Fenixoro Intersects 15 g/t Gold 300m Below Previous Deepest Intersection, Increases Known Vertical Range of Mineralization to Over 1500m, Still Open at Depth

Research, News, and Market Data on FenixOro Gold

TORONTO, Feb. 03, 2022 (GLOBE NEWSWIRE) — FenixOro Gold Corp (CSE:FENX, OTCQB:FDVXF, Frankfurt:8FD) is pleased to announce additional drill results including the deepest intersection of ore grade gold to date in the Abriaqui district.

- Hole P014 was drilled to a depth of 1008 meters and intersected 15.71 g/t Gold on the Orquidea vein at an elevation of 1245 meters. This intersection is 300 meters deeper than any previously known mineralization in the Abriaqui district. Mineralization remains open at depth on all veins intersected to date

- This depth will significantly impact the resource potential modeling on all veins (see Press Releases March 29 and September 28, 2021)

- The minimum proven vertical range of mineralization on the Orquidea vein is now 1000 meters and the new intersection extends the total vertical range of high grade gold in the greater Abriaqui system of veins to 1500 meters

- An intersection of 3.6m @ 7.26 g/t gold in P014 correlates with the Baul vein and the previously reported 7.7m @ 8.46 g/t in P006 (Press Release February 24, 2021). This correlation makes Baul the next formally modeled vein, significantly increasing tonnage estimates in the northern drill area.

Fenixoro VP Exploration Stuart Moller commented on exploration results to date. “The 8000 meters of the first two phases of drilling have given us everything we could have anticipated: multiple mineralized veins with good gold grades, thicker zones of up to 20 meters with potential for eventual low cost bulk underground mining, a much greater than expected vertical extent of mineralization, and multiple new high quality drill targets in the southeast license and elsewhere. It’s hard to overstate the importance of the deep hit on Orquidea as it puts an additional 300 vertical meters in play for all the veins in the district and the system is still open at depth.”

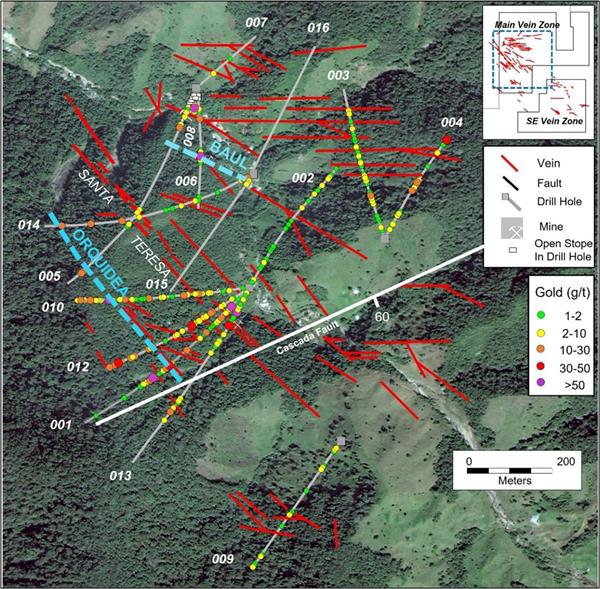

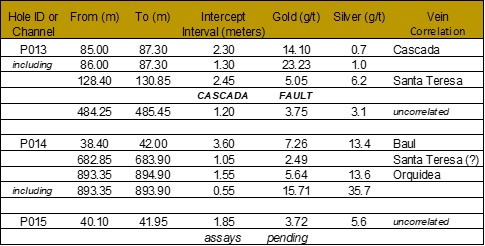

Phase 2 drilling has ended with a total of 8062 meters in 16 holes, all in the northwestern licenses of the Abriaqui property (Figure 1). Hole P013 tested the southern extension of the Northwest Vein corridor (NWC). It intersected the Cascada and Santa Teresa veins north of the Cascada Fault but the intersections south of the fault are not yet correlated. Significant results are shown in Table 1.

P014 was designed as a deep test of the potential of the veins on the NWC. It was drilled to a depth of 1008 meters at an angle of -65 degrees from the horizontal. As with most deep holes, drilling was slow and difficult but most objectives were accomplished. The Santa Teresa and Orquidea veins were intersected but it appears that the hole ended just short of Romperopa 1. The deepest intersection of high grade gold, 0.55m @ 15.71 g/t on the Orquidea vein, was at an elevation of 1240 meters. This is the deepest hit to date in the Abriaqui district and it adds 300 meters to the known vertical interval of mineralization. The mineralogy and metal ratios are similar to those higher up in the same vein system indicating that there is no reason to believe that we are nearing the economic bottom of the system.

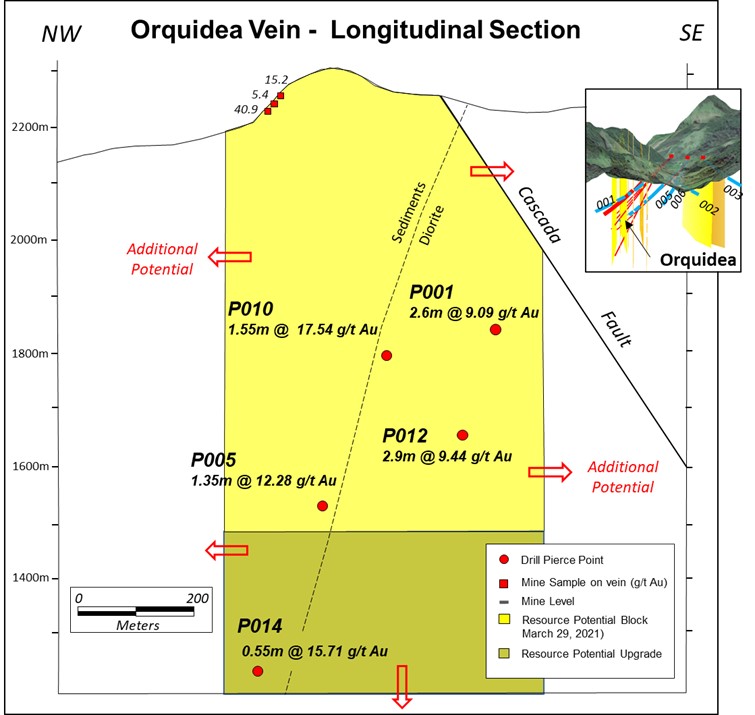

The minimum vertical interval of potentially economic mineralization in the Orquidea vein is 1000 meters and, including samples taken from mines at higher altitude in the southeastern license, the vertical interval property-wide is 1500 meters. Figure 2 is a longitudinal section of the Orquidea vein showing the drill intersections to date along with sample data from near surface mines. The five drill intersections average 1.79 meters at 11.57 g/t gold. The mineralization is open laterally in both directions and at depth. Importantly, we now know that the geologic system at Abriaqui is capable of generating high gold grades to this depth and that all veins in the district should have similar depth potential.

New Vein For Resource Model

A 3.6 meter intersection with 7.26 g/t gold in the upper part of P014 correlates with the best intersection of the first drill phase, 7.7m @ 8.46 g/t in P006 and a thinner hit in hole P005 on the Baul vein. The vein, which is open to the northwest and at depth, will be the next formally modeled structure to be included in an eventual resource model.

Holes P015 and P016 were drilled from the same platform as infill holes on the NWC and the East-West trending corridor of veins respectively. Assays are awaited for both holes.

Figure 1. Drilling through January, 2022 in the main northwest vein zone. Gold assays in drill holes projected vertically to the surface. Orquidea and Baul Veins shown in blue

Table 1. Recent drill results from holes P013 – P015

Figure 2. Vertical longitudinal section of the Orquidea vein looking northeast showing resource potential block expanded at depth by 300 meters by the intersection in P014. The five drill intercepts average 1.79m @ 11.55 g/t gold.

About FenixOro Gold Corp.

FenixOro Gold Corp is a Canadian company focused on acquiring and exploring gold projects with world class exploration potential in the most prolific gold producing regions of Colombia. FenixOro’s flagship property, the Abriaqui project, is the closest project to Continental Gold’s Buritica project. It is located 15 km to the west in Antioquia State at the northern end of the Mid-Cauca gold belt, a geological trend which has seen multiple large gold discoveries in the past 10 years including Buritica and Anglo Gold’s Nuevo Chaquiro and La Colosa. As documented in “NI 43-101 Technical Report on the Abriaqui project Antioquia State, Colombia” (December 5, 2019), the geological characteristics of Abriaqui and Buritica are similar. Since the preparation of this report a Phase 1 drilling program has been completed at Abriaqui resulting in a significant discovery of a high grade, “Buritica style” gold deposit. A Phase 2 drilling program has recently commenced.

FenixOro’s VP of Exploration, Stuart Moller, led the discovery team at Buritica for Continental Gold in 2007-2011. At the time of its latest public report, the Buritica Mine contains measured plus indicated resources of 5.32 million ounces of gold (16.02 Mt grading 10.32 g/t) plus a 6.02 million ounce inferred resource (21.87 Mt grading 8.56 g/t) for a total of 11.34 million ounces of gold resources Buritica began formal production in November 2020 and has expected annual average production of 250,000 ounces at an all-in sustaining cost of approximately US$600 per ounce. Resources, cost and production data are taken from Continental Gold’s “NI 43-101 Buritica Mineral Resource 2019-01, Antioquia, Colombia” (18 March, 2019). Continental Gold was recently the subject of a takeover by Zijin Mining in an all-cash transaction valued at C$1.4 billion.

Technical Information

Stuart Moller, Vice President Exploration and Director of the Company and a Qualified Person for the purposes of NI 43-101 (P.Geo, British Colombia), has prepared or supervised the preparation of the technical information contained in this press release. Mr. Moller has more than 40 years of experience in exploration for precious and other metals including ten in Colombia and is a Fellow of the Society of Economic Geologists.

Drill core sampling is done in accordance with industry standards. The HQ and NQ diameter core is sawed, and half core samples are submitted to the laboratory. The other half core alongwith laboratory coarse reject material and sample pulps are stored in secure facilities on site and/or in the sample prep lab. Following strict chain of custody protocols, the samples are driven to the ISO 17025:2017 certified ALS Laboratory sample preparation facility in Medellin and ALS ships the prepared pulps to their assay laboratory in Lima, Peru. As of November, 2021 similar procedures have been utilized by the ISO 9001:2015 certified Medellin branch of Ontario-based Actlabs. Blanks, duplicates, and certified reference standards totaling 15% of the total samples are inserted into the sample stream. To date, no material quality control issues have been detected. Gold is analyzed by fire assay with 50 gram charges for grades in excess of 10 grams per tonne and the additional elements are analyzed by ICP with appropriate followup for over- limits.

Reported grade intervals are calculated using uncut gold values. Maximum sample length is one meter. Intervals which include multiple samples are calculated using the full geologic interval of mineralization at a 1 g/t gold external cutoff grade and are not subject to specific rules for cutoff grades within the zones. As such, quoted thickness and grade of these intervals do not necessarily represent optimized economic intervals in a potential future mine. Reported sample and interval widths in drill holes are based on lengths of individual samples in core and do not necessarily represent true widths of mineralization. True widths will sometimes be less than the quoted interval lengths. Intervals defined by channel samples represent true widths of mineralization in vertical veins.

There are currently no NI 43-101 compliant resources or reserves in the project area. The analysis of drill and channel results is intended to estimate the potential for future resources which will require significant additional drilling to define.

Forward Looking Information

This news release contains certain forward-looking information. All statements included herein, other than statements of historical fact, are forward-looking information and such information involves various risks and uncertainties. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. Specifically, this news release contains forward looking information regarding the potential economic significance of drill results at the Abriaqui Project, conclusions as to resource potential derived from that data set, and implied assumptions as to the potential future economic viability of the gold grades and vein thicknesses reported. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. Although FenixOro has no reason to believe otherwise, there can be no assurance that the planned drill program will be completed as uncertainties exist related to future project financing and future environmental permitting. Although FenixOro has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be additional factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information.

FenixOro Gold Corp

John Carlesso, CEO

Email: [email protected]

Website: www.FenixOro.com

Telephone: 1-833-ORO-GOLD