Palladium One Announces Resource Estimate for Haukiaho Zone, Doubles Endowment at LK Project, Finland

Highlights

- Total Mineral Resource Estimates at the LK Project are now:

- 0.6 million ounces Palladium Equivalent (“Pd_Eq”) of Indicated Resources (1.60 g/t, 11 million tonnes).

- 1.7 million ounces Pd_Eq of Inferred Resources (1.19 g/t, 44 million tonnes).

- Haukiaho, NI43-101 Pit Constrained Resource Estimate announced.

- 1.21 million ounces Pd_Eq grading 1.15 g/t in 32.7 million tonnes.

- Shallow deposit with a low 1:1 strip ratio.

- Haukiaho is base metal-rich with two-thirds of the value in nickel and copper, whereas Kaukua is Platinum-Group-Elements (“PGE”) rich with two-thirds of the value in palladium and platinum.

- Resource estimate comprises 3-kilometers of strike length; part of the 17-kilometer long Haukiaho Trend.

- Two-kilometers of strike extent, immediately east of the Haukiaho Resource Estimate, contains two significant Induced Polarization (“IP”) chargeability anomalies with sufficient historical drilling to potentially be upgraded to Inferred Resources with modest additional drilling.

- Remaining twelve-kilometers of Haukiaho Trend has not been drill tested by the Company, however, widely spaced historic drilling has demonstrated that the trend is mineralized. This historic drilling provides a high level of confidence for potential additional nickel-copper resources to be delineated.

- Resource definition drilling for the Company’s primary focus area, Kaukua and the Western half of Kaukua South (“Kaukua Area”), has been completed.

- An updated Kaukua Area NI43-101 Resource Estimate is scheduled at year end.

September 7, 2021 – Toronto, Ontario – Resource definition drilling at the Kaukua Area has been completed and an updated National Instrument (“NI43-101”) compliant Mineral Resource Estimate is scheduled at year end (Figure 1). Without including an updated Mineral Resource Estimate at the Kaukua Area, today’s addition of a NI43-101 compliant Resource Estimate for the Haukiaho zone (Figure 2) has doubled the Company’s Mineral Resource endowment. The quality and scale of the Company’s overall resource potential at the LK Project continues to impress, said Palladium One Mining Inc. (“Palladium One” or the “Company”) (TSXV: PDM, FRA: 7N11, OTC: NKORF) today.

Derrick Weyrauch, President and CEO of Palladium One said, “In two short years LK has grown significantly, and we have the next Mineral Resource update at the Kaukua Area scheduled at year end. LK is clearly shaping up to be a globally significant project in a best-in-class mining jurisdiction. With Finland’s exceptionally well-designed mining and development laws and our existing resources, we believe that LK is well on its way to demonstrating the critical mass needed for a robust mining scenario. Based on the significant number of drill targets still to be tested, we see a tremendous amount of resource expansion potential remaining to be defined.”

Table 1. LK Project Total National Instrument 43-101 Pit Constrained Resource Estimate

| Deposit | Class | Tonnes (Mt) |

Pd g/t |

Pt g/t |

Au g/t |

PGE (Pd+Pt+Au) g/t |

Ni % |

Cu % |

Co ppm |

Pd_Eq* | Spot Au_Eq** g/t |

Spot Cu_Eq** % |

|

| g/t | Oz | ||||||||||||

| Kaukua | Indicated | 11.0 | 0.81 | 0.27 | 0.09 | 1.17 | 0.09 | 0.15 | — | 1.60 | 566,000 | 1.90 | 1.17 |

| Kaukua | Inferred | 10.9 | 0.64 | 0.20 | 0.08 | 0.92 | 0.08 | 0.13 | — | 1.31 | 459,000 | 1.55 | 0.96 |

| Haukiaho | Inferred | 32.7 | 0.25 | 0.10 | 0.10 | 0.45 | 0.13 | 0.18 | 53 | 1.15 | 1,210,000 | 1.26 | 0.78 |

| Total | Inferred | 43.6 | 0.35 | 0.12 | 0.10 | 0.57 | 0.12 | 0.17 | 40 | 1.19 | 1,669,000 | 1.33 | 0.82 |

* Pd_Eq calculated using prices from the 2021 NI43-101 Haukiaho Mineral Resource Estimate; $1,600/oz Pd, $1,100/oz Pt, $1,650/oz Au, $3.50 Cu, and $7.50 Ni

** Spot Au_Eq and Cu_Eq is calculated for comparison only, using recent prices, $2,500/oz Pd, $1,000/oz Pt, $1,800/oz Au, $4.25/lb Cu, and $8.50/lb Ni.

- 2019 Kaukua Mineral Resource Estimate used a 0.3 g/t Pd cut off which equates to ~0.6 g/t Pd_Eq using the 2021 Haukiaho Mineral Resource Estimate prices.

- Kaukua Mineral Resource Estimate is previously released (see press release September 9, 2019).

Table 2. Haukiaho National Instrument 43-101 Pit Constrained Inferred Resource Estimate at incremental cut-offs

| $ Value Cut-Off ($/t) |

Tonnes (Mt) |

Pd g/t |

Pt g/t |

Au g/t |

PGE (Pd+Pt+Au) g/t |

Ni % |

Cu % |

Co ppm |

Pd_Eq | Cu Eq % |

Ni Eq % |

Spot Au_Eq* g/t |

|

| g/t | Oz | ||||||||||||

| $15 | 42.6 | 0.21 | 0.09 | 0.08 | 0.38 | 0.12 | 0.15 | 54 | 1.01 | 1,385,000 | 0.68 | 0.32 | 1.10 |

| $20 | 37.7 | 0.23 | 0.10 | 0.09 | 0.42 | 0.12 | 0.16 | 54 | 1.08 | 1,310,000 | 0.72 | 0.34 | 1.18 |

| $25 | 32.7 | 0.25 | 0.10 | 0.10 | 0.45 | 0.13 | 0.18 | 53 | 1.15 | 1,210,000 | 0.77 | 0.36 | 1.26 |

| $30 | 27.5 | 0.27 | 0.11 | 0.11 | 0.49 | 0.14 | 0.19 | 54 | 1.23 | 1,090,000 | 0.82 | 0.38 | 1.35 |

| $35 | 22.0 | 0.29 | 0.12 | 0.12 | 0.53 | 0.15 | 0.20 | 56 | 1.33 | 940,000 | 0.89 | 0.41 | 1.45 |

| $40 | 16.4 | 0.33 | 0.13 | 0.13 | 0.59 | 0.16 | 0.22 | 59 | 1.45 | 765,000 | 0.97 | 0.45 | 1.59 |

* Spot Au_Eq is calculated for comparison only, using recent prices, $2,500/oz Pd, $1,000/oz Pt, $1,800/oz Au, $4.25/lb Cu, and $8.50/lb Ni.

- Domains were modelled in 3D to separate mineralized rock types from surrounding waste rock. The domains were modelled based on Pd-equivalent grade continuity above a 0.25 g/t cut-off.

- Raw drill hole assays were composited to 5 m lengths broken at domain boundaries.

- Capping of high grades was considered necessary and was completed for each domain on assays prior to compositing.

- Block grades for gold were estimated from the composites using ordinary kriging interpolation into 10 x 10 x 10 m blocks coded by domain.

- A dry bulk density of 2.0 g/cm3 was used for overburden material. Densities of 2.7 g/cm3, 2.9 g/cm3 and 3.0 g/cm3 were used for basement, gabbro/peridotite/pyroxenite and diabase, respectively.

- Blocks were classified as Inferred Resources in accordance with CIM Definition Standards 2014.

- Blocks were classified into the Inferred Resource category if the block fell within 120 m of a composite. Due to limitations with QAQC for historic drillholes, the wide-spaced drilling and the early-stage of metallurgical testwork, there are currently no Indicated Mineral Resources.

- The Mineral Resource Estimate is constrained within an optimised pit with a maximum slope angle of 55°. A slope angle of 45° was used on the south side of the pit. The optimised pit strip ratio is 0.53 (using the $15/t cut-off at which the pit was modelled) and is 0.93 using a $25/t cut-off within the bounds of the $15/t pit envelope.

- Metal prices of $1,650/oz, $3.50/lb, $7.50/lb, $20.00/lb, $1,600/oz and $1,100/oz were used respectively for Au, Cu, Ni, Co, Pd and Pt. Metallurgical recoveries of 65.2%, 89.2%, 63.7%, 63.7%, 79.8% and 80.1% for Au, Cu, Ni, Co, Pd and Pt were applied respectively. A $15/t value cut-off (equivalent to 0.4 g/t Pd_Eq) was estimated based on estimated total processing and G&A cost of $15/t of ore mined. Block dollar values use both metal prices and metallurgical recoveries. Palladium One chose to use an elevated cut-off of $25/t (equivalent to 0.6 g/t Pd_Eq) to report the base-case Haukiaho Mineral Resource Estimate.

- Palladium equivalent is calculated using the formula Pd_Eq = Pd + Cu*(Cu% Unit Value/Pd Unit Value) + Ni*(Ni% Unit Value/Pd Unit Value) + Co*(Co% Unit value/Pd Unit Value) + Pt*(Pt Unit Value/Pd Unit Value) + Au*(Au Unit value/Pd Unit Value). Metallurgical recoveries of 100% are assumed for the Pd-equivalent calculation.

- The contained metal figures shown are in situ. No assurance can be given that the estimated quantities will be produced. All figures have been rounded to reflect accuracy and to comply with securities regulatory requirements. Summations within the tables may not agree due to rounding.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The quantity and grade of reported Inferred Resources in this estimation are conceptual in nature and there has been insufficient exploration at this stage to upgrade these Inferred Resources to Indicated or Measured Mineral Resources, and it is uncertain if further exploration will result in an upgraded resource category.

Table 3. Kaukua National Instrument 43-101 Pit Constrained Resource Estimate (see press release September 9, 2019)

| Class | Tonnes (Mt) |

Pd g/t |

Pt g/t |

Au g/t |

PGE (Pd+Pt+Au) g/t |

Ni % |

Cu % |

2019 Pd_Eq* |

2021 Pd_Eq** |

Spot Au_Eq*** g/t |

||

| g/t | Oz | g/t | Oz | |||||||||

| Indicated | 11.0 | 0.81 | 0.27 | 0.09 | 1.17 | 0.09 | 0.15 | 1.80 | 635,600 | 1.60 | 566,000 | 1.90 |

| Inferred | 10.9 | 0.64 | 0.20 | 0.08 | 0.92 | 0.08 | 0.13 | 1.50 | 525,800 | 1.31 | 459,000 | 1.55 |

* Pd_Eq calculated using prices from the 2019 NI43-101 Kaukua Mineral Resource Estimate, $1,100/oz Pd, $950/oz Pt, $1,300/oz Au, $3.00/lb Cu, and $7.00/lb Ni

** Pd_Eq calculated using prices from the 2021 NI43-101 Haukiaho Mineral Resource Estimate, $1,600/oz Pd, $1,100/oz Pt, $1,650/oz Au, $3.50 Cu, and $7.50 Ni

*** Spot Au_Eq is calculated for comparison only, using recent prices, $2,500/oz Pd, $1,000/oz Pt, $1,800/oz Au, $4.25/lb Cu, and $8.50/lb Ni.

- 2019 Kaukua Mineral Resource Estimate used a 0.3 g/t Pd cut off which equates to ~0.6 g/t Pd_Eq using the 2021 Haukiaho Mineral Resource Estimate prices

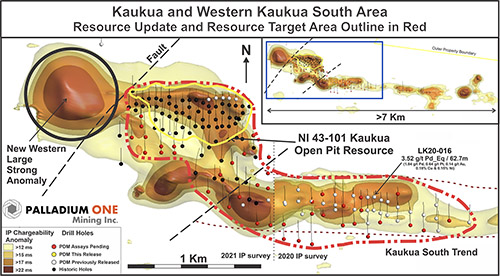

Figure 1. Historic and current drilling in the Kaukua and Western portion of the Kaukau South area. Background is IP Chargeability.

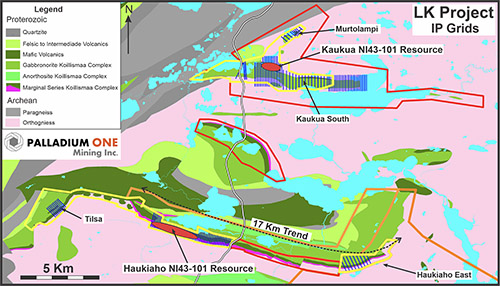

Figure 2. LK Project location map showing NI43-101 compliant Kaukua and Haukiaho Mineral Resource Estimate along with IP grids (blue lines). Yellow lines represent Exploration Permits, red lines represent Exploration Permit Applications and Exploration Reservations held by the Company.

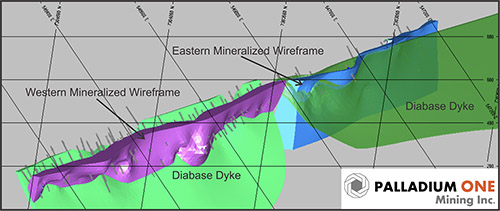

Figure 3. Inclined view looking northeast of the Haukiaho geological model showing the western (purple) and eastern (light blue) mineralized wireframes and later cross cutting diabase dyke (green).

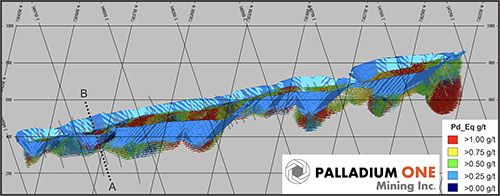

Figure 4. Inclined view looking northeast of the Haukiaho Mineral Resource Estimate block model and $15/t cut-off Optimized Whittle Pit Shell.

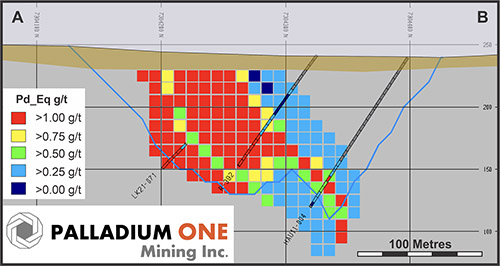

Figure 5. Cross section, looking west through the Haukiaho block model and $15/t Optimized Whittle Pit Shell.

Palladium Equivalent

Revised price assumptions – The Company is now calculating Palladium equivalent using US$1,600 per ounce for palladium, US$1,100 per ounce for platinum, US$1,650 per ounce for gold, US$3.50 per pound for copper, and US$7.50 per pound for nickel consistent with the calculation used in the Company’s September 2021 NI 43-101 Haukiaho Resource Estimate.

Spot Gold Equivalent

Spot palladium and gold equivalents are calculated using recent spot prices for comparison purposes using US$2,500 per ounce for palladium, US$1,000 per ounce for platinum, US$1,800 per ounce for gold, US$4.25 per pound for copper, and US$8.50 per pound for nickel.

Qualified Person

The Haukiaho National Instrument 43-101 Mineral Resource Estimate was independently prepared by Mr. Julian Aldridge C. Geol. (1014722), a Qualified Person as defined by the National Instrument 43-101 and a Principal Consulting Geologist of Mining Plus UK Ltd.

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101

About Palladium One

Palladium One Mining Inc. is an exploration company targeting district scale, platinum-group-element (PGE)-copper nickel deposits in Finland and Canada. Its flagship project is the Läntinen Koillismaa or LK Project, a palladium dominant platinum group element-copper-nickel project in north-central Finland, ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. Exploration at LK is focused on targeting disseminated sulfides along 38 kilometers of favorable basal contact and building on established NI 43-101 open pit Mineral Resource Estimates.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information contact: Derrick Weyrauch, President & CEO

Email: [email protected]

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release includes “forward-looking information” that is subject to a few assumptions, risks and uncertainties, many of which are beyond the control of the Company. Statements regarding listing of the Company’s common shares on the TSXV are subject to all of the risks and uncertainties normally incident to such events. Investors are cautioned that any such statements are not guarantees of future events and that actual events or developments may differ materially from those projected in the forward-looking statements. Such forward-looking statements represent management’s best judgment based on information currently available. Factors that could cause the actual results to differ materially from those in forward-looking statements include regulatory actions and general business conditions. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including those set out in the Company’s annual information form dated April 29, 2020 and filed under the Company’s profile on SEDAR at www.sedar.com. The Company does not undertake to update forward-looking statements or forward-looking information, except as required by law. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements.