Noble Capital Markets Media Sector Review – Q1 2022

INTERNET AND DIGITAL MEDIA COMMENTARY

High Flying Tech Stocks Get Their Wings Clipped

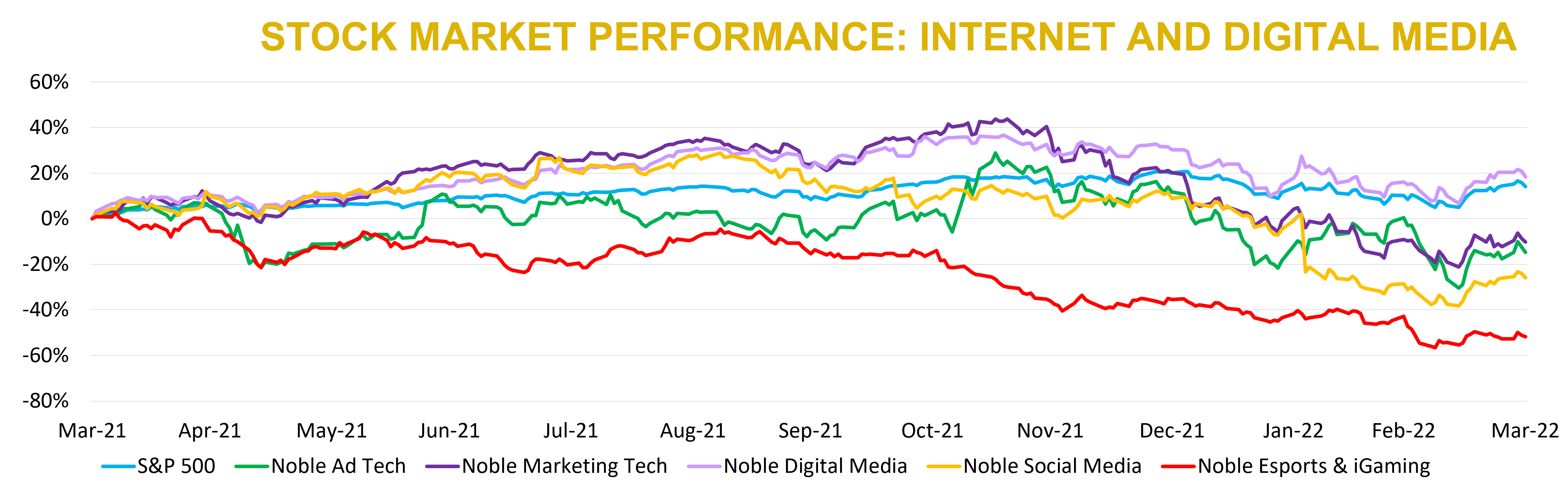

As we noted last quarter, despite performing well in 2021 overall, stocks in the Internet and Digital Media sectors performed poorly in the fourth quarter of 2021. Unfortunately, that quarter’s performance carried over into the first quarter of 2022. None of Noble’s Internet and Digital Media Indices outperformed the broader market, which we define as the S&P 500. Stocks in the S&P 500 Index decreased by 5% in 1Q 2022, which was better than Noble’s Digital Media Index (-9%), Ad Tech Index (-24%), MarTech Index (-25%), Esports & iGaming Index (-26%) and Social Media Index (-31%).

Noble’s Internet & Digital Media Indices are market cap weighted, so each sector’s performance is often driven by the FAANG stocks (Facebook, Apple, Amazon, Netflix and Google). While none of the FAANG stocks were up in the first quarter, Apple (APPL: -2%), Amazon (AMZN: -2%), and Google (GOOG: -4%) outperformed the S&P 500, while Facebook (FB: -33%), and Netflix (NFLX: -38%) significantly underperformed the broader market.

We attributed the 4Q 2021 underperformance in the Internet and Digital Media sectors to two factors: 1) difficult comparisons due to Covid related comparisons (i.e., companies that benefited from business migrating online in 2020 had tough comps in 4Q 2021 as the economy re-opened), and 2) the Fed pivot to signaling higher rates to tame inflation. Both of these issues remained evident in the first quarter.

The “re-opening” story has wreaked havoc in certain stocks and sectors. For example, investors have long been attracted to the MarTech universe based on the sector’s high growth and recurring revenue business model.

While growth has moderated slightly in recent quarters (revenues increased by 29% on average in 4Q 2021 vs. 32% in 3Q 2021), 21 of the 22 stocks in the sector posted stock price declines in 1Q 2022, and 19 of the 22 posted double digit stock price declines. Three months ago, MarTech stocks were trading at an average revenue multiple of 8.5x and a median revenue multiple of 5.3x. Today, the “mean” and median revenue multiples have fallen to 6.7x and 5.0x. It’s interesting to note that the average multiple has contracted a lot more than the median multiple, indicating that the “high-flying” MarTech stocks have been most impacted.

A good example of this is Shopify (SHOP), which traded 22.2x 2022E revenues at the time of our last quarterly Internet and Digital Media newsletter but now trades at 11.8x 2022E revenue. Shares of Shopify fell by 51% in the first quarter as its forward revenue multiple nearly halved. A provider of e-commerce software, Shopify thrived during the pandemic, as many offline businesses rushed to add online storefronts. But as the economy has reopened, and more consumers return to physical retail stores, Shopify’s growth has slowed considerably.

High-fliers in other Internet and Digital Media sectors appear to have been more impacted by Fed policy than re-opening concerns. In the Ad Tech sector, shares of The Trade Desk (TTD) fell by 24% during the first quarter. Three months ago, TTD shares traded at 24.8x 2022E revenues, but today its shares trade at 20.1x 2022E revenue. In the Social Media sector, the highest multiple stock three months ago was Snap (SNAP), which traded at 16.5x 2022E revenues, but shares of Snap fell by 24% and trade at 9.7x. In the Digital Media sector, three months ago the highest multiple stock was Netflix, which traded at 7.3x 2022E revenues, but shares of Netflix fell by 38% and now trade at 5.3x 2022E revenue.

It was not a great time to own shares in the Internet and Digital Media sectors in the first quarter of 2022, despite the fact that revenue trends continue to be robust and margins continue to improve. In our opinion, what’s changed is investor perception of where to invest in this stage of the economic cycle and the Fed’s impact as it raises rates. While signs of a slowdown don’t appear imminent in the Internet and Digital Media sectors we monitor, investors appear concerned about the impact Fed policy will have on the sector later this year or next. As the Fed continues to tighten monetary policy, investors appear to have rotated out of expensive, growth-oriented tech stocks and into more defensive sectors, as evidenced by the S&P Energy index increasing by +38%, the S&P Utility Index increasing by +7% and the S&P Health Care index declining by just 1%. Each of these sectors outperformed the broader market in 1Q 2022.

1Q 2022 M&A – Weathering the Storm; Will it Hold?

According to S&P Global Market Intelligence, technology industry M&A slowed considerably in the first quarter of 2022 with deal value falling by 36% to $216.7 billion from $338.5 billion in the first quarter of 2021. S&P Global cites heavy M&A activity in January followed by a sharp slowdown in February and March, even though the total number of technology M&A deals increased in 1Q 2022 relative to 1Q 2021. This is rather impressive during a quarter in which inflation reached a 40-year high, a war started in Ukraine, and publicly traded stocks performed poorly.

Noble tracks M&A deals in a narrower subsector of technology sector, and our data showed very different trends than the broader tech M&A. Noble breaks down our universe into 9 categories: Ad Tech; Agency & Analytics; Digital Content; Ecommerce; Information; MarTech; Mobile, and Social Media). We tracked 170 deals in these sectors in the first quarter of 2022, an 5% decrease in deal activity (unlike the broader sector). We also did not see a material slowdown in deal activity, as we tracked 62 deals in January, 51 in February and 57 in March, which is impressive in light of inflation, a war, and stock price declines.

The dollar value of the deals we tracked in 1Q 2022 increased by 225% to $106.8 billion, up from $32.8 billion in 1Q 2021. The huge increase comes almost solely from the $69 billion announced acquisition of Activision Blizzard by Microsoft in January. Excluding this one transaction, deal value increased by a healthy 15% in 1Q 2002.

From a deal volume perspective, the most active sectors we tracked were Digital Content (63 deals), Marketing Tech (47 deals) and Agency & Analytics (31 deals). From a deal value perspective, the most active sectors were Digital Content ($86.9B), Agency & Analytics ($15.9B), Marketing Tech ($1.5B), and Ad Tech ($1.4B).

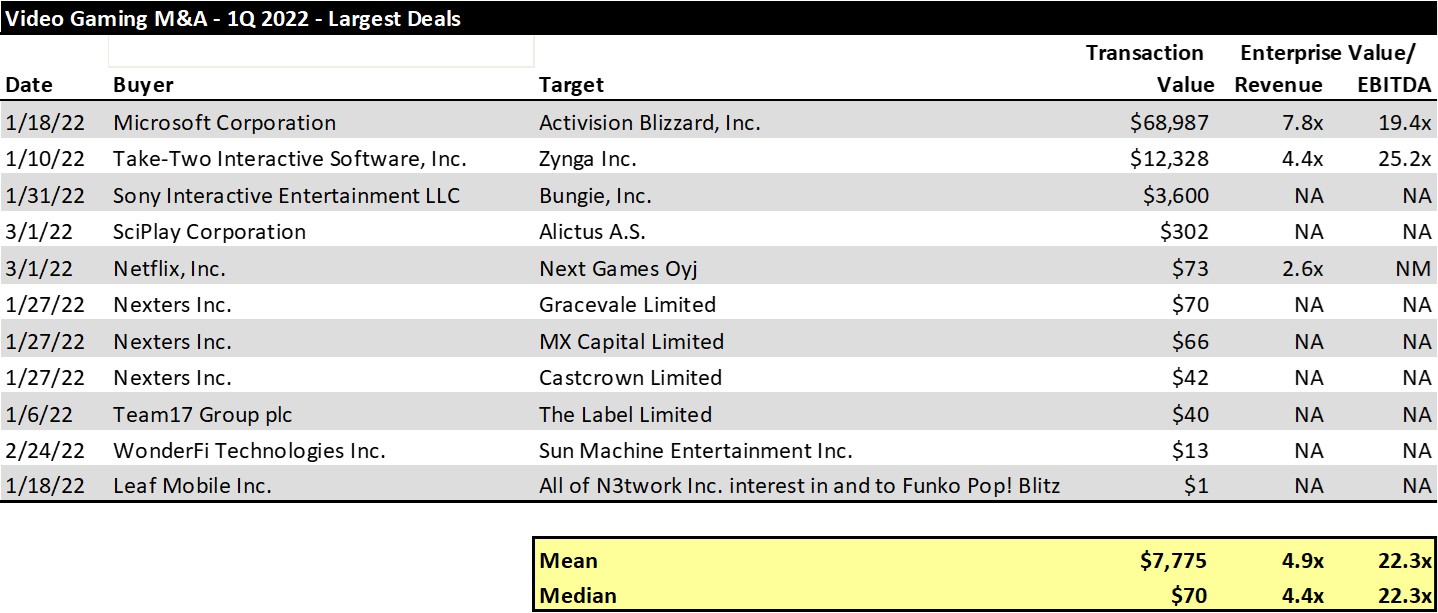

As has been the norm for the past several quarters, the largest subsector of deal value within the Digital Content sector is the video gaming sector, with $85 billion of announced deals in the first quarter. The quarter got off to a fast start with Take-Two Interactive’s (TTWO) $12 billion announced acquisition of Zynga in early January. That was followed a little more than a week later with Microsoft’s announced acquisition of Activision Blizzard for $69 billion. Sony finished the strong January with its $3.6 billion acquisition of Bungie. Perhaps most notably, Netflix has become an active acquirer in the gaming sector in the last six months. In September of last year, Netflix entered the video gaming market with the acquisition of Night School Studio, and the company followed that up in 1Q 2022 with the acquisiton of Next Games Oy and Boss Fight Entertainment.

A look at the largest Gaming M&A transactions of 2021 is provided in the chart below.

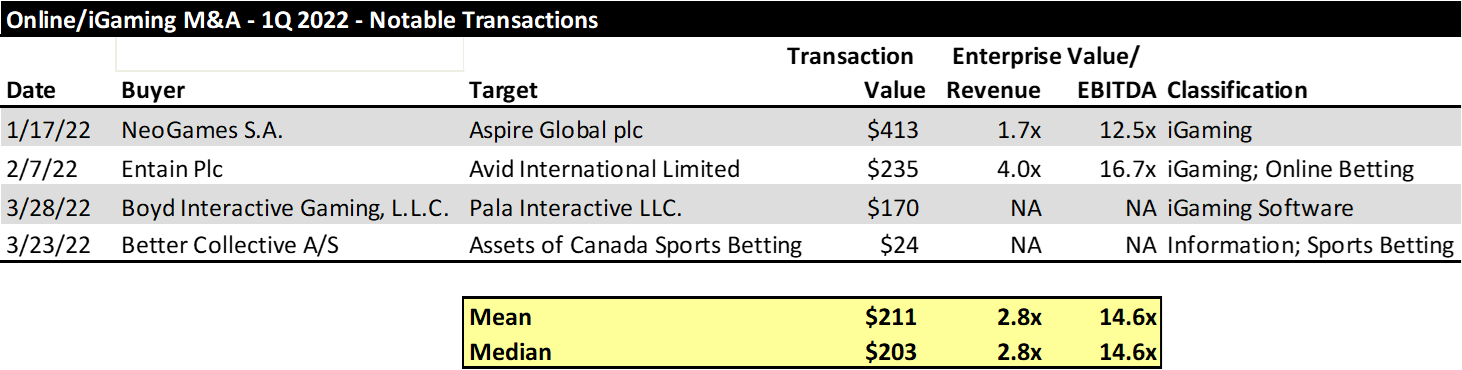

Another sector that showed continued M&A strength was the online gaming, or “iGaming” sector. As more states and countries allow for betting online, a land rush has ensued, often times with companies buying foreign assets, where online betting has been around a while, in order to provide the tools to compete in North America, where there remains significant upside opportunity. Some of the most notable transactions of betting software companies are provided below. We have included the Better Collective acquisition of Canada Sports Betting, even though Canada Sports Betting isn’t an online gaming company per se. Rather, we have included it because we have found that iGaming companies are targeting data and information companies which provide information to bettors, which is key to helping them understand their odds ahead of placing bets.

In recent quarters we have written about robust M&A activity in the Digital Publishing and Podcasts sectors. However, activity in these sectors slowed considerably. In Digital Publishing, the New York Times Company announced the acquisition of sports focused content provider The Athletic for $550 million, but that was the only major digital publishing deal where the purchase price was announced publicly. In podcasting, Liberated Syndication, or Libsyn (LSYN) acquired Podcast Ad Reps for $11.9 million, but no other major podcast M&A transactions took place during the quarter.

M&A activity weathered a storm in 1Q 2022. For now, as long as solid revenue growth, improving margins, and strong balance sheets remain the norm, we expect M&A activity to remain solid, although likely not at record levels we saw in 2021 given the backdrop of higher rates and a war on European soil, each of which creates higher levels of uncertainty.

Esports & iGaming

The following is an excerpt from a recent note by Noble’s Media Equity Research Analyst Michael Kupinski

One of the poor performing sectors in the latest quarter was the Esports & Gaming sectors, down 25% in the quarter versus a 5% decline for the S&P 500 Index. Given the recent performance, the sector is down 52% for the trailing 12 months. The performance of the sector is disappointing given that we had expected that it would be a beneficiary of the economy reopening. Our view was that in person esports events would rebound and that igaming would become a favored way for strapped States to increase revenue. While this is still our view, we were surprised that the industry became a victim of the flight to quality. Many of the stocks in the index are developmental companies, investing to gain a foothold in the fast-growing space. As such, many of the companies in the space are not cash flow positive and have needs to raise capital for investment. Consequently, many of these companies are selling non-strategic assets, raising expensive capital, and aggressively cutting expenses.

It has not helped that the fundamentals of some of the companies have not been as strong as expected. In the latest quarter, we have revised downward revenues and adj. EBITDA due to gaming regulations, slower than expected product rollout, and geopolitical issues. One exception is Codere Online (CDRO), which has significant amount of cash to continue its international expansion. While the company has been adversely affected by recent gaming regulation in Spain, we believe that there is an attractive opportunity to expand into many Latin American markets. The company also has longer term plans to enter the US market.

TRADITIONAL MEDIA COMMENTARY

The following is an excerpt from a recent note by Noble’s Media Equity Research Analyst Michael Kupinski

Overview

Is it time to buy?

Consumer cyclical stocks, such as the media and entertainment sectors, tend not to perform well during periods of rising interest rates. This is a function of the sensitivity of advertising to the general economy. Rising interest rates tend to slow economic activity and potentially portend an economic downturn. The Fed Reserve indicated that it plans a series of rate hikes in 2022, with the first being a 0.25 basis point bump on March 16th. . But media investors do not appear focused on the prospect of an economic downturn. This is largely due to the current favorable advertising environment. Most media companies reported better than expected advertising in the fourth quarter and guided toward favorable first quarter trends. In addition, media companies appear optimistic for the second half of the year with the anticipated influx of political advertising.

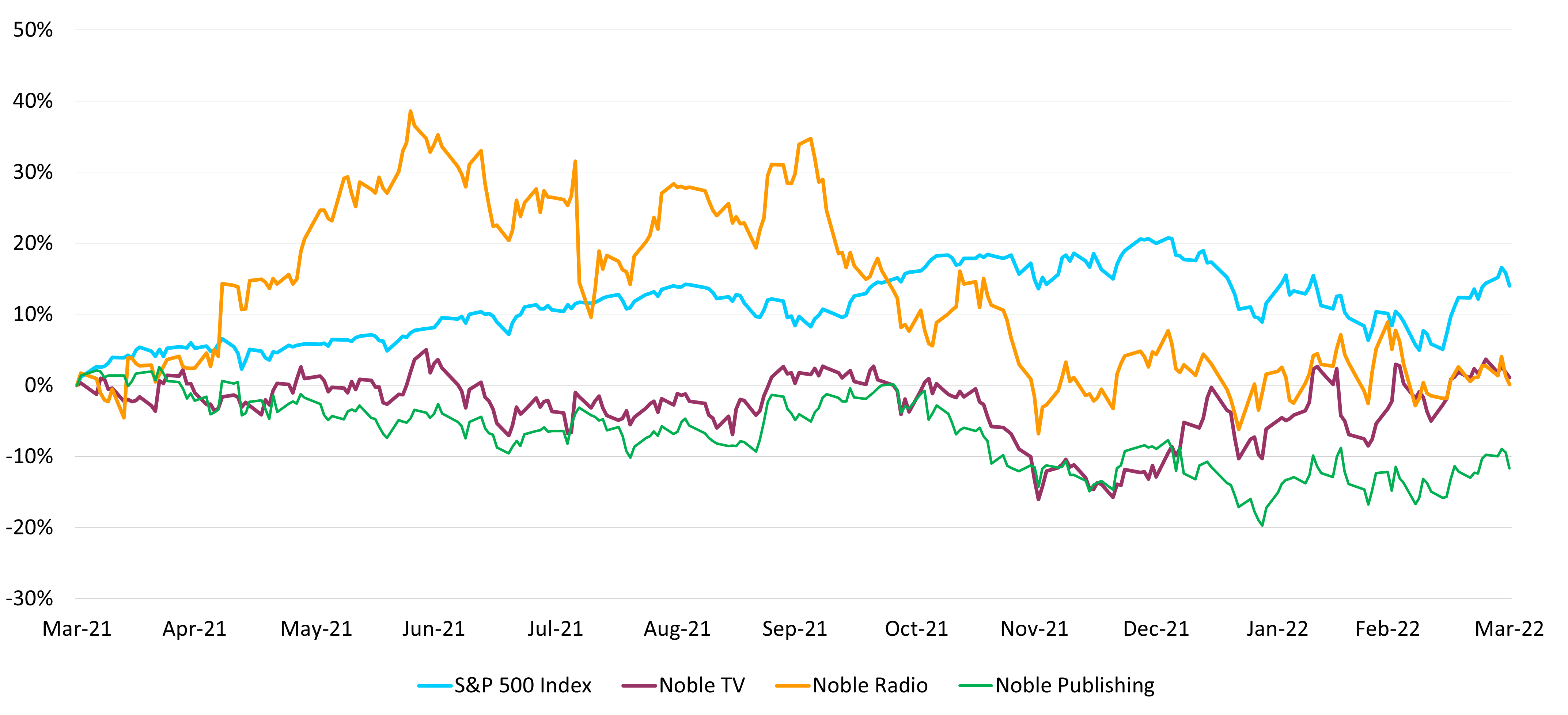

For this reason, we believe, the traditional media companies outperformed the S&P 500 Index in the latest quarter, with the TV sector performing the best, (highlighted later in this report). Coincidently, Broadcast Television is one of the biggest beneficiaries of the influx of political advertising, which will largely fall in the third and fourth quarters. In addition, TV broadcasters have diversified revenue streams, most notably retransmission revenue, which is not tied to the vagaries of the economy. Retransmission revenues as a whole account for an average –% of total broadcast revenue. Finally, many broadcasters indicated that sports betting has become a meaningful contributor to the improved advertising environment. With favorable revenue visibility, not surprisingly, TV stocks have outperformed the traditional media stocks, including Broadcast Radio and Publishing.

No doubt that there has been a rotation in the market, with investors moving toward larger, established companies, with more predictable revenue and cash flow, favoring those with solid balance sheets. Developmental companies and industries that are in investment mode have struggled in this environment, like the Esports & iGaming industries. Many of these companies have investment spending desires, but may be locked out as access to the capital markets have become limited. As a result, many developmental companies significantly cut back costs in a survival mode reaction.

Is the pain nearly over? We do not think so. In our view, while the inverted yield curve may have investors and analysts likely to begin modeling the prospect of an economic downturn in the future, we believe that the portfolio repositioning has just begun. Our key takeaway is that investors should be looking for opportunities. The best time to buy media stocks has typically been during an economic downturn or when the markets already factor one in. A process that seems to have begun. As such, we encourage investors to go hunting. We continue to favor companies that are in growth industries, have solid balance sheets, and stock valuations that may already reflect recession type valuations.

Broadcast Television

Broadcast Television: Returning Capital To Shareholders

The Noble Broadcast TV index increased 15% in the first quarter as investors anticipate a strong fundamental year in 2022 with the influx of political advertising and a strong economy. Some broadcasters indicated that political advertising in 2022 could be more than what was spent in the past Presidential election year. We are not as sanguine about that opportunity but believe that political advertising should increase a solid 30%, which is in line with the historic 20-year growth rates over Presidential year and biennial election year cycles. While the key auto category is still not fully recovered, broadcast management indicated that the category should cycle toward growth in 2023, a function of supply chain issues abating and a significant number of new models being introduced. Notably, most companies appeared very optimistic about sports betting advertising, which has emerged to become a leading category. Several large States appear to be poised to approve online sports betting, like Florida and California, which should meaningfully bolster core advertising.

In addition, we believe the reason that the stocks outperformed in the quarter, investors have come to realize that advertising is a smaller portion of total broadcast revenue. For the year 2021, retransmission revenue, a stable a predictable source of revenue, now accounts for a significant 44% of average broadcast revenue. Finally, the broadcast industry has substantially improved balance sheets. Industry wide, net debt is on average 3.6 times EBITDA, with the mean at a modest 2.7 times. While there are companies higher than the averages, many of those companies have a path toward lowered leverage in 2022 given the anticipate influx of high margin political advertising.

With the favorable fundamental tailwind and reasonable debt levels, many companies are returning capital to shareholders in the form of dividends and share repurchase programs. Entravision announced a $20 million share repurchase program and Nexstar increased its quarterly cash dividend by 29%. We believe that more companies are likely to announce similar moves as debt leverage comes down.

Notably, with the favorable Q1 stock performance up 15%, the Noble Broadcast TV index over the trailing 12 months increased a modest 1%. This modest gain was below historic 25-year averages for the stocks in the year prior to an election year. On average, TV stock gained 22% in the year prior to an election year. We wonder if investors are nervous about the geopolitical events, rising inflation and rising interest rates. Notably, the stock valuations appear compelling. As the accompanying Broadcast TV Company Comparable table illustrates, the average TV stock trades at 6.5 times EV to 2022 EBITDA and 7.5 times 2023 EBITDA, at the low end of historic averages in the range of 6 to 12 times. In our view, the Broadcast TV stocks appear to trade at recessionary type valuations. As such, we believe that investors should go hunting for bargains in TV.

Broadcast Radio

A Transformed Industry

Broadcast Radio stocks failed to hold onto the previous quarter gains and fell in line with the general market in the first quarter 2022, down slightly over 4%. For the trailing 12 months, Radio stocks were flat versus a 15% gain for the general market, as measured by the S&P 500 Index. The relatively poor performance of the Radio group, in our view, does not do the group justice.

There has been a favorable transformation happening in the industry, one that is shifting away from traditional Radio and toward faster growth revenue streams, such as Digital, and, even into the Metaverse. In addition, many companies are aggressively paring down debt, another aspect we believe is missed by investors. Furthermore, there is a favorable fundamental tailwind, bolstered by strong revenue growth in developing ad categories including crypto currency and sports betting. There are also improving trends in the important auto category. In addition, the industry is expected to benefit from the influx of political advertising, largely in the fourth quarter. Political advertising typically accounts for roughly 3% of total full year Radio revenue.

Regarding the transformation…

Many of the Radio broadcasters have invested in growing businesses outside of Radio and into fast growing digital, podcasts, esports, and gaming. For some of the more aggressive diversified Radio companies, like Salem Media and Townsquare Media, digital now accounts for 29% and 50% of total company revenues, respectively. Beasley Broadcasting, with digital roughly 13% of total revenues, is ramping up its digital investments, which is expected to reflect an acceleration in revenue and improved margins. Companies like iHeart Media have even announced venturing into the Metaverse to bring virtual spaces and enhanced fan experiences. Importantly, digital revenue streams have been especially resilient during the Covid pandemic and we would expect a similar experience should the economy weaken.

Debt is coming down…

Companies like Cumulus Media, Salem Media and Beasley Broadcasting, which have had some of the highest debt leverage in the industry, have shored up balance sheets through asset sales and aggressive debt reduction. In the case of Cumulus, management highlighted that debt levels are approaching a range that it will likely pursue some form of a return of capital to shareholders. This prospect seemed to be dismissed by investors, the CMLS shares are down 30% from highs reached in November 2021.

As shown in the accompanying radio comp sheet, Radio stocks trade at compelling multiples below 7 times EV to EBITDA. Notably, some of these companies have significant digital media operations, and, as such, the stock valuations are all the more compelling. For instance, as illustrated earlier in the Digital Media section of this report, the Marketing Technology stocks trade an average 4.2 times Enterprise Value to Revenues. Applying this metric to Townsquare’s digital businesses would place a stock valuation at $35 per share. That would be just for its digital businesses! We believe that investors have not yet realized the transformation of some of these companies, or the substantial upside as these companies garner more attractive valuations based on its fast-growing businesses lines.

Publishing

The Noble Publishing Index was down a modest 3% in the first quarter, slightly outperforming the general market’s 5% decline. For the latest 12 months, the Noble Publishing Index decline 11%, underperforming the general market’s 14% advance. The biggest news in the Publishing sector was that Lee Enterprises successfully thwarted the Alden Group’s efforts to gain seats on the company’s board and take control of the company. Notably, near current levels, LEE shares trade slightly above the $24 takeover offer by the Alden Group. We believe that the recent weakness in the shares, down from recent highs in January of $43, is a reflection of investors exiting the takeover story.

While deal oriented investors appear to be putting pressure on the LEE shares, we encourage investors to take a look at this company. The company is aggressively investing into its digital future and is near the transition toward revenue growth. We believe that the company’s favorable revenue and cash flow growth outlook into 2024 is compelling as highlighted in the accompanying Newspaper Industry Comp sheet.

DOWNLOAD THE FULL REPORT (PDF)

View the PDF version for segment analysis, M&A activity, and more…

Noble Capital Markets Media Newsletter Q1 2022

This newsletter was prepared and provided by Noble Capital Markets, Inc. For any questions and/or requests regarding this news letter, please contact >Chris Ensley

DISCLAIMER

All statements or opinions contained herein that include the words “ we”,“ or “ are solely the responsibility of NOBLE Capital Markets, Inc and do not necessarily reflect statements or opinions expressed by any person or party affiliated with companies mentioned in this report Any opinions expressed herein are subject to change without notice All information provided herein is based on public and non public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on their own appraisal of the implications and risks of such decision This publication is intended for information purposes only and shall not constitute an offer to buy/ sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice Past performance is not indicative of future results.

Please refer to the above PDF for a complete list of disclaimers pertaining to this newsletter