Image Credit: Alexander Schimmeck (Unsplash)

OPEC’s Rift Impacts U.S. Energy Markets, Including Alternative

Oil prices are almost 40% higher than they began the year. Should the 5% dip over the past week be cause for concern among energy investors? Perhaps the reasons for the dip, impact on competition, and the U.S. production level ought to attract the most focus.

The volatility comes after an aborted meeting of OPEC+, the outcome of which was expected to result in an agreement to increase output, undoing 2020 cuts implemented as the economic lockdowns caused a worldwide glut of crude oil. Instead, OPEC+, which includes the original OPEC cartel members and their oil-producing allies, failed to reach an agreement.

Background:

In 2020 OPEC+ made the decision to severely slow production by nearly 10 million barrels a day as demand vanished from the impact of lockdown orders in economies both large and small. In 2021, the price of oil had risen as much as 50% to its high point as the world began relaxing COVID-era restrictions. Oil-exporting nations are now looking to orchestrate the way forward out of the pandemic crisis and into a world where world energy needs are expected to turn sharply away from petroleum.

The Agreement that Didn’t Happen

The expected

agreement that would have increased world oil production fell apart because of a conflict between Saudi Arabia and the U.A.E. The U.A.E. asked to have its production target increased, this would have expanded its percentage of combined OPEC output. Increasing one country’s overall share has a tendency to create conflict. The cartel has stayed united with minimum open conflict, and they only act with a unanimous vote. The current outcome of “status quo” where the countries are expected to operate under the existing Covid era limited output will have the effect of keeping oil prices high but perhaps cut into potential revenue for the members involved.

U.S. Oil Prices vs. International

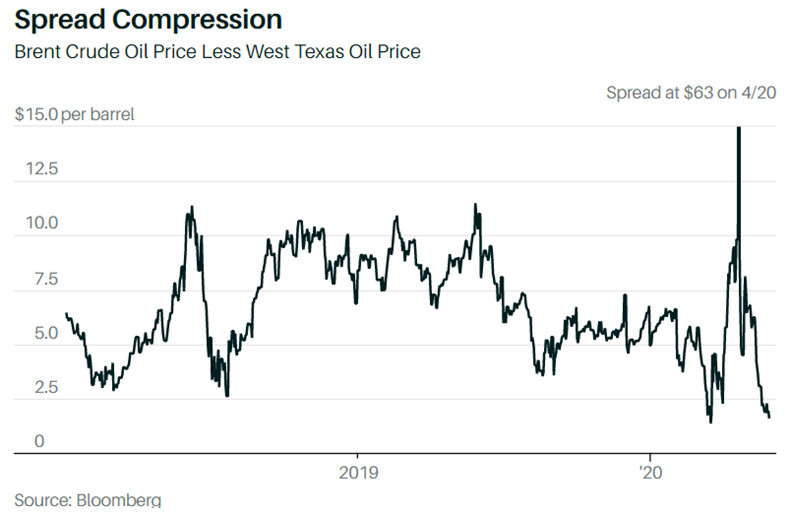

U.S. oil prices jumped and then declined yesterday (July 7) as traders deciphered and adjusted to the new OPEC outlook. Oil price volatility isn’t all that the markets experienced by the uncertain future. Oil spreads, the gap between international crude and U.S. production have narrowed. Producers globally benefit from higher prices. Downstream related business such as refiners prefer fat spreads between U.S. and non-domestic per barrel prices. The narrowing can be seen as a drag on some U.S. energy stocks.

Benchmark U.S. crude oil prices were up about 1% Wednesday morning (July 7), then turned sharply down about 2.6% by 10:40 a.m. E.S.T. Benchmark global crude prices began up about 0.8% before turning lower, dropping about 2.1%. West Texas Intermediate oil futures, the U.S. benchmark, are at $71.48 a barrel. Brent crude oil futures, the international benchmark, are at $72.95 a barrel.

Supply-demand factors in the U.S. are a driver of the spread compression. U.S. inventory post-Covid is at a massive deficit compared to normal levels. As the U.S. economy is sprinting out of last year’s poor economy, the rest of the world is crawling forward from the problems. Narrower spreads tend to reduce U.S. exports and invite imports. This dampens the potential for U.S. producers.

OPEC controls about one-third of global oil production. A rift between two rival countries could impact what occurs with energy sources that compete with oil and even help speed or slow movement away from petroleum. Competition between Gulf allies is heating up in other areas as well as the countries are working to diversify their revenue to be less reliant on oil as the move to reduce dependence accelerates. Increasing Petrodollars ($ U.S. dollars exchanged for crude) are important.

Take-Away

The rift between Saudi Arabia and the U.A.E. may widen or narrow. The countries are going through a challenging time where revising their economies for diversified income appears critical. The U.A.E. is ahead of the Saudis on this; financing additional economic revitalization projects increases the thirst for maximizing oil sales profit.

What occurs halfway across the world impacts the spread between U.S. crude and all other sources. When the spread narrows, other sources become more attractive than they had been. This can impact not just domestic oil sales but related businesses down the line, and even competing energy sources.

Suggested Reading:

Oil Market Conditions May Change as We Enter the Second Half of 2021

|

How Does the Gates Buffett Natrium Reactor Work?

|

Space SPACs in the SPAC Space

|

Can You Invest in Uranium Directly?

|

Sources:

https://www.barrons.com/articles/opec-meeting-oil-output-delay-51625170007?mod=article_inline

https://finance.yahoo.com/quote/CL%3DF/chart

Stay up to date. Follow us:

|