Improved Efficiencies and Rising Oil Prices May Help West Canada Producers to Soon Generate Strong Cash Flow

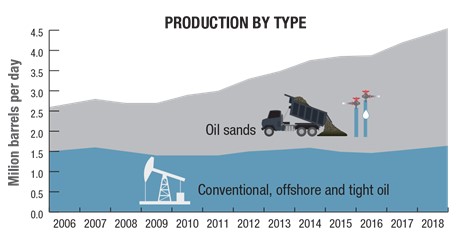

Canada is the fourth-largest producer of oil and the third-largest exporter of oil. Most of their production comes from Western Canada, which has a long history of oil production. About 80% of the oil produced in Canada is from the Alberta Providence, with Saskatchewan producing another 10%. About half of Canadian oil production is from oil sands deposits in northern Alberta and Saskatchewan. Oil sands (tar sands, crude bitumen, or bituminous sands) are sandstone deposits containing a mix of sand, clay, and water. Within the deposits is a dense, viscous form of petroleum that may require heating or dilution to allow the oil to flow to the surface. While oil sand production garners significant attention due to large deposits, it is worth noting that western Canada also has large deposits of more traditional oil deposits in shale formations. These formations are fracked to produce quick payouts and low decline curves, similar to the Permian Basin deposits in the United States. And like the Permian Basin wells, drilling, and operating costs are declining as companies perfect the process.

Lower Production Costs

Oil sand production has grown in recent years as the cost of an oil sand project has decreased 25-33%. The breakeven oil price for oil sand projects has fallen from around $65 per barrel to $45 per barrel. Oil sand production has larger upfront fixed costs due to the construction of steaming facilities. That makes them less likely to shut in or cut back drilling due to temporary decreases in prices. Shale production, on the other hand, is more flexible to changes in oil prices. Shale production also tends to be less expensive to produce than oil sand, with companies reporting production costs closer to $20 per barrel and all-in breakeven pricing closer to $30 per barrel.

Oil Sands bpd production has increased as conventional bpd production has remained stable

Western Canada Shale Plays

There are many shale plays in western Canada. The Cardium Formation is one of the largest shale formations and includes several profitable plays including the Pembina Field, the largest oil field in Alberta. Other producing areas in Western Canada include the Muskiki Formation, the Wapiabi Formation, the Blackstone Formation and the Kaskapau Formation.

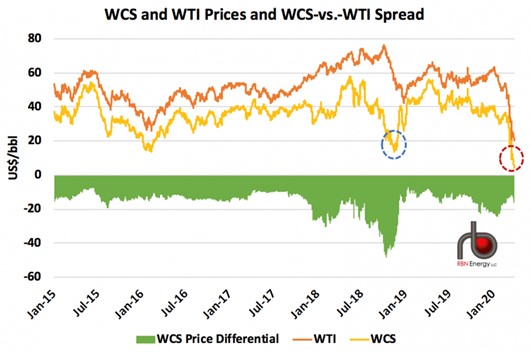

As western Canadian oil production grows, new infrastructure needs to be built to transport and store oil. Delays in the construction of new pipelines has meant that the Western Canadian Select oil price trades at a discount of approximately $10 per barrel to West Texas Intermediary prices. That discount roughly offset the gains associated with converting prices from the U.S. dollar to the Canadian dollar. There is a good chance the basin discount will decrease as new pipelines are built. Mark Salkeld, president of the Petroleum Services Association of Canada explains, “The only thing holding us back is access to market and the cost.”

Shale oil production in western Canada went dormant when oil prices sunk last spring

Take-Away

With oil price rebounding during the summer, production is returning. With low production costs and improving prices, western Canadian oil producers may soon be generating strong cash flow once again.

Register Now for Today’s Virtual Road Show Featuring InPlayOil (IPO:CA, IPOOF):

|

Virtual Attendance of the InPlay Oil (IPOOF)(IPO:CA) Virtual Road Show – has limited free registration. TODAY, November 23 1pm EST Join Douglas Bartole – CEO & President as he discusses his company and answers questions from attendees. REGISTER |

Sources:

https://en.wikipedia.org/wiki/Oil_sands

https://www.businesswire.com/news/home/20190501005040/en/Costs-of-Canadian-Oil-Sands-Projects-Fell-Dramatically-in-Recent-Years-But-Pipeline-Constraints-and-other-Factors-Will-Moderate-Future-Production-Growth-IHS-Markit-Analysis-Says, Businesswire, May 01, 2019

https://www.reuters.com/article/us-canada-oil-shale-insight/why-canada-is-the-next-frontier-for-shale-oil-idUSKBN1FI0G7, Nia Williams, Reuters, January 29, 2018

https://static.aer.ca/prd/documents/reports/DuvernayReserves_2016.pdf, Alberta Energy Regulator, December 2016

http://oilshalegas.com/cardiumshale.html, Oilshalegas.com