Regulation of a Special Purpose Acquisition Company

(Part of a Channelchek Series on SPACs)

The primary U.S. regulator of publicly traded securities is the Securities and Exchange Commission (SEC). Their role is threefold; they’re responsible for protecting investors, maintaining the fair and orderly function of securities markets, and facilitate capital formation. SPACS are certainly part of capital formation, they are an investment vehicle, and they are traded on securities markets. So SPACs hit squarely on all three main responsibilities. If that isn’t enough to place the regulator as first in line for oversight (state laws, accounting rules, OCC regs could also apply), the SEC also promotes full public disclosure, protects investors against fraudulent and manipulative practices, and monitors corporate takeover actions. It also approves registration statements for bookrunning at underwriting firms. Combined, this places them solidly as the regulator overseeing special purpose acquisition corporations.

Although SPACs are not new offering types, the increased enthusiasm among both sponsors and investors over the past year has caused the SEC to increase their attention on all aspects of the SPAC lifecycle including sales and post-merger or acquisition trading. Regulation of a Special Purpose Acquisition Corporation is the third of a Channelchek series on SPACs. From this installment, you should better understand some of the heightened or unique considerations the SEC has regarding SPACs, including:

- The unprecedented surge, celebrity-sponsored SPACs, and innovative non-standard SPAC structures

- Disclosure and information made publicly available so holders and investors are best prepared to make informed investment and voting decisions

- How SPACs differ from traditional IPOs and whether or not they should

- Accounting treatment of warrants

As unique as many aspects of everyone’s work lives have been over the past 13 months, the SEC has had its own unprecedented, out-of-the-blue situations to quickly analyze, understand and determine if actions should be taken to protect investors. This could include “meme-investors” and the market gyrations they promote, broker-dealers halting trading on issues; the SEC halted trading activity in 15 firms themselves, and also an unprecedented surge in SPAC IPOs coming to market.

As it relates to the SPAC IPOs, for the whole process, including after the de-SPAC stage, the SEC has indicated it has some concerns. They have made it clear they are paying attention and they have issued some changes that may reduce the boiling pace of SPAC creation, to a more manageable and sustainable simmer.

SEC Concerns

The SEC in its role of overseeing trading, has issued guidance, voiced some concerns, and changed the way accounting is handled of an important part of the sponsors’ compensation. Applying existing regulation and making sure safeguards are in place is designed to be good for everyone involved, here we’ll look at concerns that seem to have moderated the SPAC IPO pace for now.

Concerns they have communicated include risks from fees, conflicts of interest, sponsor compensation, celebrity sponsorship and the potential for retail participation drawn by hype, and the sheer amount of capital pouring into SPACs, each of which is designed to hunt for a private target to take public. There is a finite number of targets and presumably a slow level of potential new targets being “born.”

The Securities and Exchange Commission staff are looking at the filing process and disclosures by SPACs and their private targets. According to the SEC, staff professionals are reviewing these filings and may seek clearer disclosure when guidance is provided to registrants and the public. They are focusing their “places for improvement” efforts on SPAC and private target disclosure to allow for the public to make informed investment and voting decisions about SPAC transactions.

An issue they have expressed is that they believe evaluation has been a little different with some SPACs. They have said that forward-looking statements and future expected cash flows are generally considered more important when evaluating a deal rather than what celebrity may be touting the future prospect or other possible hype. Forward-looking information needs a solid basis to have utility, they suspect putting a celebrity out front as the face of a SPAC may give undo credibility for success. The SEC is concerned that the nature of the transactions relative to a more standard IPO of a private company lends itself to increased levels of speculation and could open the door to fraud. This is especially true if “stars” are brought in to garner attention and also because there is an urgency and time factor that could rush judgment. The issue is heightened not because of cases of misuse of information and projections but because with the sheer amount and size of the transactions may invite potential misuse.

The SEC is also looking at the trading that goes on at the time of the business combination. Many shares are sold at that time and then wind up in the hands of others. In other words, many investors in the SPAC’s own initial offering are not the investors in the ultimate public company’s new financial structure and business operations. The SEC has decided that if a major shift in ownership is occurring in most SPACs, just before and after de-SPAC, they should view it as a new speculative entity. Almost as though it is a whole new process. They’re looking at this with the question in mind, “are additional safeguards needed?”

Accounting

On April 12, 2021, the SEC released a statement titled Staff

Statement on Accounting and Reporting Considerations for Warrants

Issued by SPACs. The statement clarified that SPAC warrants with certain common features must be booked as liabilities rather than equity. The SEC suggested the warrants, typically considered compensation to sponsors for the risks they’ve taken and costs they’ve endured, are not equity. They recommend these be restated as debt in most of the common configurations. This is important as it changes the balance sheet of the operating company and it alters the nature of the warrants, which often trade as equities in addition to SPAC shares.

Other Information

It’s important to understand that the SEC is neutral. They want to understand what disclosures investors need so they may make informed investment and voting decisions. It is one of their critical functions to make sure investor information is reliable and not materially misleading (in every securities transaction). They want investors to have unfettered access to information – and then be free to make their own decisions about how to invest or vote. In the case of SPACs, although the SECs high-profile review may have slowed the process, their intent is to make sure all the proper protections are in place.

Suggested Reading

|

|

Lifecycle of a SPAC

|

Analysis of a SPAC

|

|

|

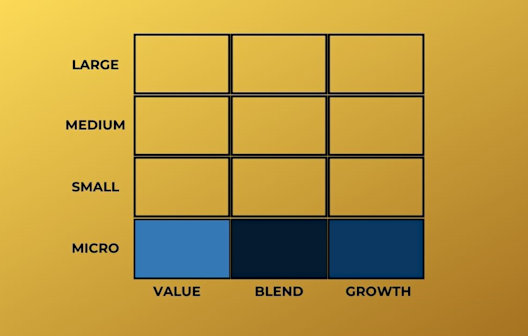

Do Microcap Stocks Provide Better Diversification?

|

SPAC Activity Accelerating in 2020

|

Sources

https://www.sec.gov/news/public-statement/munter-spac-20200331

https://www.cnbc.com/2021/01/30/what-is-a-spac.html

https://www.sec.gov/oiea/investor-alerts-and-bulletins/celebrity-involvement-spacs-investor-alert

https://news.crunchbase.com/news/athletes-and-celebrities-join-the-spac-boom-sec-takes-notice/

https://www.sec.gov/news/public-statement/accounting-reporting-warrants-issued-spacs

https://www.sec.gov/news/public-statement/division-cf-spac-2021-03-31

https://www.sec.gov/corpfin/disclosure-special-purpose-acquisition-companies

https://www.thestreet.com/investing/sec-halts-trading-in-15-firms-due-to-questionable-market-moves

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|