Image Credit: Tom Fisk (Pexels)

What’s in the Infrastructure Bill for US Battery Production?

The Infrastructure Bill that just passed the Senate and is headed to the House for a possible vote this Fall is undoubtedly helpful for metals producers. However, not all will benefit. If passed, there’d be billions for upgrading highways, railways, and power grids. So steel, copper, and aluminum are obvious winners, but as written, for minerals used in batteries such as lithium or cobalt, the bill will not only increase domestic demand but aims to increase supply as well.

There is $6 billion earmarked for battery materials processing and manufacturing projects and an additional $140 million allocated to what is called a rare earths demonstration plant. This is part of a greater investment drive across the full metallic supply chain.

The “investment” within the bill works to place importance on production capacity of critical metals and “green” the overall infrastructure of the country while making a solid effort to “buy American.” A tall order considering the country’s reliance on imports.

Rare Earth Metals

The United States’ supply of rare earth compounds can best be described as imported. Almost 80% of shipments come from China, according to the United States Geological Survey (USGS).

The Department of Energy (DOE) is already steering funds into research and development on the necessary materials needed, from primary processing to recycling, the infrastructure bill makes the commitment much larger with a $140 million grant to build a facility, “to demonstrate the commercial feasibility of a full-scale integrated rare earth element extraction and separation facility and refinery”.

A partner from academia is expected to “provide environmental benefits through use of feedstock derived from acid mine drainage, mine waste, or other deleterious material.” The US is considered vulnerable in its not being able to supply enough critical minerals for what is expected to provide the energy needs of the near future.

Critical mineral recycling also gets money through this bill as it allocates $100 million per year through 2024 in grants for developing, processing, and recycling critical minerals. Recycling projects will get a minimum of 30%. Any project based in the United States will be prioritized and none will be allowed to export to “a foreign entity of concern”.

Battery Metals

There is $7.5 billion allocated in the bill for EV charging. The House is rumored to be looking to refine the bill and bolster some of these numbers for them to approve a revised version.

While the plan is to move quickly forward with electric vehicles, currently the country will not have enough domestic production of lithium, nickel, and cobalt to make the batteries needed to power those vehicles. This may be remedied by the bill’s allocations of $3 billion for each of the following: battery materials processing, and battery manufacturing projects. Grants in each case will be for either demonstration plants, full commercial facilities or the retrofitting of existing facilities in the United States. Grants are only offered to U.S. owned organizations. The winners of grants will be subject to North American intellectual property rights with a commitment not to “use battery material supplied by or originating from a foreign entity of concern.”

Permitting

Getting US-funded new mines for nickel, lithium, or cobalt refining can be a slow process given the current complexity of the permitting processes. Far too slow if the country is going meet the stated targets. The bill notes, “The Federal permitting process has been identified as an impediment to mineral production and the mineral security of the United States,” it calls for the implementing performance metrics as a condition of approving critical mines that are part of the program.

Environmental opposition to these metal mining projects is another impediment. This will be part of what is addressed; it remains to be seen just how quickly permitting can be put through, given the obvious counter-productive nature of mining.

The Dirty Mining Issue

“Whole-concept” or “total mining” is addressed in the infrastructure bill. Despite the shorter deadlines and grant periods, the bill allows a 10-year deadline for the United States Geological Survey (USGS) to provide a comprehensive survey of national mineral resources. The intent is “using a whole ore body approach rather than a single commodity approach, to emphasize all of the recoverable critical minerals in a given surface or subsurface deposit”.

The bill also calls for the USGS to “map and collect data for areas containing mine waste to increase understanding of above-ground critical mineral resources in previously disturbed areas.” These wastes are expected to feed the proposed new rare earths processing plants.

Brand new mines will remain a problem for critical minerals planners; going back to what has already been mined seems more sensible.

Take-Away

The infrastructure bill is an obvious win for construction materials but will also provide a strong framework and a lot of R&D money for miners and academia alike. The top take from the as yet not fully passed or signed bill is that it will focus on companies in the U.S. This will mean many current mining and recycling companies within our borders will have tremendous potential to grow at a rapid pace.

Discover US-based mining companies to explore here on Channelchek. Then subscribe to our YouTube channel to listen to interviews with the top brass from metal producers.

Suggested Reading:

ESG Scores and How to Use Them

|

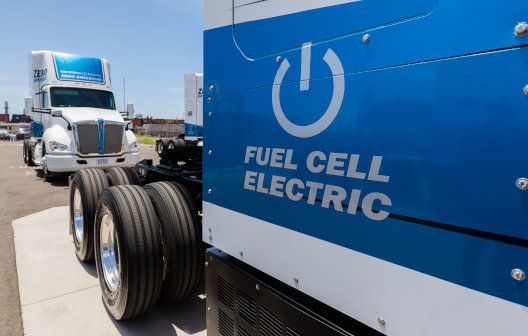

Lithium Battery vs Hydrogen Fuel Cell

|

Ford’s Announcement is Another Reason for Copper Producers to Smile

|

Debt Ceiling Debate Impact on Stocks and US Treasury Credit Rating

|

Sources:

https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

Stay up to date. Follow us:

|