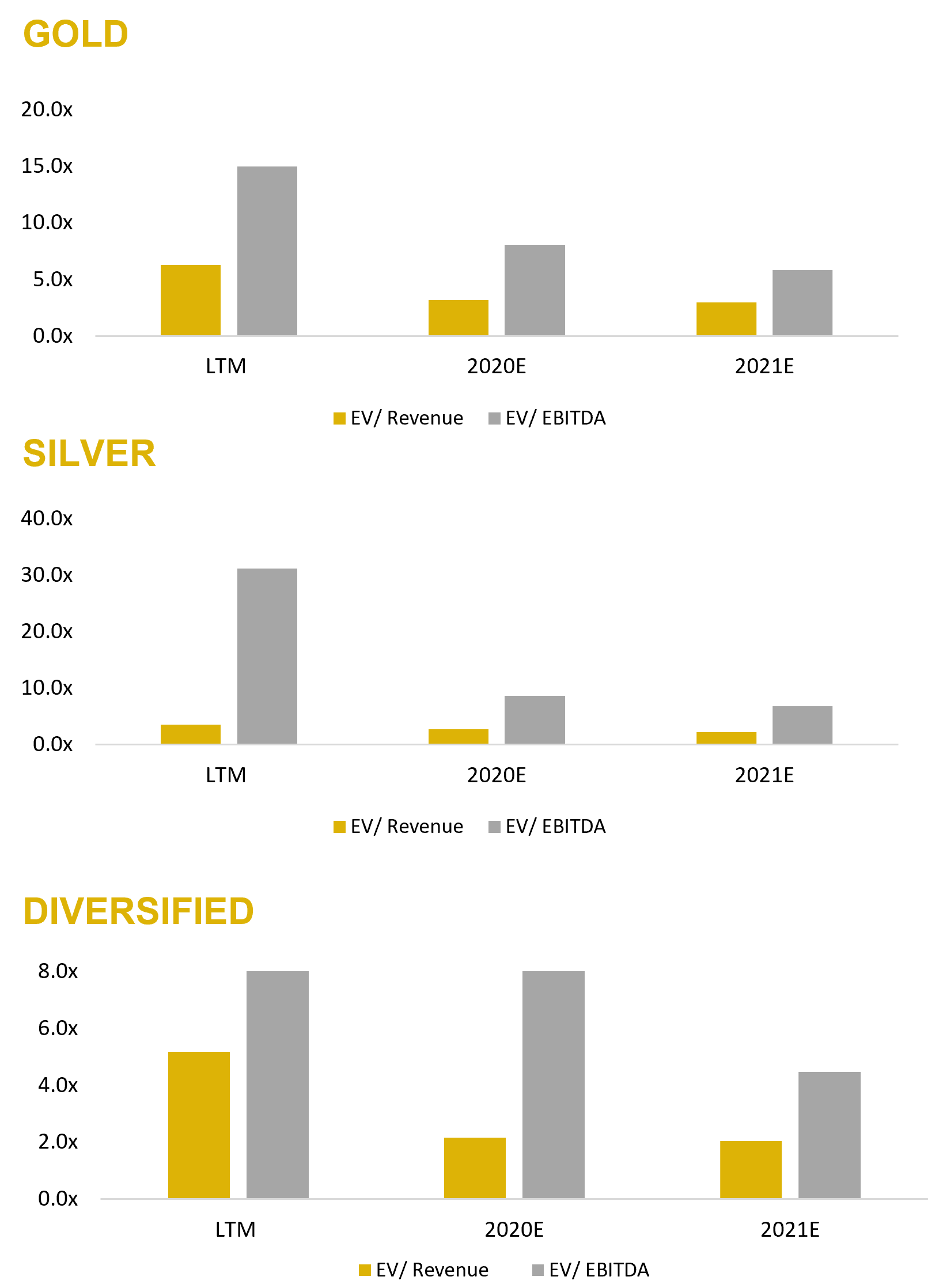

While much uncertainty remains, including the trajectory of the war in Ukraine, the U.S. Federal Reserve will likely achieve its goal of tamping down inflation. Despite a cautious near-term outlook, precious and industrial metals prices could hold up relatively well despite near-term headwinds. As a means of portfolio diversification, exposure to the mining sector is beneficial and investors may want to consider junior mining companies due to more attractive valuations relative to larger cap peers and the potential for increased M&A and industry consolidation.

Source: Capital IQ as of 03/31/2022

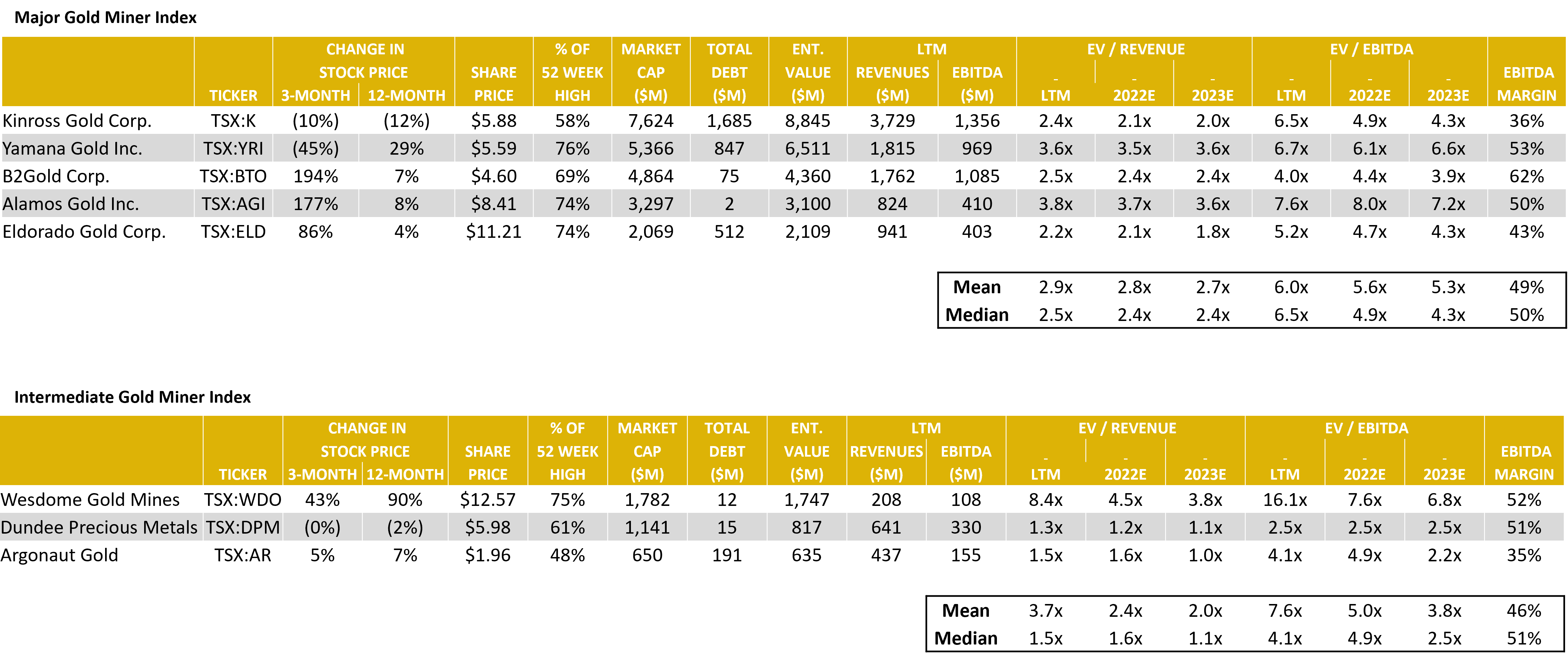

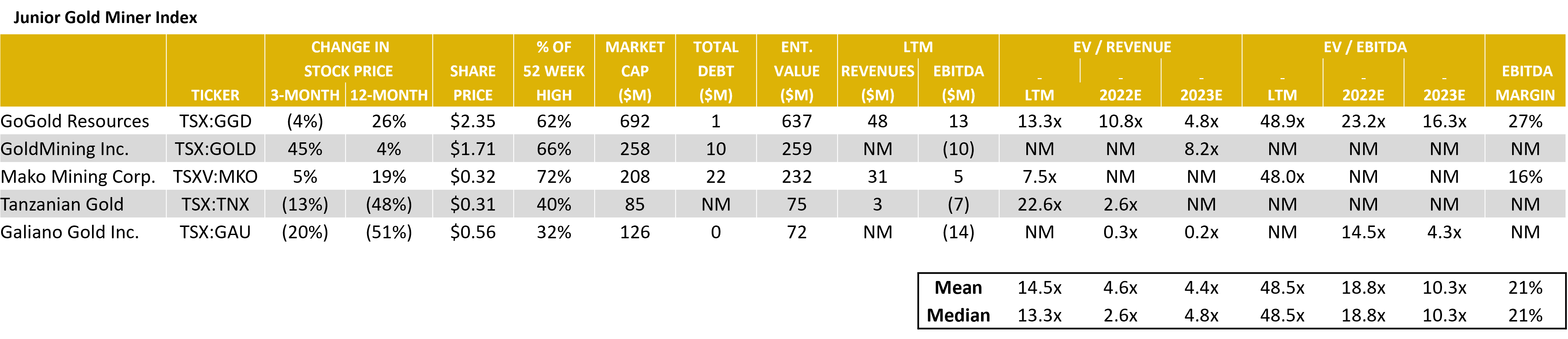

Gold Mining – Comparable Tables

Source: Capital IQ as of 03/31/2022

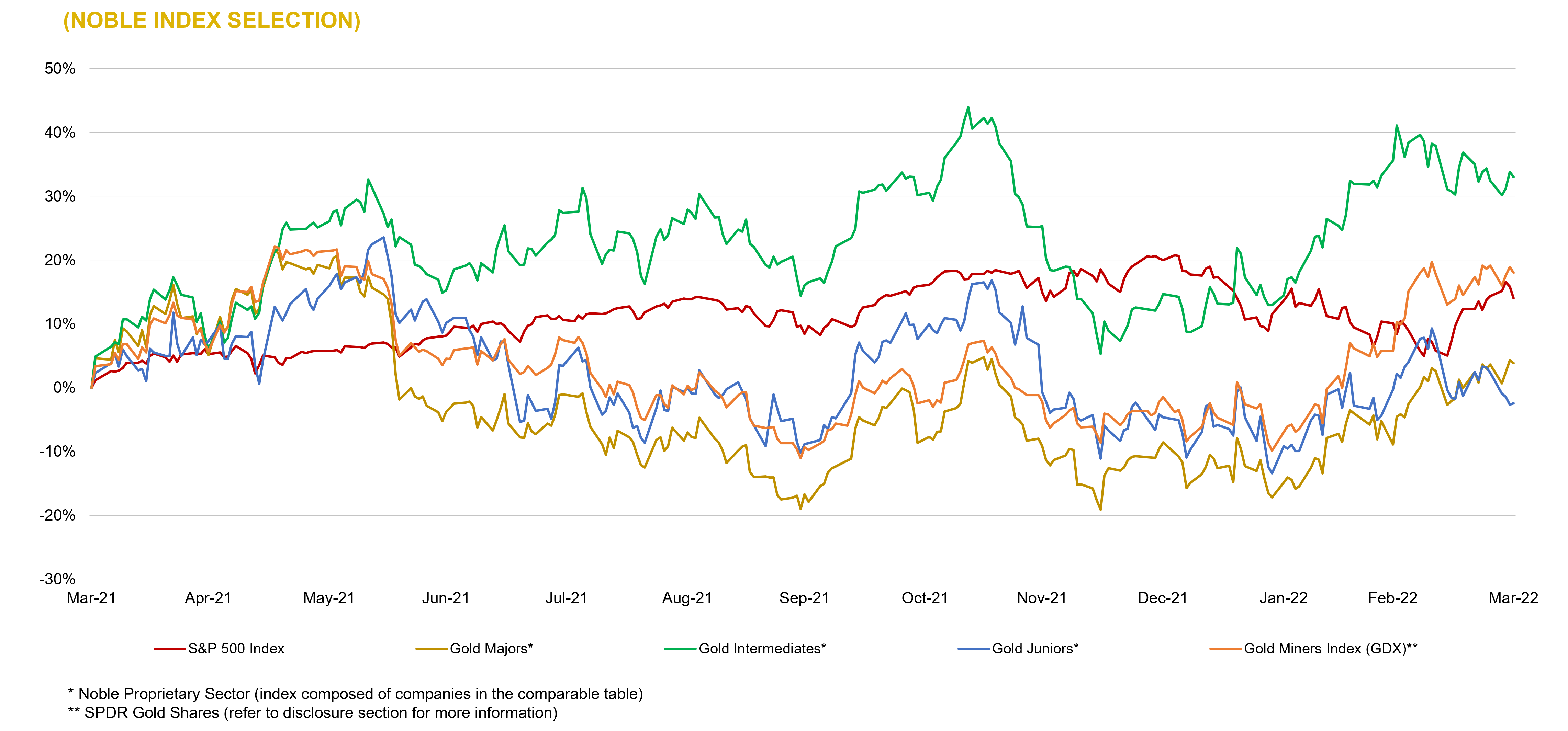

Gold Mining – LTM Equity Performance

Source: Capital IQ as of 03/31/2022

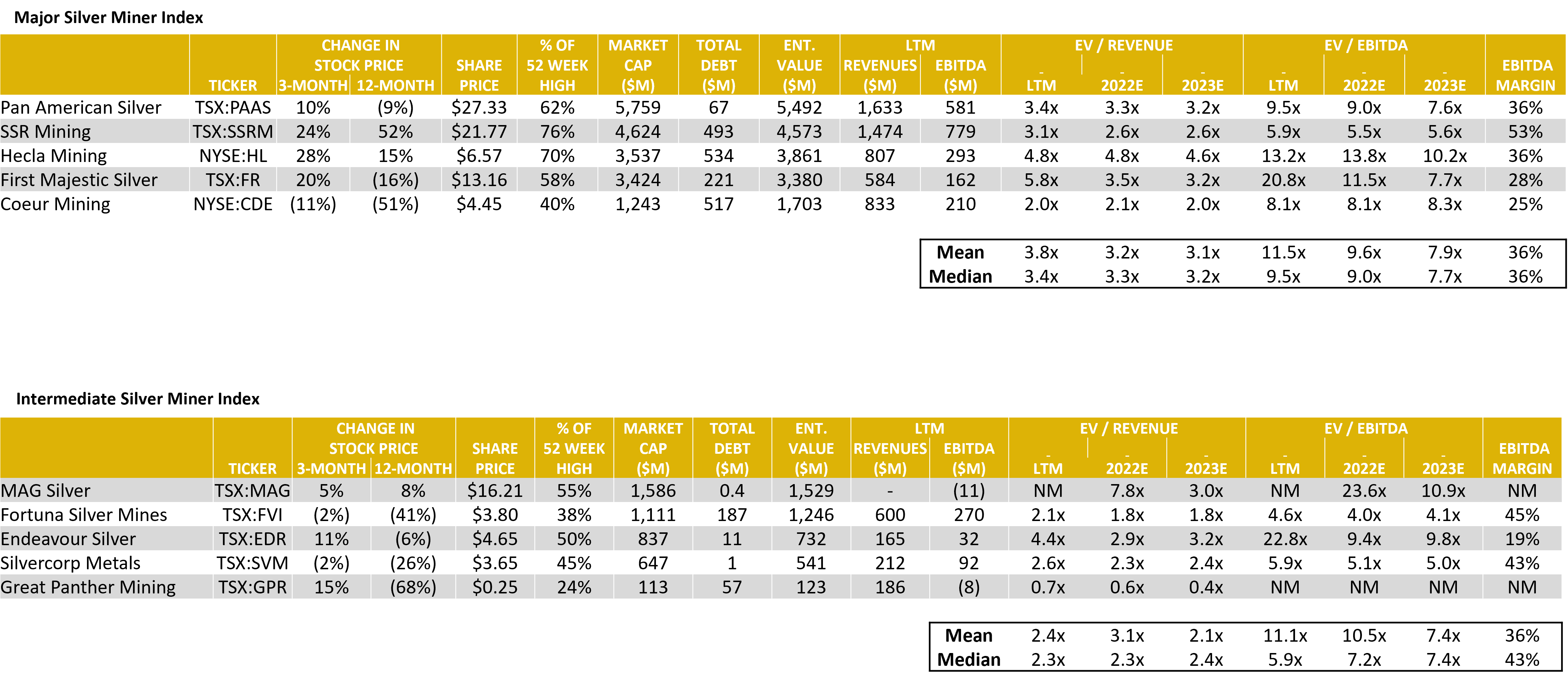

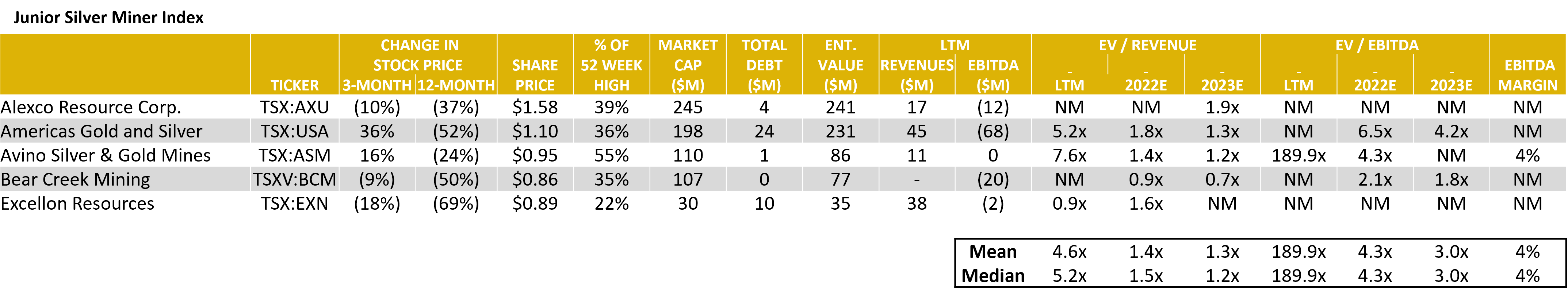

Silver Mining – Comparable Tables

Source: Capital IQ as of 03/31/2022

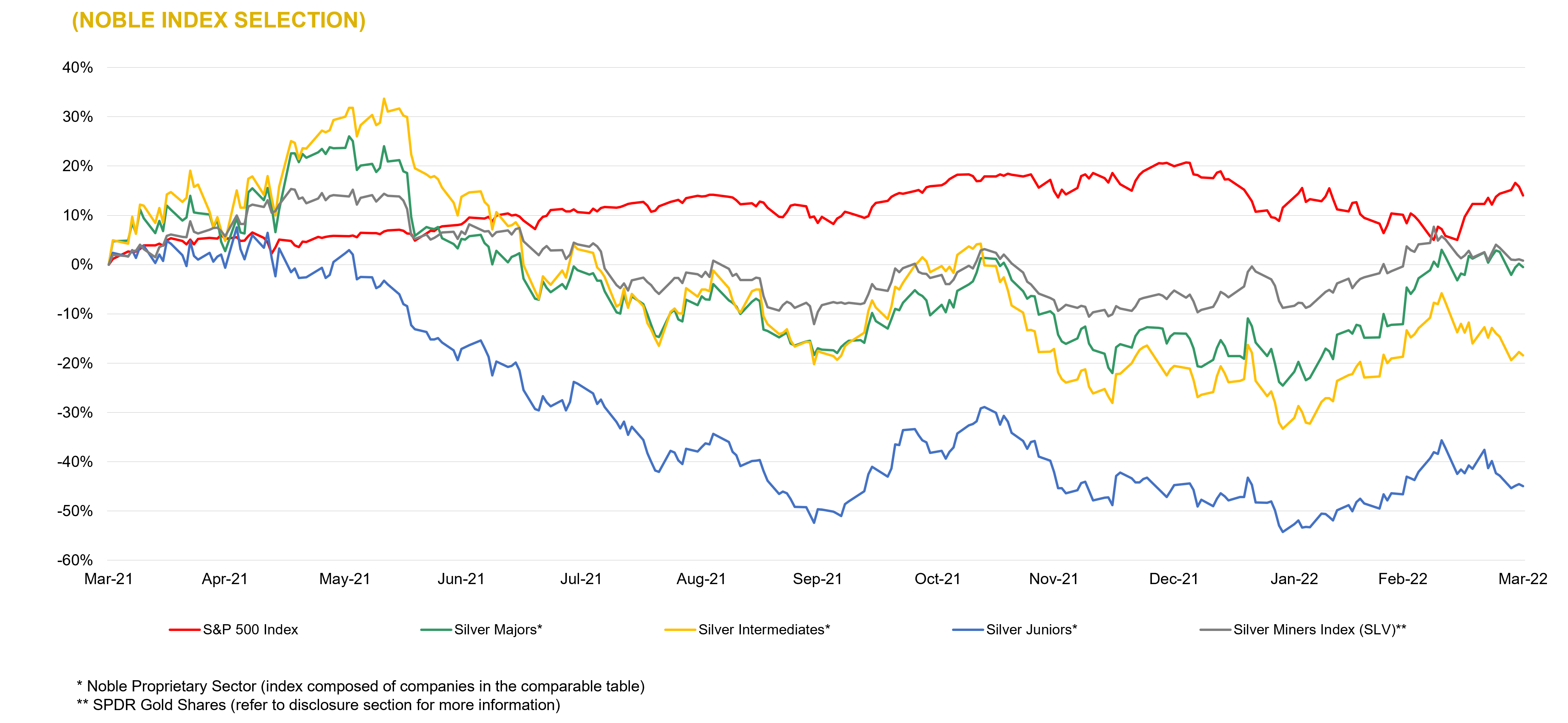

Silver Mining – LTM Equity Performance

Source: Capital IQ as of 03/31/2022

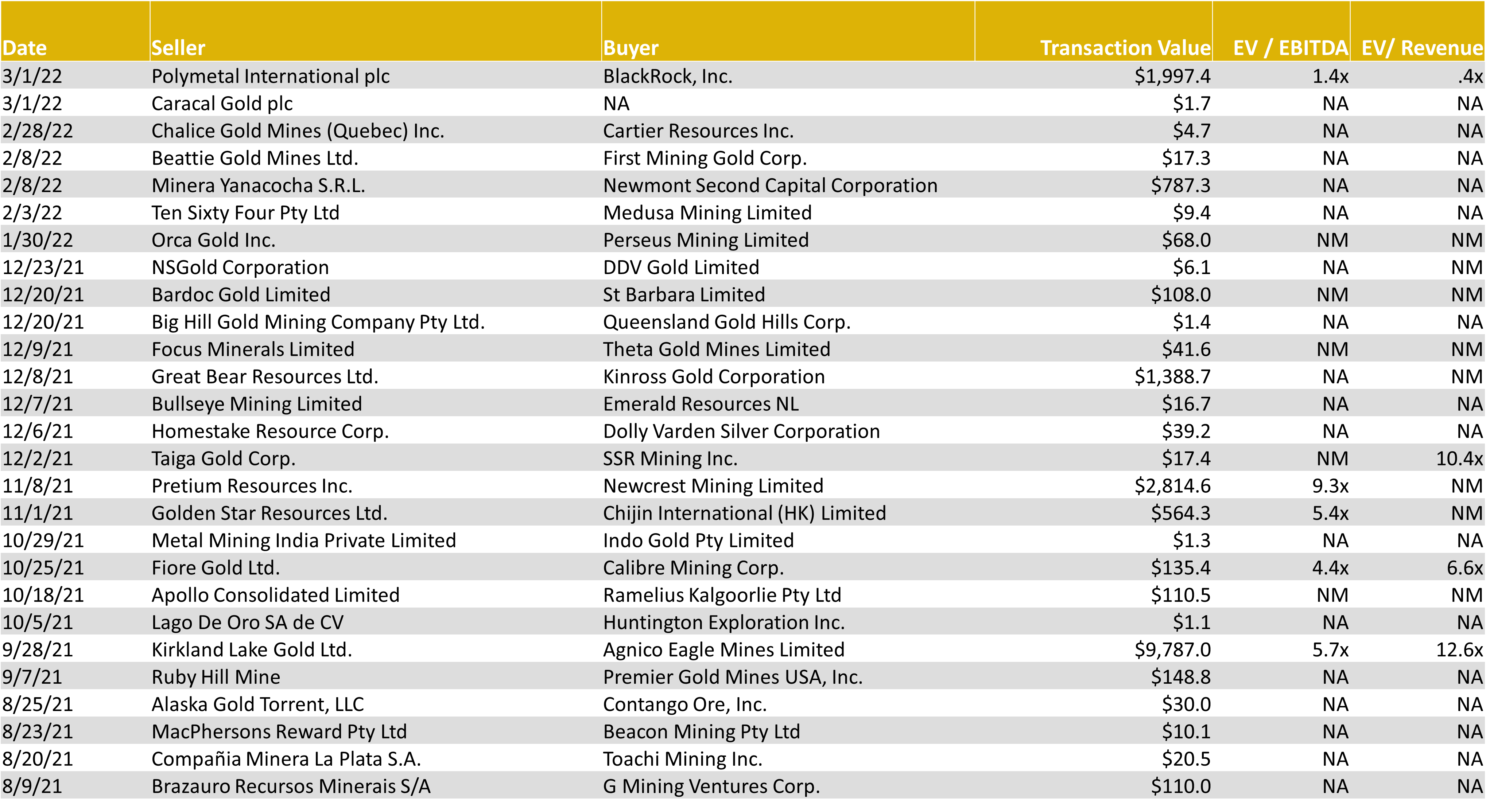

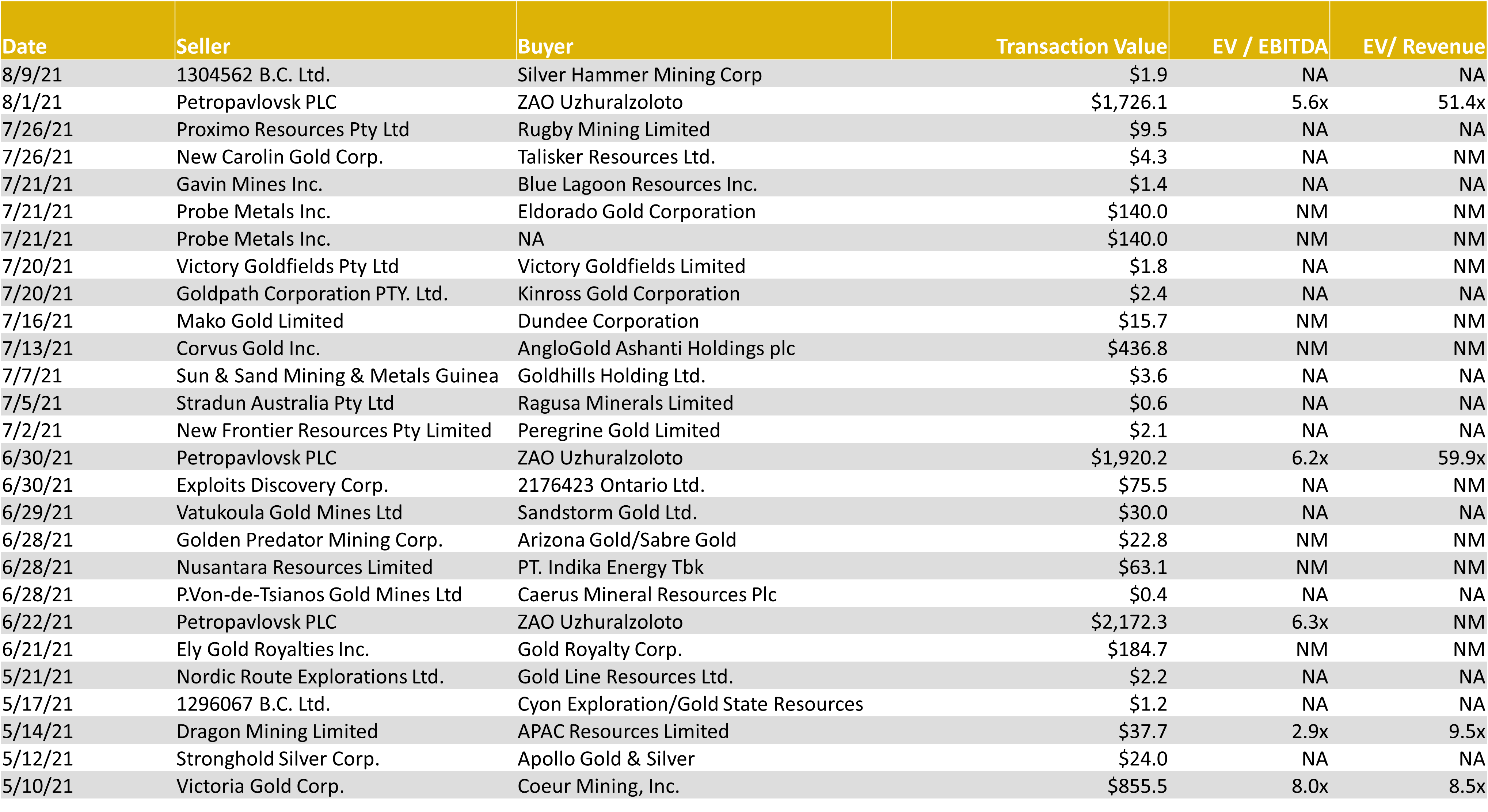

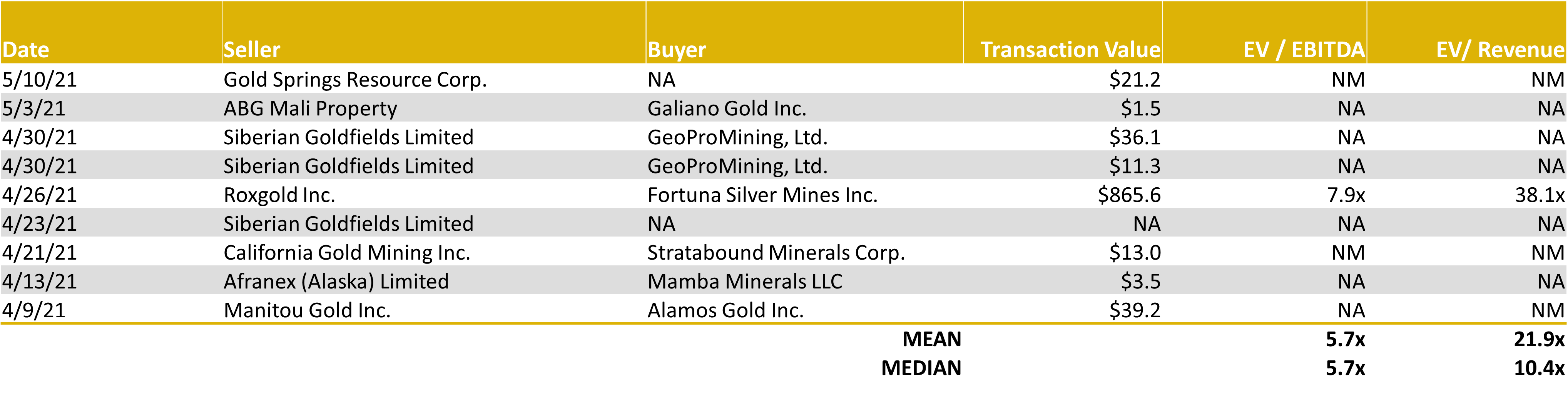

Gold & Silver – LTM Global M&A Activity

Source: Capital IQ as of 03/31/2022

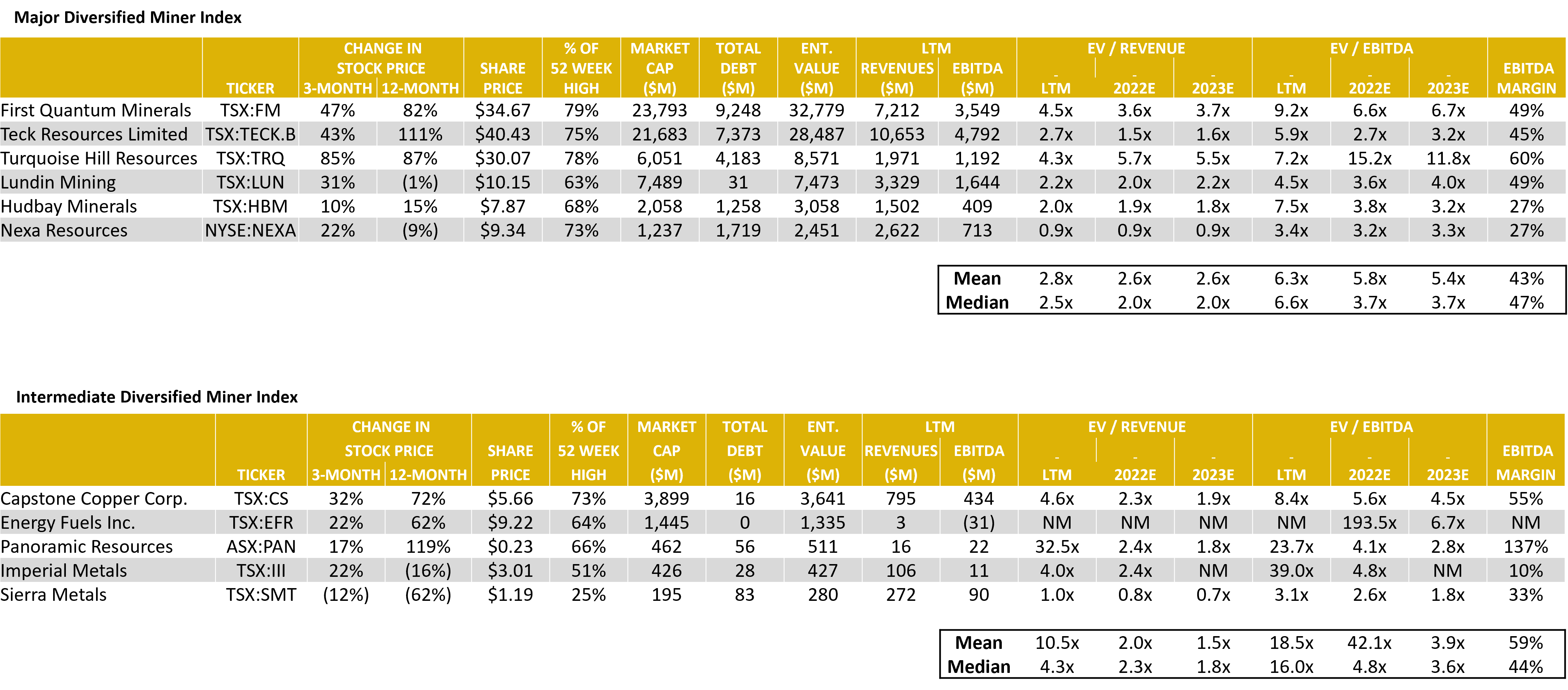

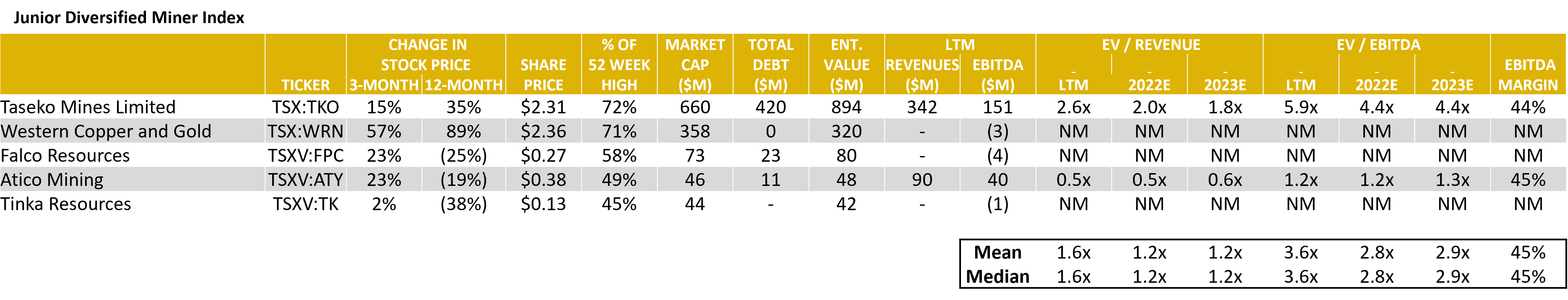

Diversified Mining – Comparable Tables

Source: Capital IQ as of 03/31/2022

Diversified Mining – LTM Equity Performance

Source: Capital IQ as of 03/31/2022

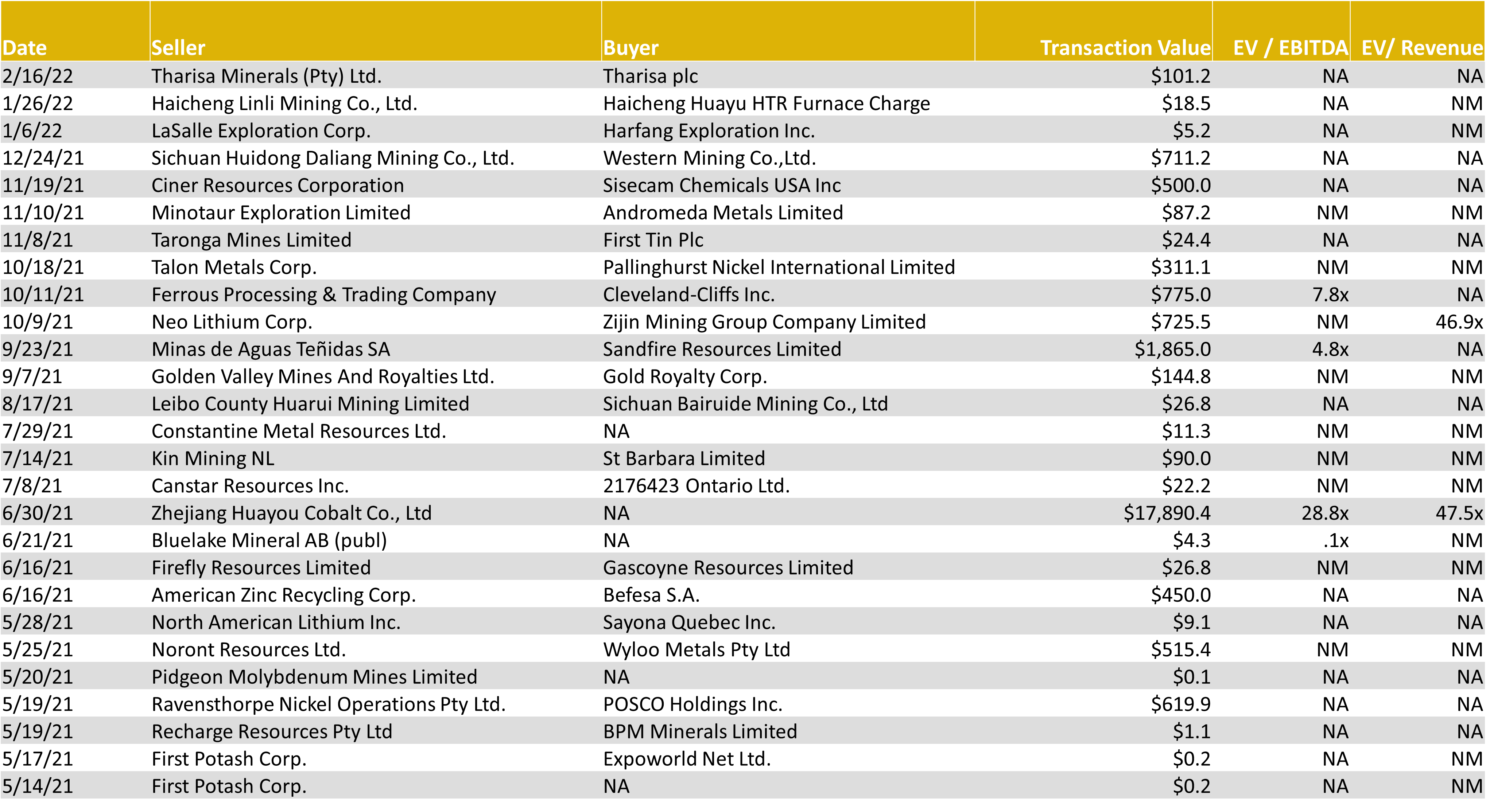

Diversified Mining – LTM Global M&A Activity

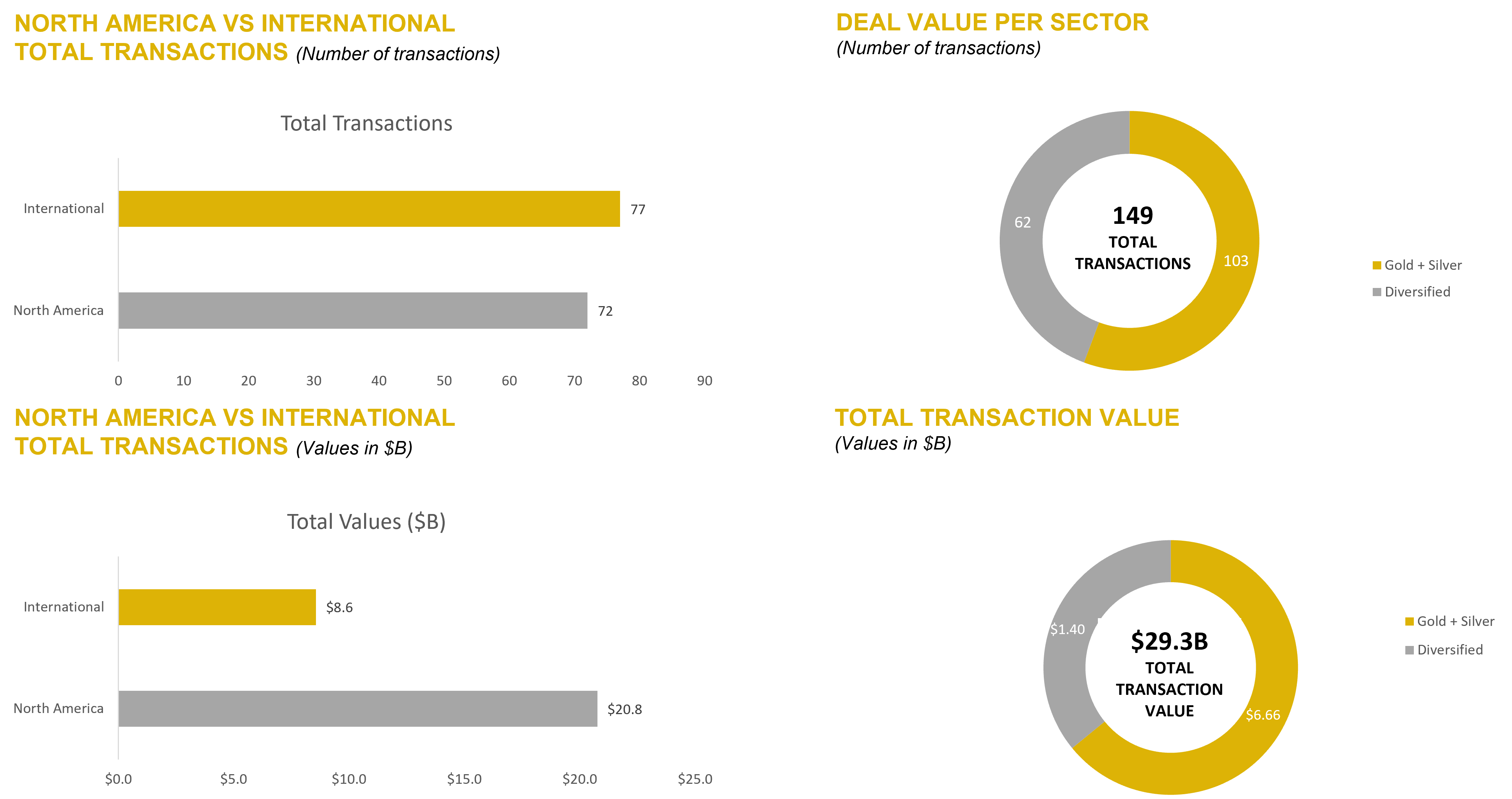

Source: Capital IQ as of 03/31/2022

LTM Mining Industry M&A Summary

Source: Capital IQ as of 03/31/2022

NOBLE QUARTERLY HIGHLIGHTS

Cypress Development Corp. (TSXV:CYP, OCTQB:CYDVF)

Industry: Metals and Mining – Diversified Metals and Mining

Cypress Development Corp. is a Canadian based advanced stage lithium exploration company, focused on developing its 100%-owned Clayton Valley Lithium Project in Nevada, USA. Work completed by Cypress led to the discovery of a world-class resource of lithium-bearing claystone adjacent to the Albemarle Silver Peak mine, North America’s only lithium brine operation. Cypress is advancing its Clayton Valley Lithium Project in Nevada towards the production of high-purity lithium hydroxide suitable for tier one battery usage.

1st Quarter News Highlight:

February 4, 2022: Cypress Development Completes Over-Subscribed $18.1 million bought deal financing. Pursuant to the Offering, the Company issued a total of 9,058,000 units of the Company (“Units”) at a price of $2.00 per Unit and 142,000 Warrants (as defined below) at a price of $0.1598 per Warrant, for aggregate gross proceeds of $18,138,720. Each Warrant entitles the holder to acquire one common share of the Company at a price of $2.65 with a Warrant expiry date of February 4, 2024. The net proceeds from the Offering are expected to be used by the Company to fund ongoing work, development and permitting activities at its Clayton Valley Lithium Project in Nevada and for working capital and general corporate purposes.

Maple Gold Mines Ltd. (TSXV:MGM, OCTQB:MGMLF)

Industry: Metals and Mining – Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Quebec’s prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel.

1st Quarter News Highlight:

March 17, 2022: The Company reported a substantial resource increase in the Douay property after an updated Mineral Resource Estimate performed during the first quarter. Indicated resources increased by 21% to 511,000 OZ AU, and inferred resources increased by 7% to 2,525,000 OZ AU. Matthew Hornor – President and CEO – commented: “Looking ahead, the Company is targeting larger step-out and deeper drilling along the full extent of the Douay resource area.”

Allegiant Gold Ltd. (OTCQX:AUXXF)

Industry: Metals and Mining – Gold

Allegiant owns 100% of ten highly-prospective gold projects in the United States, seven of which are in the mining-friendly jurisdiction of Nevada. Three of Allegiant’s projects are farmed-out, providing for cost reductions and cash-flow. Allegiant’s flagship, district-scale Eastside project hosts a large and expanding gold resource and is in an area of excellent infrastructure.

1st Quarter News Highlight:

March 17. 2022: The company announced the completion of its previously announced $4,014,414 financing and strategic investment by Kinross Gold Corporation for the exploration and development of the Eastside property in Nevada. As a result, Kinross now owns 9.9% of the issued and outstanding shares of Allegiant. The strategic investment by Kinross calls for the formation of a four-person Technical Advisory Committee comprised of two members from each company. The Technical Advisory Committee will provide advice and guidance on the upcoming core-drilling program at the HGZ within the Original Pit Zone at Eastside.

Source: Company Press Releases

DOWNLOAD THE FULL REPORT (PDF)

Noble Capital Markets Metals & Mining Newsletter Q1 2022

This newsletter was prepared and provided by Noble Capital Markets, Inc. For any questions and/or requests regarding this newsletter, please contact >Francisco Penafiel

DISCLAIMER

All statements or opinions contained herein that include the words “ we”,“ or “ are solely the responsibility of NOBLE Capital Markets, Inc and do not necessarily reflect statements or opinions expressed by any person or party affiliated with companies mentioned in this report Any opinions expressed herein are subject to change without notice All information provided herein is based on public and non public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on their own appraisal of the implications and risks of such decision This publication is intended for information purposes only and shall not constitute an offer to buy/ sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice Past performance is not indicative of future results.

Please refer to the above PDF for a complete list of disclaimers pertaining to this newsletter