What’s in the Surprise Cryptocurrency Bill

A Bill regulating digital assets was introduced in the House last Thursday (July 29). It would become a comprehensive law that provides for rules and oversight on everything from stablecoins, to regulators of decentralized finance (DeFi), the validity of exchanges, and other related topics.

This bill surprised most involved in digital markets as it was submitted by Rep. Don Beyer’s (D-Va.) who is not known for any involvement in crypto-currencies or digital assets. Yet the representative from Virginia presented the 58-page “Digital Asset Market Structure and Investor Protection Act,” as the all-inclusive set of rules and laws that would create the regulatory framework for digital assets. In its current form, it defines which type of cryptocurrencies may be securities, which type fall under commodities rules, and builds on tax data systems for reporting.

The bill also hands power to the Treasury Secretary to veto the creation of stablecoins, it directs regulators to define rules to govern decentralized finance (DeFi) and for agencies to determine whether they should create a charter for crypto exchanges.

All-Inclusive

The industry and those that make digital asset transactions would be best served if they know what the rules are (or will be) and that they won’t dramatically change. This bill, if it moves forward, would allow for clarity in ways that make it easier to know what the playing field looks like. The bill covers many areas of the industry, was put together by people who understand both the tech side and the market implications and is specifically about digital assets.

Last week other legislative actions were also taken that involved cryptocurrencies, but they were mixed in with other bills and debates. For example, the infrastructure bill last week included language concerning cryptos. It’s too soon to know whether the new bill has support among Rep. Beyer’s colleagues. Beyer is the chairman of Congress’s Joint Economic Committee and a member of the tax policy-making House Ways and Means Committee.

Central Bank

Digital Currency Authorization

There is language that would authorize the Federal Reserve, to create a CBDC. Recently, the Fed, which is expected to release a position paper in the coming weeks, said it wasn’t sure it had the authority to do so under its current mandate.

Infrastructure

Bill

Last week in the Senate, a bipartisan infrastructure bill included a provision that seeks to raise $28 billion in part by enforcing a broader set of information reporting requirements for crypto users than the U.S. currently has. This provision would require cryptocurrency brokers and investors to disclose their transactions to the Internal Revenue Service.

This is just a small part of funding the infrastructure bill that recognizes that the $2 trillion crypto market could be embraced and taxed.

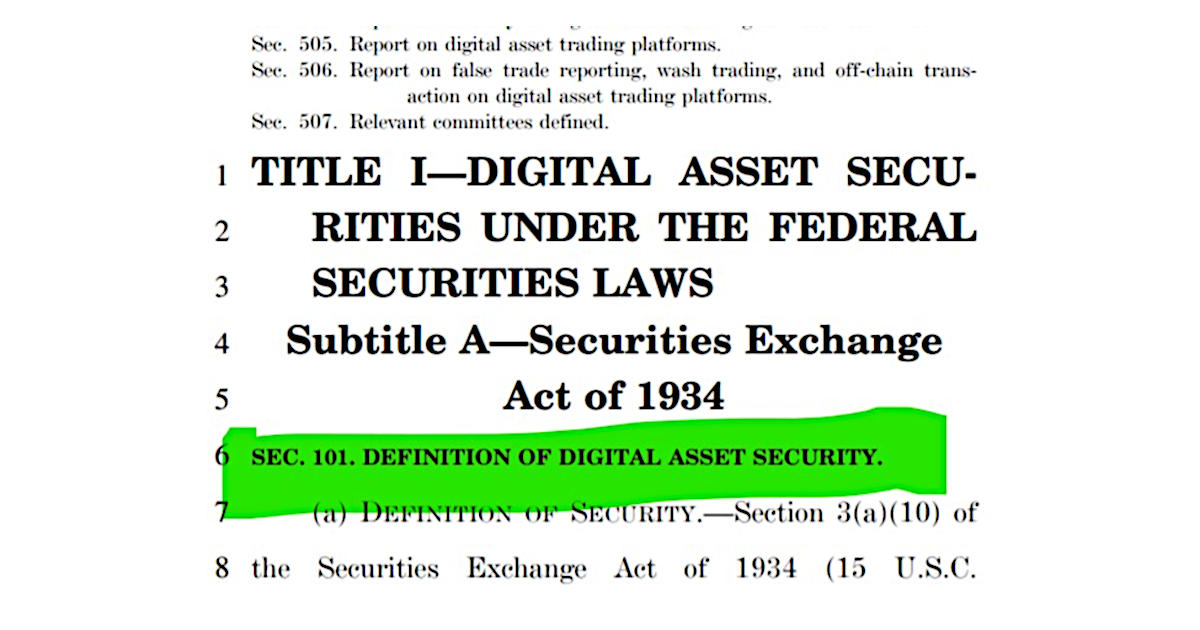

Securities vs. Commodities

Under the current version of the bill, the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) would have to more specifically define what aspects of the cryptocurrency market fall under which jurisdiction.

As far as the SEC is concerned, any “digital asset securities” that provide for equity could come under its oversight. As written, if the owner has a right to equity, profits, interest, dividend payments, or voting rights, the token would fall under the bill’s definition of a digital asset security. This would also hold true for an initial coin offering (ICO), tokens issued to finance the development of a product or platform have an equity component.

There is another provision that is important to this fledgling market and industry. This concerns “desecuritization.” The bill creates a path for a token that is treated as a digital asset security to become a cryptocurrency that will not be treated as a security. This answers SEC Commissioner Hester Peirce’s desire to create a safe harbor for crypto projects while in their infancy.

Cryptocurrencies that don’t fall under the SEC’s jurisdiction would fall under the CFTC’s. The bill asks these two regulators to publish proposed rulemaking to classify the 25 most-traded cryptocurrencies and the 25 cryptocurrencies with the highest aggregate as either securities or commodities.

Stablecoin

Issuance

The bill exhaustively defines how the U.S. should look at stablecoins. These are digital assets that trade essentially one-for-one with dollars or other government-issued currency. If passed, this would seem to allow for a CBDC. The stablecoin provision may create hurdles for issuers as it seems to render many illegal. The Treasury Department would have oversight and veto power over the creation and usage of all stablecoins in the U.S. under its terms.

“Beginning on the

date of the enactment of this section, no person may issue, use, or permit to

be used a digital asset fiat-based stablecoin that is not approved by the

Secretary of the Treasury under subsection,” – Digital Asset Securities Law Bill

This appears to give the Treasury Department the ability to restrict trading of any non-government stablecoins. An issuer would need to apply; then, the Treasury would consult with the Fed, the SEC, CFTC, and possibly foreign central banks or financial regulators before deciding whether to approve the proposal. The bill also explicitly prohibits the Treasury from grandfathering any existing stablecoins.

Anonymity

The bill also requires the Financial Crimes Enforcement Network (FinCEN) to draft regulations concerning anonymity-enhancing services as it relates to cryptocurrencies.

“The purpose of the rule … shall be to ensure that anonymizing services, money mule and anonymity-enhanced convertible virtual currencies are not used to prevent association of an individual customer with the movement of a digital asset, digital asset security or virtual currency of which the customer is the direct or beneficial owner,” – Digital Asset Securities Law Bill

This prohibits crypto exchanges or others from letting customers use mixers or similar services.

DeFi

While the bill does not explicitly define regulations concerning DeFi, custody, wash trading, or trading platforms, it does direct federal agencies to evaluate and publish reports on regulation recommendations.

Take-Away

All digital assets are getting much more attention in Washington. Protecting consumers and finding new sources of revenue to fund projects along with better surveillance seems to be driving this attention. The Chairman of the Joint Economic Committee put forward a comprehensive bill that could answer and clarify questions the market has been asking and tie the hands and reduce the attractiveness of digital assets.

Keep up with blockchain news by registering to receive emails from Channelchek. We follow events concerning blockchain technologies and many other industries that are important to investors.

Suggested Reading:

What is the Feds Position on Crypro, Stablecoin, and CBDCs

|

Cryptocurrencies and the Howey Test

|

Decentralized Apps Using Blockchain to Change the Internet

|

Repurposing Powerplants for Crypto-mining

|

Sources:

https://beyer.house.gov/uploadedfiles/beyer_028_xml.pdf

https://beyer.house.gov/news/documentsingle.aspx?DocumentID=5307

https://www.nytimes.com/2021/07/30/us/politics/infrastructure-deal-cryptocurrency.html

Stay up to date. Follow us:

|