Young Traders Confounding Wall Street Pros is Cyclical

Before there was WallStreetBets (WSB), before there was Robinhood, and even before Davey Day Trader, there were the SOES Bandits. This was the name given to the mostly 25 to 30-year-olds capitalizing on technology to make a few bucks. Twenty-five years ago the new styled day trader confounded the Wall Street establishment as a rise of individuals trading electronically for the first time took root. There was a perfect storm of ingredients that led to online trading rooms opening around the country offering a seat to anyone with money to trade and the desire to learn. The setup unfolded and the business of individuals trading stocks from office space with high-speed internet (not dial-up) had explosive growth. It was a huge disruptor to Nasdaq market makers among others. The old guard on Wall Street and business news scoffed at the profession, what else could they do, the new styled trader was costing firms money.

Technology Has Always Shifted Market Conditions

The setup in this case included three factors. The Small Order Execution System (SOES) was enhanced after the 1987 market crash to make sure the “little guy” had a better chance of their orders being executed. The internet had just become high speed in office buildings and shopping centers, and tech and dot-com stocks were continuing to rally.

What SOES did for smaller investors is automatically match up small trade orders if the order was at the best bid or offer and next up to be filled. There was no human accepting the order on the market-makers side. The stipulation required for a transaction to be auto-filled is it first had to be entered through the Small Order Entry System. The transaction was required to be for 1000 or fewer shares and the price per share, below $250. Institutions could not use SOES; licensed brokers transacting for themselves were also excluded. The system and the rules were intended to fix the problem that occurred in October 1987 when sell orders were left unfilled for small accounts. Market makers ignored the smaller transactions and worked to fill the larger orders first. This caused many smaller investors to not be able to get out of positions to prevent further losses. The limit as to how many times per day a SOES trader was permitted to place an order on the same ticker is five minutes. This prevented them from executing more than 1000 shares by sending them in quick succession. Once a trader places an order through SOES, they must wait at least five minutes to place another trade on the same stock through SOES. This did not prevent any trader from, on a good day with many setups that fit their plan, to not place hundreds of trades.

The Markets themselves generally run in cycles, and there is evidence in their being cyclicality to disruption of the established players every generation or so. The ingredients are the same, technology leading to better access, access inspiring creative ways to profit, established players flexing their muscle.

|

1867: Day Trading and the New Ticker Tape

Instances of taking full advantage of technology for Day trading go back 150 years or more. Soon after the telegraph was invented, stock markets used the telegraph’s communication technology to create the first ticker tape. Ticker tape made it easy to communicate information about transactions occurring on the exchange floor with brokers. Before the internet and other global communication platforms were invented, brokers would try to live in close proximity to exchanges like the New York Stock Exchange, as it meant they were getting a steady supply of ticker tape with the most up-to-date information. |

Young, informed, computer-savvy individuals working on Wall Street figured out how to take money out of the market using the SOES system and the growing access to high-speed internet connections. These SOES traders, soon dubbed the SOES Bandits quickly became responsible for 13% of the Nasdaq volume. Their main advantage was speed. SOES traders were placing trades electronically and receiving instant executions while their counterparties were using open outcry, in a trading pit.

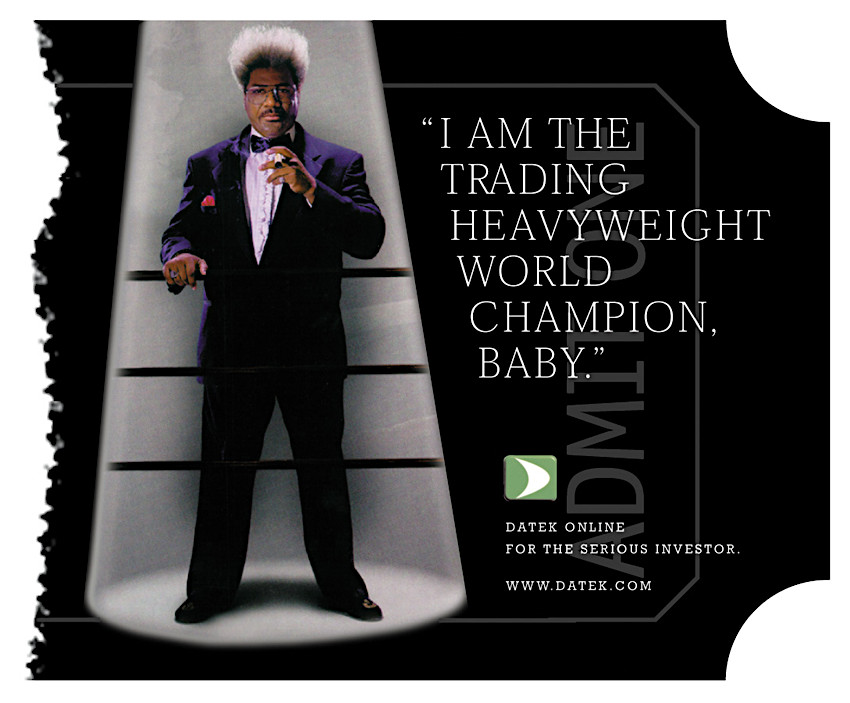

The small guys had an edge with the technology they were using. These so-called Bandits became vilified by Wall Street, regulators, and the financial media as market destroyers. What they were really doing is preventing some of the profit that they were taking from going to where it would have gone before, the major Wall Street firms. Successful SOES traders were pulling thousands of dollars a day from the market. Although not everyone was successful, there were enough making 8 figure incomes to inspire masses to try the new career. Franchises and chains such as ALL-Tech Investments and Datek Online sprung up and there were rooms filled with casually dressed traders across the country in dimly lit rooms staring at CRT screens and placing trades online. Their presence annoyed the old guard.

An Advertisement for DATEK ONLINE from 1998

Blame, Ridicule, and Reality

SOES trading’s success was the result of how it interacted with fragmented order flow. They were essentially getting between the wall and the wallpaper for as low as a sixteenth or an eighth (decimalization began in 2001). The bandits’ speed advantage is what provided their edge. While market makers were yelling in a trading pit and discussing transactions over the phone, a bandit had the novel ability to get in and out of a stock with the click of a button.

SOES bandits were blamed by Wall Street, the financial media, and regulators for reducing liquidity, widening spreads, and increasing market volatility. The day traders were mostly short-term momentum players that tried to go home with no positions at the close. They would jump in long as prices were rising and wrestle with the uptick rule when placing a trade to go short while prices were falling. The narrative in the news and expressed anxiety that SOES traders were contributing to ‘unnatural’ market trends that weren’t based on fundamental factors.

Studies since have found the opposite may be true. Instead of increasing market volatility, they concentrated price changes into shorter time periods. Instead of a trend taking an hour to unfold, it might have taken 15 minutes with the SOES traders behind it. Prices adjusted faster, and their activity enhanced market efficiency.

There was also another reason; the stock markets price discovery system is considered to have improved, market makers weren’t trading their own accounts, therefore they weren’t as highly incentivized to produce price discovery in the way an individual, trading their own assets are.

Take-Away

On Jan. 25, 1915, telephone service from coast to coast was opened up to the public for the first time. Imagine the advantage the traders had that originally thought to use this technology to capitalize on the discrepancies between the New York Stock Exchange and the Los Angeles Exchange. An online search did not uncover any groups complaining about anyone in 1915 using the phone to make money trading stocks. The search did not uncover any laws written to prevent the use of the new technology in this way. Instead, what occurred is efficiencies sprang from it and the markets traded tighter.

The SOES system coupled with the technology of high-speed internet availability changed the markets during the 90s allowing many more people to transact directly and at a reduced cost. Markets have since produced more pronounced drops and longer trends. Market participants needed to adapt to this change and others or go out of business. That’s the case with all businesses. The Small Order Execution System methods became less profitable for each trader as competition grew with the swelling ranks of newer Bandits. Market-makers, to their chagrin, tightened up their orders and were more diligent all-around. As computers became more common throughout Wall Street, the Nasdaq removed the SOES system advantage (2000).

Discovering ways to use technology to pull money from the market is 150+ years old. The most recent incarnation of confounding and upsetting the Wall Street old guard is online communities including Reddit, StockTwits, and the Robinhood traders. With increased intensity, they have been following their own rules and using technology to exploit situations. This is part of the ongoing cycle of change in the business. The subreddit group WallStreetBets (r/wallstreetbets), is doing what has been done before. They are taking improved communication and more robust trading technology, combining the two and trying to place winning trades. Everyone involved, with money on the line, will adapt and soon lower the success rate of the current novel trading methods.

It’s a cycle; technology happens, younger more tech adept then adopt and find their spot, establishment adapts and adjusts to the new activity, the more powerful flex their muscles and again gain the upper hand.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

Emotions, Markets, and Mayhem (Faith in Cycles)

Contango, ETFs, and Alligators

How Good are Experts at Predicting the Market

Sources:

Father of Day-Trading Sought To Be Investors’ Advocate

Watch Out Stock Market Here Come the SOES Bandits

The Trading Profits of SOES Bandits

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|