Image Credit: K-State Research and Extension

Firearm Stocks Spike After Mass Shootings as Investors Dismiss the Chance of Tightening Gun Laws

The day after an armed 18-year-old entered the Robb Elementary School in Uvalde, Texas, and shot dead 19 children and two teachers, the share prices of gun and weapons manufacturers jumped.

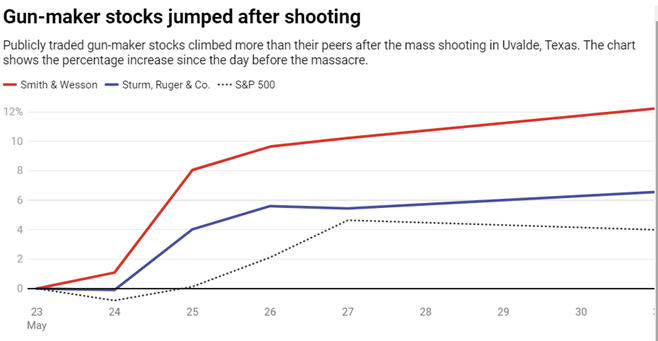

A week on, and the market rally of gun stocks following the latest mass shooting hasn’t subsided. As of the close of trading on May 31, 2022, the stock price of weapons-maker Sturm Ruger was up more than 6.6% since May 23, the day before the shooting. For Smith & Wesson, the jump was even more marked, with shares up over 12% from the stock price prior to the mass killing in Uvalde.

| This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It was written by and represents the research-based opinions of Brad Greenwood, Associate Professor of Information Systems and Operations Management, George Mason University. |

But that relationship – a mass shooting followed by a spike in gun industry stocks – wasn’t always the case. My colleague Anand Gopal and I studied the impact of 93 mass shootings on the stock price of publicly listed firms from 2009 to 2013. We found that, contrary to what happens now, mass shootings in that period were followed by a drop in share price for Smith & Wesson and Sturm Ruger, the two gun companies still publicly listed in the U.S.

So why has that changed? The answer may lie in how hopes of legislation over tighter restrictions on gun sales have dwindled over the last decade. The takeaway is investors no longer seem to worry so much about the chances of tightening firearms regulation when assessing the long-term viability of gun manufacturers in the aftermath of mass shootings.

Let’s look at the factors that influence the valuation of such stocks after mass shootings. First you have increasing demand for weapons. Research has shown that gun sales go up after a high-profile shooting as Americans “arm up,” both out of a perceived concern for their safety and fear of tighter restrictions.

The thinking is simple: “I better buy firearms while I still can, before legislation makes it harder for me to do so.” This increased demand would, on its own, spur the market price of gun and ammunition manufacturers by providing an unanticipated financial windfall.

But then you have the counter factor: Any talk of tighter rules on gun sales puts at risk the long-term viability of the companies by curtailing future cash flows. The business model of gun-makers, after all, is to sell increasing numbers of firearms to the public. Any ban or restrictions on what types of weapon you can purchase – or even who can buy a firearm – would limit their ability to increase profits.

In the period we looked at, investors seemed to lean into this fear of future legislation more, as seen in the reduced valuation of publicly listed firearm companies after mass shootings. Our research showed that the mass shootings from 2009 to 2013 resulted in a penalty imposed on firearms stocks over a two-, five- and 10-day window. That is to say, a mass shooting would be followed by a cumulative abnormal drop in share price over that period. The penalty worked out to around 1.25% over a five-day period.

Interestingly, even over the years we looked at, things began to change. The negative stock market response to mass shootings tapered off in the later years of our study, suggesting that the threat of any regulatory measures was not as keenly felt by investors.

Inaction over gun control at the federal level – and the loosening of regulations among some states – in the years since our work has seemingly led to a rebalancing of the two main factors at play. Yes, there is still the surge of demand for gun sales after mass shootings. But the fear over potential regulations over gun sales has seemingly abated.

The surge in the stock price of Smith & Wesson and Sturm Ruger after the Uvalde school shooting provides strong correlational evidence that firearm stocks now rise after such events. A similar effect was seen after the 2018 mass shooting at the Marjory Stoneman Douglas High School in Parkland, Florida.

But there is a problem when it comes to saying outright that there is a link. One of the things in the statistical model we used in our research no longer works. The reason: There are simply too many mass shootings in the U.S. They occur with such frequency that we can no longer implement this kind of analysis looking at the effect of isolated incidents and the stock market effect on gun companies.

In fact, according to the Gun Violence Archive, there were 18 more mass shootings in the U.S. in the seven days after the Uvalde shooting.

Suggested Reading

The SPAC Advantage in a Volatile or Bear Market

|

Leveraged and Inverse ETF Do’s and Mostly Don’ts

|

Rates, Rubles, and Gold

|

Avoiding the Noise and Focusing on Managing Your Investments

|

Stay up to date. Follow us:

|