Image Credit: Pixabay (Pexels)

Are Michael Burry’s Twitter Predictions on Point?

I’m bullish on Michael Burry Articles. The demand among investors and other readers is intense. Even those published

two years ago on Channelchek are consumed by new readers each day. And each time he deletes

his Twitter (TWTR) account, even more traffic is driven to those stories. The hedge fund manager, medical doctor, and subject of the movie, “The Big Short,” has again deleted his Twitter account after highlighting through various tweets, how ahead of the curve he has been with his predictions.

As an investor with a cult-like following, Burry is best known for having predicted the 2008 mortgage crisis, and more significantly, how to line up trades to profit from it. Anecdotally, it seems he’s more comfortable predicting

downside. This year he began suggesting the U.S. economy may succumb to a similar fate. Throughout 2022, with growing concern, Burry has been consistently warned of a painful recessionary period ahead, and has held investments in prisons, military contractors, and has shorted Apple (AAPL), and placed big bets against U.S. Treasuries.

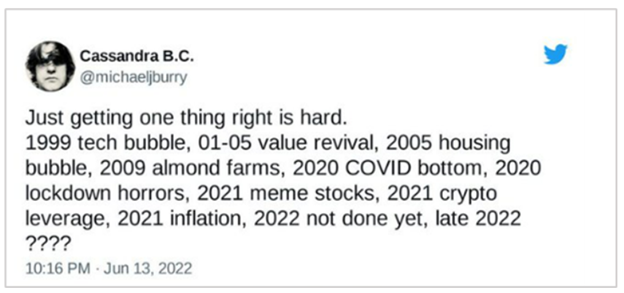

As with his short on the mortgage markets, Burry is usually early with his predictions. Others in the investment world tend to disregard his early warnings well ahead of events that often have eventually unfolded as he predicted. Based on his tweets, this lack of being believed frustrates the successful fund manager. This is likely why he refers to himself on Twitter as Cassandra

B.C. In Greek mythology, Cassandra was a Trojan priestess with the gift of accurately prophecizing the future. However, she was also cursed with no one ever believing her prophecies – Cassandra was instead described as insane.

It is typical for Burry to disable his Twitter account after tweeting some of his more emotional tweets. He does this and then resurfaces with those tweets deleted. Recently deleted posts show Burry believes that fake Twitter accounts use his tweets. Specifically, he suggests bots and others pump asset purchases as comments on his posts. This helps them boost whatever it is they are trying to pump. He gives the reason for deleting his account as a way to discourage misuse of his famous tweets,“But it’s breathtaking, this religion of real and fake people. The speculation probably tops anything in history,” he wrote.

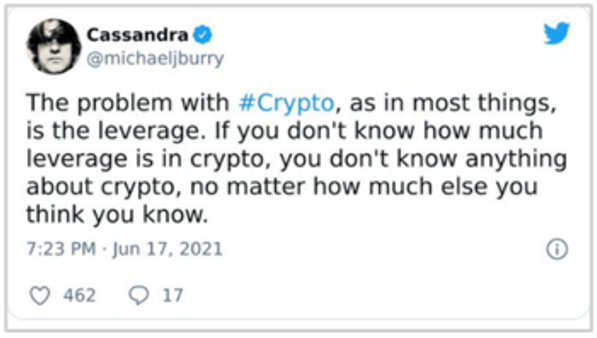

He is no fan of cryptocurrency. “If you don’t know how much leverage is in crypto, you don’t know anything about crypto, no matter how much else you think you know,” he tweeted. This is a similar cry to his posts in April 2020 when he predicted the U.S. would suffer from runaway inflation. He was also critical of the wisdom of the meme stock frenzy, which skyrocketed the prices of a few nostalgic stocks.

After last May’s CPI numbers, Burry tweeted, “Transitory, no. Peak, no. To the moon? If you mean a cold dark place.” As per Burry, inflation broke the weakest sector with “no buyers for MBS.” His prophecy that inflation numbers have not yet peaked this year and says the mainstream news that are reporting a strong dollar are looking at it incorrectly. In his

measurement system, the dollar is weak. is being heeded by some of his followers, the reduced value of the dollar spending power the inflation of May is not yet at its peak has created profound fear among the masses, as they are already dealing with the reduced disposable income coupled with increasing gasoline prices and other everyday use items.

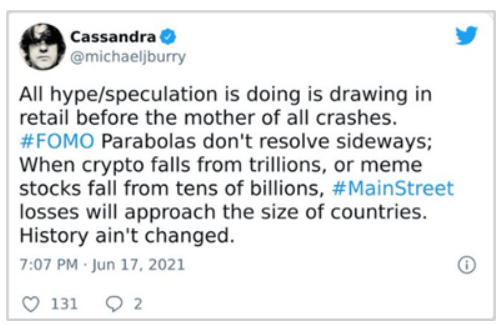

It was in June 2021 Burry posted, “When crypto falls from trillions, or meme stocks fall from tens of billions, #MainStreet losses will approach the size of countries. History ain’t changed.” While scoffed at the time, and certainly there were many who got in, got out, and grew their accounts back then, but those that held are seeing a lot of red due to both the crypto selloff and the unwinding of the meme stock trade, not to mention the overall market performance.

Burry’s latest exit from Twitter was after a warning for the rest of 2022. He indicated unfathomable pain. While there is already pain in the market and on main street, his forecast is in addition to what may be a recession this year, a reduction in savings rates, 41-year high inflation rates, relative dollar weakness, and markets down between 23% and 31%.

Take Away

Dr. Michael Burry has again tweeted

about doom and complained that people aren’t listening. It is worth understanding his expectations and deciding whether they are viable and if there is action you as an investor should take. Articles surrounding his expectations and his portfolio holdings are widely read by investors. Sign up for Channelchek emails to stay in touch with these stories and many others.

Managing Editor, Channelchek

Suggested Content

A Close Look at Michael Burry’s Plane Crash Comments

|

Michael Burry’s Latest Portfolio Brings the FAANGS Out

|

Michael Burry Couldn’t Resist Tweeting a Few Words About Twitter’s Largest Shareholder

|

Can Stock Market Index Enthusiasm Cause Costly Bubbles?

|

Sources

https://www.newtraderu.com/category/michael-burry/

Stay up to date. Follow us:

|