Lifecycle of a Special Purpose Acquisition Company

(Part of a Channelchek Series on SPACs)

Special purpose acquisition companies (SPACs) are essentially shell companies. That is to say; they have no business activities, just a legal structure. On the path to becoming a SPAC, the shell company applies for a listing on a stock exchange to raise money with the intent to use the capital to acquire a business. While there is a lot of information available to consume surrounding the magnitude of 2020s SPAC activity (up 400%), or the more accelerated level of deals in 2021, our readers have told us they would like more information regarding the structure of these opportunities, how they might become involved, where research might be found on acquisition targets, common terms used, and risks.

Lifecycle

of a SPAC is the first of what will be ongoing educational pieces published by Channelchek on the subject. From it, you should gain a better understanding of:

- How the initial SPAC comes into being and the risk and rewards of the SPAC founders

- Expectations, contractual and otherwise of all parties

- The fate of the minority SPAC shareholders that reject a target for acquisition of an upvoted company

- How SPACs differ from traditional IPOs

At its

Most Basic

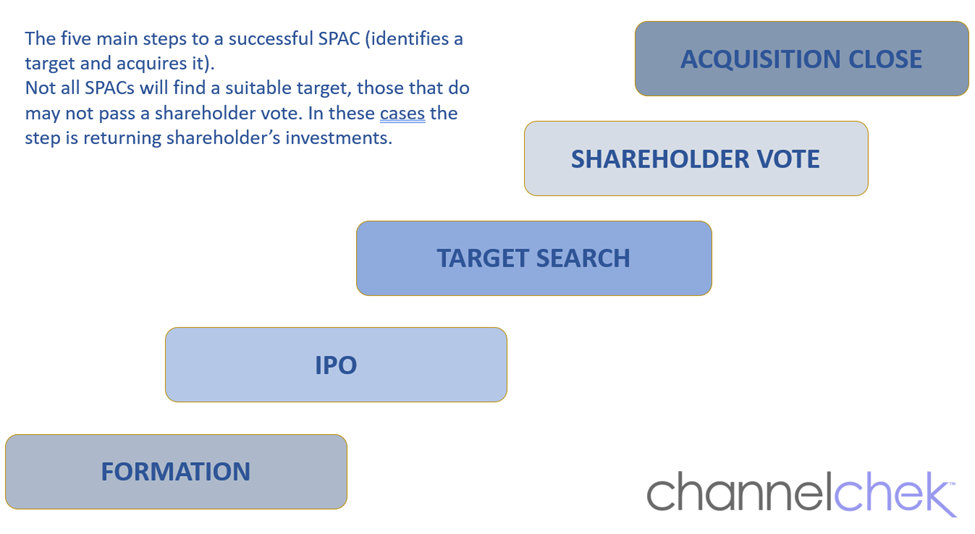

All SPACs originate with an initial formation, which is then followed by its IPO. After there is a search for a target acquisition. Once found, there is a shareholder merger vote, with approval by shareholders, the acquisition is close upon. Should no identified target be acceptable to shareholders, after an agreed-upon time frame spelled out during the SPAC formation, proceeds are returned to the initial investors.

Five Main Steps from SPAC to De-SPAC

Life Cycle

FORMATION

– Step One

At the outset, when a SPAC is created, the sponsor and often its management team contribute a relatively small amount for a cash stake in the investment offering; this “skin-in-the-game” is referred to as “founders’ stock.” The stock of these founding investors is generally 20 percent of the stock after the SPACs initial public offering. This is their compensation for creating the shell company, identifying a suitable target, and closing the merger. The sponsor that is managing parts of the structure may lend use of the founder’s contribution to fund ongoing expenses. In addition, the SPAC selects legal counsel and underwriters and establishes its governing documents.

INITIAL

PUBLIC OFFERING (IPO) – Step Two

After the SPAC is created and all of the defining documents, including legal existence are in place, the shell corp begins the public offering process with the intent to find a suitable target. This includes the SPAC filing with the SEC, an initial registration statement. The SPAC then typically raises capital by issuing units (these often consist of common shares and warrants); the proceeds raised are held in a trust and not released until a target is acquired or funds returned to investors.

After the offering, the units are separated into shares of common stock and tradable warrants. The warrants are designed to minimize dilution yet provide added compensation for the initial investors. They are often exercisable within a short time frame after a merger is completed.

TARGET

SEARCH – Step

Three

The search for a suitable acquisition includes the sponsors vetting potential businesses through a ramped-up financial and legal due diligence process. Historically, SPACs had been focused on companies with a positive EBITDA. More common targets since 2020 have been a pre-revenue “story-stock.” These are at times referred to as a “unicorn,” ie, it is so special that its apparent value creates enthusiasm.

There is a timeline defined prior to the SPAC IPO to close an acquisition, it depends on multiple factors. One factor is that dissenting SPAC shareholders have the right to redeem shares; this could create uncertainty regarding the amount of funding available to pay target shareholders and to cover months of operating expenses after closing. This often leads to SPACs, and the acquired to negotiate “minimum cash” on closing. For this reason, SPAC acquisitions often include a simultaneous Private Investment in Public Equity (PIPE) upon merging.

SHAREHOLDER

VOTE – Step Four

SEC proxy rules and approval of corporate bylaws typically require shareholder acceptance before the completion of the de-SPAC process. With this, the completion of a merger typically requires the entities to file a proxy with the SEC, obtain and respond to the SEC’s comments, mail the proxy to the SPAC’s shareholders, and hold a shareholder meeting. The sponsor and other founding shareholders committed as they founded the entity to vote their interest which is typically 20% in favor of a transaction, this decreases the number of additional common shares needed to vote in favor of the merger.

ACQUISITION

CLOSE – Step Five

If an affirmative majority vote is obtained from the proxy process, the target acquisition can close by merging into the SPAC, then the target company becomes a reorganized publicly traded entity. A Super 8-K must be filed within four days of the acquisition. It contains substantially the same information that would be required in a registration statement for companies that go through a traditional IPO. Further, the sponsor’s founders’ shares and warrants are locked up for a specified period (the “lock-up period”) starting from the date of the Super 8-K filing. The lock-up period is typically one year and was decided at the early stages of the SPAC.

Other

Information

The public offering steps of a SPAC differ from that of a traditional IPO in at least one very important way. The target company, if it is eventually acquired, was not involved in the formation of the SPAC or the IPO. Instead, the terms of the offering in a SPAC IPO and the agreements the SPAC has with their management team, and sponsor, takes the lead role. They decide the value that the acquired company investors extract from any SPAC merger.

Related Channelchek

Articles:

|

|

Will 2020 go Down as the Year of the SPAC (July 27, 2020)

|

SPAC Activity Accelerating in 2020 (August 21, 2020)

|

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|