ESG Indicators and How Investors Use Them

The idea of investing with the expectation of financial return is nothing new. Today’s trend toward a renewed appreciation for operating with sustainable resources with an eye toward environmental impact is building momentum. Investors, some out of social and environmental concerns, and others to cash in on a developing segment (or both) may be best served by considering the environmental, social, and governance (ESG) impact of companies they invest in. The rise of investors who now expect some social returns also creates an incentive for businesses to quantify their success not only financially but also in terms of how they are influencing the world.

The concept of sustainable investing began as a way for impact-oriented organizations – nonprofits, multilateral development banks – to have long-term funding mechanisms and wean away from dependency on grants. Over the years, it has grown more entrenched into the realm of common institutional and retail investing.

In this emerging world of sustainable investment popularity – a world of green portfolios and impact investors – ESG indicators have provided some direction in what actually constitutes a socially conscious investment decision. At the same time, the ESG investing space is still new and unclearly defined. Certain frameworks exist to “rank” organizations on their ESG ratings.

What does this mean for your actual investment decisions?

The Frameworks

MSCI

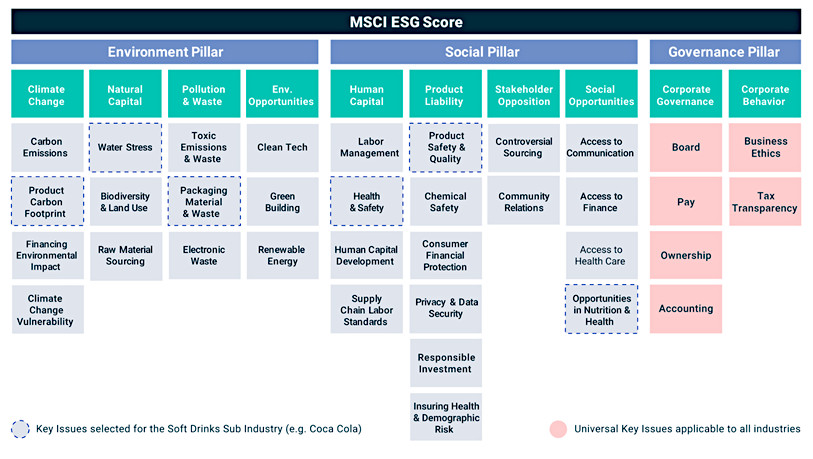

The MSCI Framework measures ESG scores based on 35 key data points across each pillar. The environmental pillar includes factors like carbon emissions and land use. The social pillar considers issues surrounding human capital and labor management as well as sourcing and data security. Many of their data points are applicable to just about any industry. Some, like water stress, are more heavily considered specifically for the soft drinks sub-industry.

SSGA

The SSGA Framework considers the integration of ESG indicators along with traditional financial KPI analysis. State Street has its own R-Factor™ Scoring Model based on how well companies adhere to the Social Accountability Standards Board (SASB) standards. SSGA then maps the raw metrics and applies them to their investments depending on their relevance to the industry.

Practical ESG Investing

The frameworks simply provide some context into what ESG rankings consider. Ultimately, the theories behind these frameworks are only as useful as the ways in which they are applied.

One interesting method towards large-scale climate-neutral investing comes from the Dutch. Pension funds in the Netherlands and Nordic countries have goals to be climate neutral over the course of the next few years. ABP, the largest pension fund in the Netherlands, has a plan for making their clients’ money go towards a greener world by 2025. They will be phasing out their investments in companies where coal mining makes up 30% or more of annual revenue. It is also slowly pulling out of those whose oil production from tar sands accounts for more than 20% of annual revenue.

ESG investing has seen the largest increases by investors using ETFs and assets under management. Up and coming companies, largely app or web-based, allow tech-savvy retail investors to put their money into ESG ETFs and index funds with a simple tap or click. Some of the most well-known include Betterment, Nuveen, Humankind Funds, and Benevity.

Individual companies offer more targeted investment opportunities. Some investors have created Facebook “fan” pages to follow these companies and interact with other involved self-directed investors. One example is the GEVO Shareholders Facebook page, where investors discuss the company and stock performance. Gevo, Inc. is a renewable chemicals and biofuels company whose research is widely followed here on Channelchek.

The ESG Approach

Ultimately, socially responsible investing is an approach thought to put money towards something that will have long-term positive impacts in a broad sense and more specifically for sustainable companies. At the core of the approach is the ethos that money influences business; one might as well have a positive influence where possible.

Paying attention to the ESG rankings and indices can also indicate the long-term growth potential of the companies. For example, the higher the environmental ranking, the less likely it is that the company relies on a finite resource like fossil fuels. The higher the social and governance rankings, the less likely the company will experience bottlenecks in its supply chain due to labor issues or come under fire for allegations regarding mistreatment of its workforce. Companies with a high ESG ranking also tend to have diverse leadership which can contribute to higher innovation.

About the Author:

Laila Jiwani is a freelance writer specializing in topics related to social finance and international economic trends. Currently based in Dallas, Texas, she is an Erasmus Mundus Joint Master’s Graduate and has worked for economic development organizations in the U.S., Morocco, Kenya, Pakistan and Kyrgyzstan.

Suggested Reading:

Can one do Good and do Well in Tandem

Is the Small Firm Effect for Microcaps Real?

Can Mining be Green and Sustainable?

Sources:

https://www.msci.com/our-solutions/esg-investing/esg-ratings/esg-ratings-key-issue-framework

https://www.ft.com/content/4854829b-ca38-4267-aab7-8691cd7a87e9

https://www.ssga.com/investment-topics/environmental-social-governance/2018/10/esg-terminology.pdf

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|