With the Russia-Ukraine War, Gold’s Safe-Haven Status Lasts

While several asset classes have suffered immense stress in recent weeks, precious metals (PMs) have remained relatively elevated. Moreover, concerns have arisen that since the Russian central bank pegged the ruble to gold, it helps uplift the yellow metal.

For context, the Russian central bank announced on Mar. 25 that it would pay 5,000 rubles ($52) per gram of gold. This allowed the USD/RUB to garner an exchange rate of ~96.15 (5,000/52). However, the important point is that the policy was aimed at supporting the ruble, not the PMs.

To explain, when Russia invaded Ukraine, NATO responded with seismic sanctions. As a result, the USD/RUB rallied to an all-time high of 121.21. However, the threats worked perfectly for Russia, as the USD/RUB is now at ~79.68 and lower than the 85.28 recorded pre-invasion. Furthermore, Russian President Vladimir Putin attempted the same feat when he said that all Russian gas exports would need to be paid for in rubles.

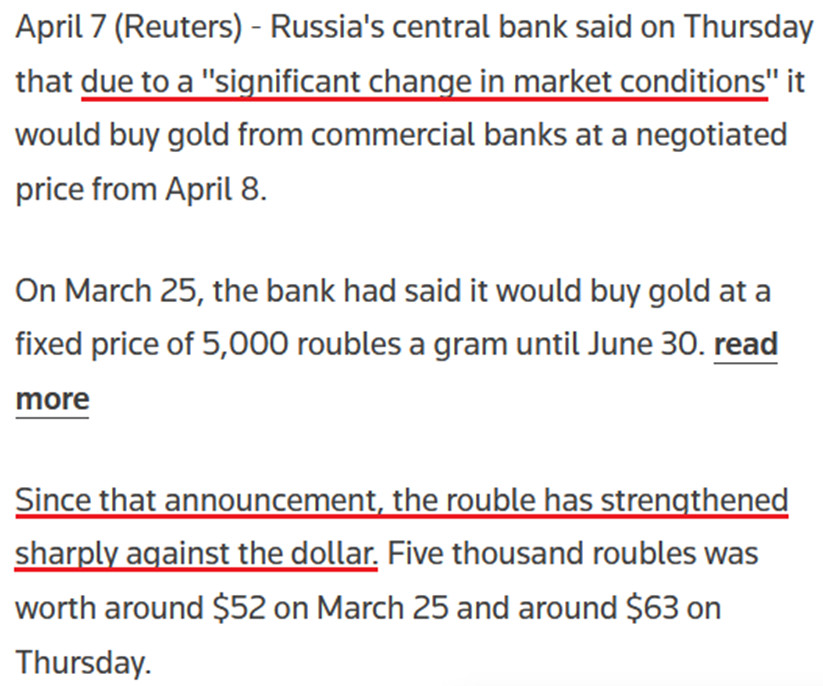

A Reuters article stated:

“Putin’s order to charge ‘unfriendly’ countries in rubles for Russian gas boosted the Russian currency after it plunged to all-time lows when the West imposed sweeping sanctions on Moscow for its invasion of Ukraine. European gas prices also rocketed up.”

However, with the ruble strengthening materially in recent weeks, the policy is no longer needed.

Please see below:

Likewise, it’s the same story for the PMs. After announcing the fixed peg on Mar. 25, the Kremlin scrapped that policy on Apr. 7, since the ruble is strong enough and doesn’t need any indirect support.

Please see below:

Furthermore, the Russian central bank cited a “significant change in market conditions” for reversing the policy. In a nutshell: since the ruble is stronger than it was before the invasion, the currency impact of sanctions is immaterial. Therefore, the central bank is happy to let the ruble float.

Please see below:

All in all, the moves made by the Russian central bank were designed to support the ruble. When a currency plunges, the FX-adjusted cost of imports skyrockets. As such, sanctions would cripple growth, inflation would rage, and the Russian economy would suffer stagflation on steroids. However, by stabilizing the currency, Russia solves half of the problem. Thus, while the recent developments may seem like they uplifted the PMs, they’re largely immaterial from a medium-term perspective.

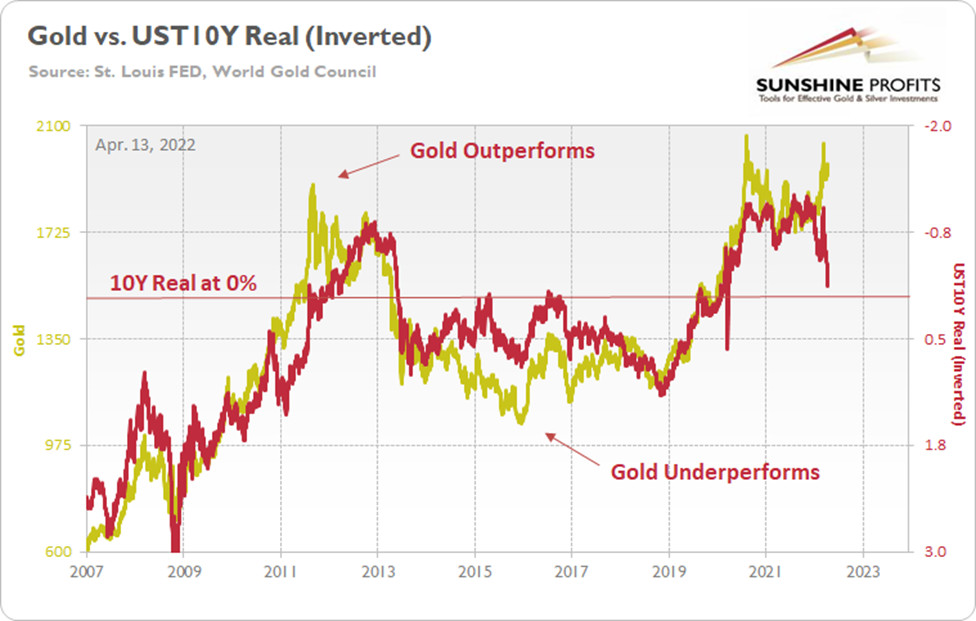

More importantly, the PMs’ domestic fundamental outlooks continue to deteriorate. For example, the U.S. 10-Year real yield hit a new 2022 high of -0.12% on Apr. 11 and closed at -0.13% on Apr. 12. Moreover, while momentum keeps the yellow metal uplifted, history shows that the current gold price is unsustainable.

Still a Momentum Trade

To explain, the gold line above tracks the price tallied by the World Gold Council, while the red line above tracks the inverted U.S. 10-Year real yield. For context, inverted means that the latter’s scale is flipped upside down and that a rising red line represents a falling U.S. 10-Year real yield, while a falling red line represents a rising U.S. 10-Year real yield.

Moreover, I wrote on Apr. 11 that gold and the U.S. 10-Year real yield have a daily correlation of -0.92 since 2007. Therefore, we must ignore 15+ years of historical data to assume that gold’s best days lie ahead.

To that point, the famous quote from John Maynard Keynes is relevant here. He said that “markets can stay irrational longer than you can stay solvent.” In a nutshell: the price action can make investors second-guess themselves, even when the data supports the opposite conclusion. Furthermore, if you analyze the arrows above, you can see that investors’ optimism helped gold outperform the U.S. 10-Year real yield in 2011, while investors’ pessimism helped gold underperform the U.S. 10-Year real yield in 2015.

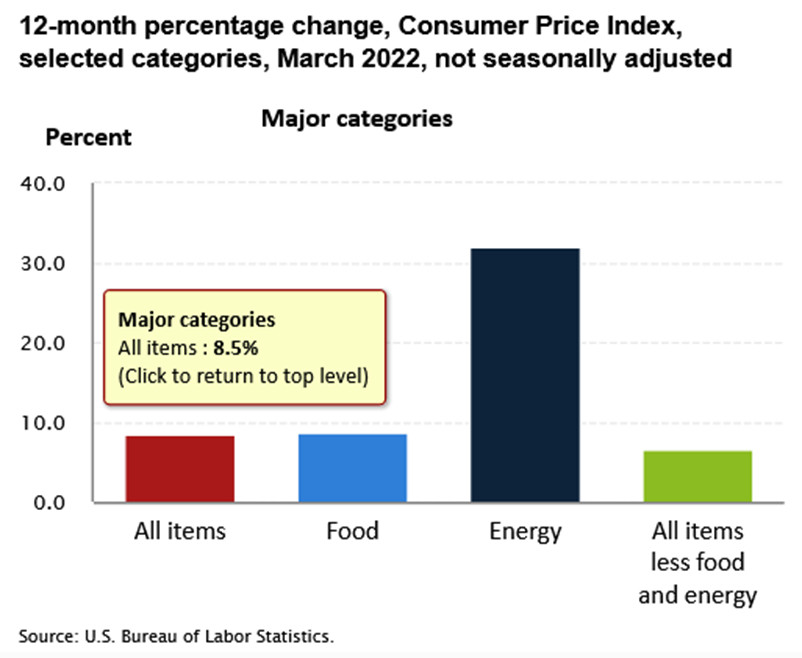

As a result, sentiment rules the day in the short term, and the algorithms move in whichever direction the wind is blowing. Therefore, we find ourselves in that situation now. With the Russia-Ukraine conflict increasing gold’s geopolitical appeal, safe-haven momentum remains ripe. In addition, another 2022 high in the headline Consumer Price Index (CPI) also increases gold’s inflation-hedge appeal. For context, the metric increased by 8.5% year-over-year (YoY) on Apr. 12.

However, investors are short-sighted about the medium-term implications. While conventional wisdom implies that abnormally high inflation is bullish for the PMs, the reality is that pricing pressures awaken the Fed. Since positive real yields are essential to curb inflation, the Fed has to tighten financial conditions to achieve its goal.

To explain, I wrote on Apr. 5:

I warned throughout 2021 that a hawkish Fed and tighter financial conditions are bearish for the PMs. And while the fundamental expectation worked perfectly before the Russia-Ukraine crises erupted, the medium-term thesis is clearer now than it was then.

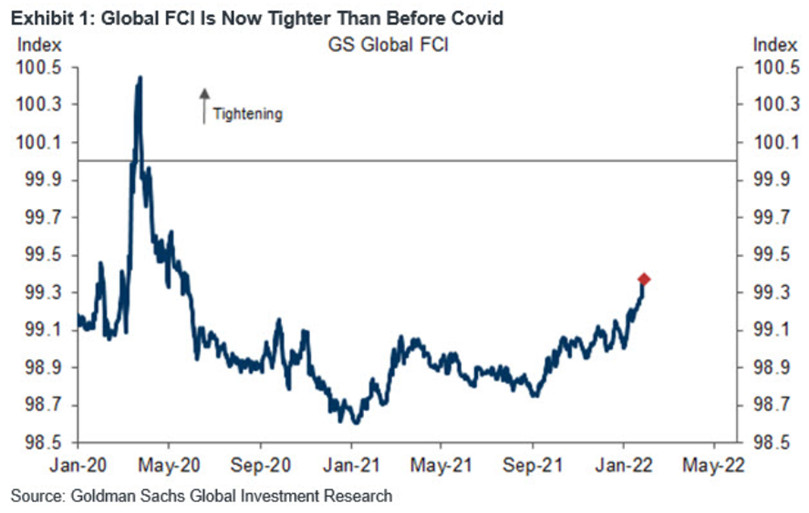

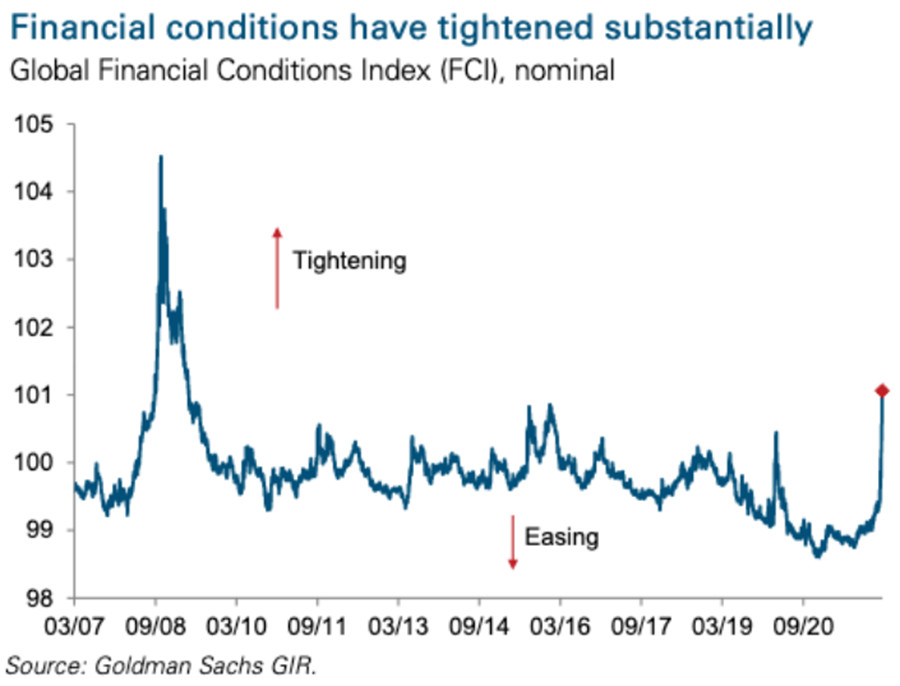

Please see below:

To explain, the orange line above tracks the number of rate hikes priced in by the futures market, while the blue line above tracks Goldman Sachs’ Financial Conditions Index (FCI). If you analyze the movement of the former, futures traders expect roughly nine rate hikes by the Fed in 2022.

However, if you focus your attention on the right side of the chart, you can see that the FCI has declined materially from its highs. Therefore, financial conditions are easier now than they were before the March FOMC meeting. However, the Fed needs to tighten financial conditions to calm inflation. But since market participants are not listening, Chairman Jerome Powell needs to amplify his hawkish rhetoric until the message hits home.

Think about it: if looser financial conditions are used to stimulate economic growth and inflation, how can the Fed calm the pressures without reversing the situation? Moreover, please remember that the current policy stance contributed to 8%+ annualized inflation. Thus, it’s unrealistic to materially reduce inflation from 8% to 2% without the Fed materially shifting the liquidity dynamics. Therefore, investors’ optimism will likely reverse sharply over the medium term.

To that point, while the implications of a higher FCI and higher real yields take time to play out, the Fed has upped the hawkish ante in recent days. In the process, both the bond and the stock market have changed their tones. Therefore, commodities like the PMs will likely be the last shoe to drop.

For additional context, I wrote on Feb. 2:

If you analyze the right side of the chart, you can see that the FCI has surpassed its pre-COVID-19 high (January 2020). Moreover, the FCI bottomed in January 2021 and has been seeking higher ground ever since. In the process, it’s no coincidence that the PMs have suffered mightily since January 2021. Furthermore, with the Fed poised to raise interest rates at its March monetary policy meeting, the FCI should continue its ascent. As a result, the PMs’ relief rallies should fall flat like in 2021.

Likewise, while the USD Index has come down from its recent high, it’s no coincidence that the dollar basket bottomed with the FCI in January 2021 and hit a new high with the FCI in January 2022. Thus, while the recent consolidation may seem troubling, the medium-term fundamentals supporting the greenback remain robust.

Thus, while the USD Index has surpassed 100 and reflects the fundamental reality of a higher FCI and higher real yields, the PMs do not. However, the PMs are in la la land since the FCI is now at its highest level since the global financial crisis (GFC).

Please see below:

Also noteworthy, the FCI made quick work of the March 2020 high from the first chart above. Again, Fed officials know that higher real yields and tighter financial conditions are needed to curb inflation. That’s why they keep amplifying their hawkish message and warning investors of what lies ahead. However, with commodities refusing to accept this reality, they’ll likely be the hardest-hit once the Fed’s rate hike cycle truly unfolds.

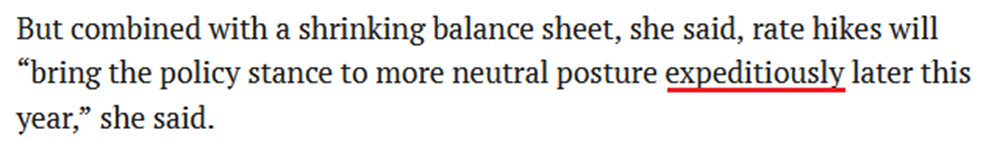

Speaking of which, Fed Governor Lael Brainard said on Apr. 12: “Inflation is too high, and getting inflation down is going to be our most important task.”

She added: “I think there’s quite a bit of capacity for labor demand to moderate among businesses by actually reducing job openings without necessitating high levels of layoffs.” As a result, she’s telling you that Fed officials will make it their mission to slow down the U.S. economy.

With phrases like “capacity for labor demand to moderate” and “reducing job openings” code for what has to happen to calm wage inflation, the prospect of a dovish 180 is slim to none. As such, this is bullish for real yields and bearish for the PMs.

More importantly, notice her use of that all-important buzzword.

Moreover, where do you think she got it?

For context, Powell said that on Mar. 21. The bottom line? It’s remarkable how the PMs’ fundamentals can deteriorate so rapidly while sentiment remains so optimistic. However, while the Russia-Ukraine conflict keeps the momentum alive, it’s likely a long way down when the war premiums unravel.

Moreover, while real yields and financial conditions imply much lower prices for the PMs, they still have plenty of room to run over the medium term. As a result, while the permabulls may feel invincible, the fundamentals that drove the PMs’ performance over the last 15+ years couldn’t be more bearish.

In conclusion, the PMs rallied on Apr. 12, as momentum runs high across the commodity complex. However, investors either fail to foresee the medium-term consequences of the Fed’s rate hike cycle, or they simply don’t care. Either way, reality should re-emerge over the next few months, and once sentiment shifts, the PMs’ lack of fundamental foundations should result in profound drawdowns.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

|

About the Author: |

Suggested Reading

Precious Metals Seem to be Ignoring the Fed’s message

|

The SPAC Advantage in a Volatile or Bear Market

|

How do Gold Royalty Companies Work?

|

Metals & Mining First Quarter 2022 Review and Outlook

|

Source

https://www.sunshineprofits.com/

Stay up to date. Follow us:

|