Image Credit: Pascal (Flickr)

Recipe for Higher Uranium Prices

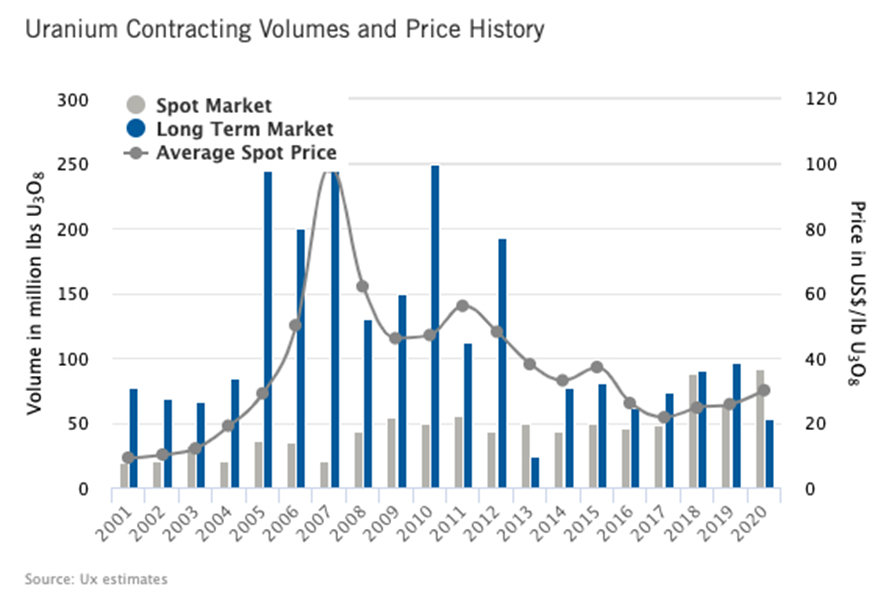

Uranium contract prices are now above the levels that existed before the Fukushima power plant disaster in 2011. Although demand for nuclear fuel is increasing, global production of uranium has fallen off. So far in 2021, there have been two significant uranium mines closed. They are the Ranger mine in Australia’s Northern Territory operated by Energy Resources of Australia (ASX: ERA) and COMINAK’s Akouta mine in Niger, which had been in service for nearly half a century. With the temporary suspension of its Cigar Lake mine in December 2020, Cameco (TSX: CCO, NYSE: CCJ) temporarily suspended production of its Cigar Lake mine in December of 2020. This left them behind on production by 1.5 million pounds. The world’s largest uranium operation, Cameco’s McArthur River mine, suspended operations back in July 2018.

UxC, LLC has been providing market research and analysis to the nuclear industry since 1987. They make the case that declining uranium inventories and depletion of reserves are likely to drive higher-cost production by 2025. As it stands, there are more than 443 nuclear reactors in operation worldwide and 52 under construction. Significant production disruptions raise questions about the availability and cost of uranium in the coming years.

Nuclear fuel is not traded on the commodities market. Individual contracts between utilities and producers dictate the commodities’ price. Investors can get exposure to price changes of the metal by investing in mining companies. Research on many of the companies active in this space can be found by typing “uranium” in the upper left Company Data search bar of Channelchek. Among the companies, you can explore on Channelchek, are three U.S. companies highlighted below that may benefit from the reduced supply and increased demand of their output.

Uranium Energy Corp (UEC) is an independent U.S. uranium mining company. The company controls 104M lbs of qualified resources and a fully permitted uranium processing plant in South Texas. UEC has a potential production profile of around 4 million pounds of U.S.-origin U3O8 per year with room to expand. UEC is up 85% YTD.

enCore Energy Corp. (https://channelchek.vercel.app/aux/(expanded:check-channels)ENCUF) is focused on working towards becoming a domestic United States uranium producer. With significant existing resources in the southwest United States and licensed uranium production facilities in Texas, enCore holds the largest uranium position in the Grants Mineral Belt and licensed processing capacity to respond quickly to market opportunities. ENCUF is up 76.4% YTD.

Energy Fuels (UUUU) holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch ISR Facility in Wyoming, and the Alta Mesa ISR Facility in Texas. The producing White Mesa Mill is the only conventional uranium mill in the U.S. and has a licensed capacity of 8 million pounds of U3O8 per year. Nichols Ranch is in production and has a licensed capacity of 2 million pounds of U3O8 per year. Alta Mesa is currently on standby. Energy Fuels also owns several licensed and developed uranium and vanadium mines on standby and other projects in development. UUUU is up 77.2% YTD.

Take-Away

Many factors drive the price of any commodity, and when it comes to uranium-powered plants, they have gone in and out of favor. So there is risk. One way to gain exposure to uranium as an investor is through uranium producers. Channelchek.com may help you uncover companies poised to trade with the renewed interest in nuclear power.

Suggested Reading:

|

|

Harnessing Nuclear Power

|

The Increasing Popularity of Uranium Investments

|

|

|

How does Uranium Fit into the ESG Landscape

|

Is the Future of Nuclear, Small Modular Reactors?

|

Sources:

https://www.mining.com/stars-are-aligning-for-uranium-price-rally/

https://www.orano.group/reamenagement-cominak/en

https://www.mining.com/stars-are-aligning-for-uranium-price-rally/

https://pris.iaea.org/PRIS/home.aspx

https://www.mining.com/stars-are-aligning-for-uranium-price-rally/

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|