Sierra Metals Announces Positive Preliminary Economic Assessment Results for Doubling Output at Its Bolivar Mine in Mexico to 10,000 Tonnes Per Day

After Tax NPV of US$283 Million

TORONTO–(BUSINESS WIRE)– Sierra Metals Inc. (TSX: SMT) (BVL: SMT) (NYSE AMERICAN: SMTS) (“Sierra Metals” or “the Company”) is pleased to report the results of a Preliminary Economic Assessment (“PEA”) regarding the Company’s Bolivar Mine, located in Chihuahua State, Mexico.

This PEA report was prepared as a National Instrument 43-101 Technical Report for Sierra Metals Inc. (“Sierra Metals”) by SRK Consulting (Canada) Inc. (“SRK”).The full technical report will be filed on SEDAR within 45 days of this news release.

Highlights of the PEA include:

- After-tax Net Present Value (NPV): US$283 Million at an 8% discount rate

- Incremental benefit of increasing the production to 10,000 TPD from 5,000 TPD is estimated to have an after tax NPV (@8%) of US$57.4 million, and IRR of 27.9%

- Net After-tax Cash Flow: US$521 Million

- Life of Mine & Sustaining Capital Cost: US$317 Million

- Total Operating Unit Cost: US$19.77/tonne and US$1.16/lb copper equivalent

- Plant Processing Rate after expansion: 10,000 tonnes per day (TPD)

- Average LOM Copper Grade 0.72%

- Copper Price Assumption US$3.05/lb

- MineLife: 14 years based on existing Mineral Resource Estimate

- Life of Mine Copper Payable Production: 583 million pounds

Luis Marchese, CEO of Sierra Metals commented:

“I am very encouraged by the results of this PEA which support the Company’s organic growth strategy and plan to profitably develop and grow the Bolivar Mine production rate to 10,000 TPD in 2024 from today’s capacity of 5,000 TPD, based on current analyst consensus metal price estimates. The Company plans to continue with its disciplined approach of profitable growth and now plans to proceed with the next step of the completion of a prefeasibility study to further de-risk the plan and determine the best path forward.”

He continued “The PEA study compared the value of the current operations at Bolivar at 5,000 TPD against several output expansion alternatives from 7,000 to 15,000 TPD and determined 10,000 TPD as the optimum production level based on our current mineral resource base. We note that the estimated value for Bolivar at 5,000 TPD using current analyst estimates at US$225 million, was roughly in-line with the value estimated in our 2018 PEA ($214 million) which justified our expansion to 5,000TPD two years ago. The value could be further increased by the potential sale of magnetite (iron ore) as a by-product and recent exploration drilling which could further increase the resources and value of our asset, as they get incorporated into future operating plans.”

He concluded, “We are continuing with our strategy to increase the value of the company on a per share basis. This builds upon the demonstrated success we have shown with increasing our current mineral resource base and improving the throughput at all mines. We expect these positive developments to further improve profitability and cashflow for the Company and all shareholders this coming year as well as in the future.”

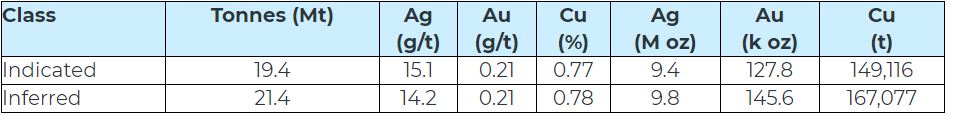

Mineral Resource Estimate

The property is located in the Piedras Verdes District of Chihuahua State, Mexico, approximately 250 kilometers southwest of the city of Chihuahua and consists of 14 mineral concessions (6,800 hectares). The Bolivar deposit is a Cu-Zn skarn and is one of many precious and base metal deposits of the Sierra Madre belt, which trends north-northwest across the states of Chihuahua, Durango, and Sonora in northwestern Mexico (Meinert, 2007). Mineralization exhibits strong stratigraphic control, and two stratigraphic horizons host the bulk of the mineralization: an upper calcic horizon, which predominantly hosts Zn-rich mineralization, and a lower dolomitic horizon, which predominantly hosts Cu-rich mineralization. In both cases, the highest grades are developed where structures and associated breccia zones cross these favorable horizons near skarn-marble contacts.

This PEA considers depleted measured, indicated, and inferred resources reported in 2019 by SRK and effective as of December 31, 2019. The results of this PEA shown in Table 1-1 are indicative of conceptual potential and are not definitive.

Table 1-1: Summary of Mineral Resources estimate as reported by SRK,2020 (Effective December 31, 2019)

Source: SRK, 2020

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- All figures are rounded to reflect the relative accuracy of the estimates.

- Mineral resources are reported at a value per tonne cut-off of US$24.25/t using the following metal prices and recoveries; Cu at US$3.08/t and 88% recovery; Ag at US$17.82/oz and 78.6% recovery, Au at US$1,354/oz and 62.9% recovery.

Mining Methodology

Bolivar is a producing operation. The primary mining method at Bolivar is underground room and pillar mining. Previous mining at Bolivar has sometimes used lower cost and more productive long hole stope mining in areas where the mineralized zones have a steeper dip angle, and the mine plans to undertake a geotechnical assessment program in 2020/2021 to expand the use of long hole mining.

Mineral Processing

The Piedras Verdes Plant, located 5.1 kilometers from the Bolivar Mine, uses a conventional crushing-grinding-flotation circuit to recover mineralized mineral and to produce commercial quality copper concentrates with silver and gold by-product credits. Mineral is delivered from the mine to the plant in 18-tonne trucks. The mine is constructing an underground tunnel that will enable mineralized material to be delivered via underground truck transport to a portal adjacent to the mill. This development will eliminate the impact of bad weather on the current surface truck haulage system and will provide a lower cost and more reliable method of delivering mineralized material to the plant.

Mineral processing and the recovery of the mineral is demonstrated, and copper, silver and gold recoveries are established at 88%, 78.7% and 62.43% respectively.

The Piedras Verdes Plant’s current throughput capacity is 5,000 TPD. In line with proposed increases in mine output, the processing capacity at Piedras Verdes will increase to 10,000 TPD in 2024.

A new dry-stack tailing storage facility (“TSF”) (herein referred to as “New TSF”) is to be located just to the west of the existing facility, and has an expected life through 2025. The site is also installing an additional thickener and filter presses to allow additional water recovery. Thickened tails (60% solids) are currently being placed in the TSF. After the filter presses are constructed, dry-stack tailings will be placed in the New TSF starting in the latter part of 2020. The PEA considers the use of tailings as backfill and has included the capital and operating costs for a backfill plant. Storing some of the tailings underground would increase the life of the New TSF, and potentially permit the removal of mineralized material pillars that are currently unrecoverable.

The overall Project infrastructure exists already and is functioning and adequate for the purpose of the supporting the mine and mill.

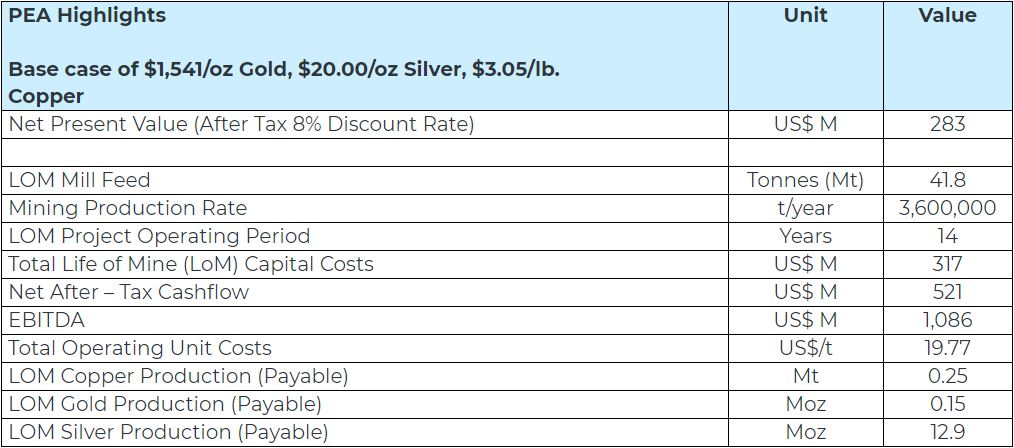

Economic Analysis

This PEA indicates an after tax NPV of US$283 million (using a discount rate of 8%) at 10,000 TPD (in 2024). Total operating cost for the life of mine is US$827 million, equating to a total operating cost of US$19.77 per tonne milled and US$1.16 per pound copper equivalent. Highlights of the PEA are provided in Table 1-2.

Table 1-2: PEA Highlights

Quality Control

All technical data contained in this news release has been reviewed and approved by:

Americo Zuzunaga, FAusIMM CP (Mining Engineer) and Vice President of Corporate Planning is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Augusto Chung, FAusIMM CP (Metallurgist) and Vice President of Metallurgy and Projects to Sierra Metals is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Sierra Metals

Sierra Metals Inc. is a diversified Canadian mining company focused on the production and development of precious and base metals from its polymetallic Yauricocha Mine in Peru, and Bolivar and Cusi Mines in Mexico. The Company is focused on increasing production volume and growing mineral resources. Sierra Metals has recently had several new key discoveries and still has many more exciting brownfield exploration opportunities at all three Mines in Peru and Mexico that are within close proximity to the existing mines. Additionally, the Company also has large land packages at all three mines with several prospective regional targets providing longer-term exploration upside and mineral resource growth potential.

The Company’s Common Shares trade on the Bolsa de Valores de Lima and on the Toronto Stock Exchange under the symbol “SMT” and on the NYSE American Exchange under the symbol “SMTS”.

For further information regarding Sierra Metals, please visit www.sierrametals.com

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals | Facebook: SierraMetalsInc | LinkedIn: Sierra Metals Inc

Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of Canadian and U.S. securities laws (collectively, “forward-looking information“). Forward-looking information includes, but is not limited to, statements with respect to the date of the 2020 Shareholders’ Meeting and the anticipated filing of the Compensation Disclosure. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential” or variations thereof, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading “Risk Factors” in the Company’s annual information form dated March 30, 2020 for its fiscal year ended December 31, 2019 and other risks identified in the Company’s filings with Canadian securities regulators and the United States Securities and Exchange Commission, which filings are available at www.sedar.com and www.sec.gov, respectively.

The risk factors referred to above are not an exhaustive list of the factors that may affect any of the Company’s forward-looking information. Forward-looking information includes statements about the future and is inherently uncertain, and the Company’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors. The Company’s statements containing forward-looking information are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update such forward-looking information if circumstances or management’s beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.

Mike McAllister

Vice President, Investor Relations

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Email: [email protected]

Americo Zuzunaga

Vice President of Corporate Planning

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Luis Marchese

CEO

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Source: Sierra Metals Inc.