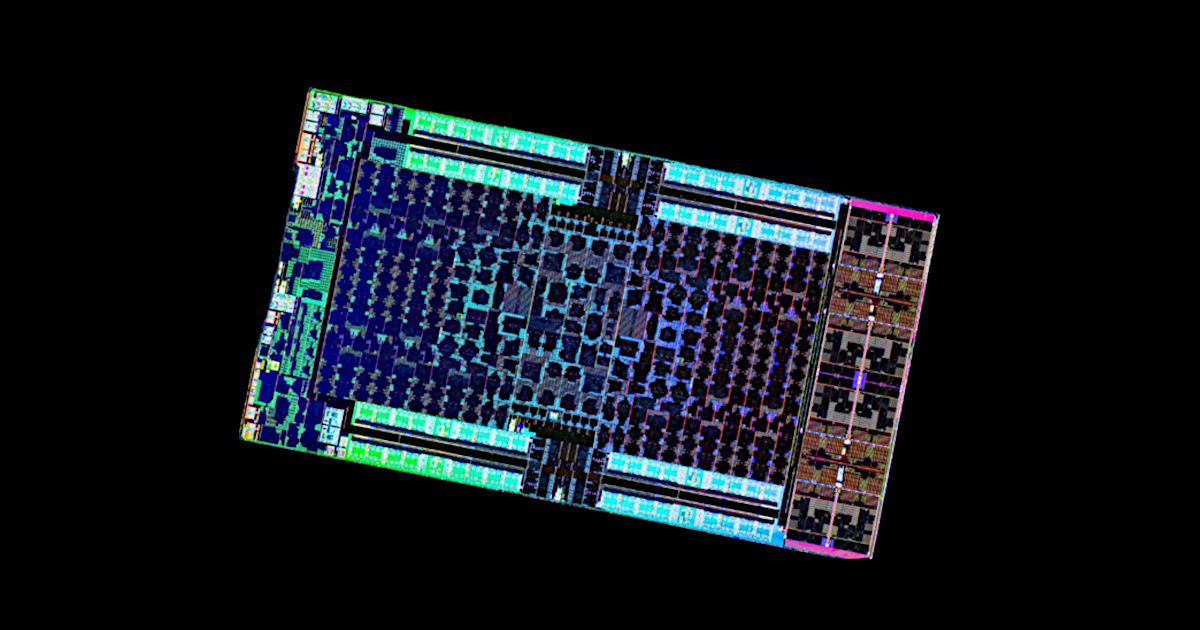

Image Credit: Fritzschens Fritz (Flickr)

The Computer Chip Shortage, Where We Are Now

To understand when the microchip shortage will end it helps to deeply understand how it began, and what is being done. The problems started with a global pandemic, a trade war, drought, fires, and snowstorms. At the same time, there has been record demand for computer chips. Microchips are in everything from washing machines to fitness watches. And new cars could require several dozen. The inability for consumer-goods manufacturers to secure the specific chips needed has idled production of many things we take for granted, meanwhile chip production, even under ideal conditions, is somewhat painstaking.

Background

The covid-19 pandemic caused decreased demand for new cars. This made sense as many were faced with an uncertain economic future, and their time spent behind the wheel of a car came to a screeching halt. Car companies, not looking to get stuck with a glut of cars slimmed-down manufacturing. Some plants even switched gears and manufactured ventilators for the government. The reduced auto manufacturing and reduced orders for parts including chips, which help control everything from transmissions to braking, and engine surveillance, caused microchip companies to refocus.

While car demand faltered, demand for home electronics like laptops, smart TVs and, new phones were in high demand as setting up a functioning home office became important. There was also increased demand for electronic recreation causing game console sales to tick-up dramatically.

Factories reacted and began producing chips to match the changed demand. They actually increased manufacturing to the point where by January 2021 YOY sales were up 13.2%. They still were not able to meet demand. So bad was the shortfall that Apple produced 10 million fewer iPhone 13s last year than it had planned to.

When Will the Chip Shortage Resolve Itself?

Today’s chips are far more complex than ever before. The first Intel (INTC) microchip contained 2500 individual transistors, today there may be as many as 30 billion transistors on a single chip. As complex and delicate as chips today are, the fragility of the related supply chains has been the main difficulty.

Creating a single microchip can involve from 10 to 100 different manufacturers working on the same exact semiconductor wafer. Effectively, one semiconductor may travel around the world a half dozen times before being complete and ready for the manufacturer. And every part of the process is critical to the final product. With transportation slowed and some factories closed with the pandemic, slowdowns, bottlenecks, and roadblocks were almost a certainty and still are a problem.

Taiwan Semiconductor Manufacturing (TSMC) has a hand in close to 50 percent of the world’s microchips. It has scaled up production efforts to meet the demand, but there is only so much they can do since so many other parties are relied upon. Any changes in production methods also are subject to testing and evaluation. This is especially important when it comes to chips used in new cars. In addition to the safety concerns, they need to endure under harsh conditions for at least ten years.

New car shortages, with reports of some selling for up to $20,000 over sticker, have begun to get government attention. The U.S. President has pledged $50 billion in funding over the next decade to incentivize chip manufacturing within U.S. borders. The European Union has committed €145 billion over the next few years for the same purpose. Meanwhile, South Korea has announced $450 billion of investment and China has pledged over $1 trillion. Factories to handle all of the intricacies take years. One of the largest current projects is a $12 billion TSMC facility that is due to open in Arizona in 2024. In the near future, the shortage is expected to continue, the recent outbreak of the omicron variant of Covid19 may delay production plans even further.

One more thing weighing on chip production for the next month is that China is said to be aiming for zero Covid infections prior to the 2022 Winter Olympics scheduled to begin February 4. The measures they are taking to achieve this have slowed current production of microchips and everything else.

Take-Away

Manufacturing computer chips is not remote work. The reasons for chip shortages for the products that are in high demand came about through a series of steps that included consumer behavior, meeting changed consumer demand, difficulty in shipping, and problems in bringing people to work. Now that it is a recognized problem, the amount of effort being undertaken to correct it may lead to a future where chips are in more than ample supply. That, however, is not likely to occur during the first two quarters of 2022. Chips are delicate and any new facility or process will necessitate thorough testing, the last thing a chip manufacturer needs is a recall.

Suggested Reading:

Will the Markets Continue to March Higher in 2022?

|

Why Small Cap Stocks May Outperform Large Caps in 2022

|

Ketchup Package Shortage and Covid19

|

Can 5G and Airport Safety Coexist?

|

Sources:

https://www.semiconductors.org/global-semiconductor-sales-increase-13-2-year-to-year-in-january/

https://www.techradar.com/uk/news/why-ps5-shortage

Stay up to date. Follow us:

|