Imagine a Bitcoin ETF With No Underlying Bitcoin Assets

What if investors finally get the opportunity to own a Bitcoin ETF or an overall cryptocurrency fund, and there is no actual cryptocurrency held within the fund? This may be the case with the first incarnation of any crypto ETFs. The SEC Chair, Gary Gensler, has been open to the idea of allowing crypto exposure in funds, however this may come with strings attached. Back in August, Gensler said that crypto ETFs that comply with the SEC’s strict laws on mutual funds and other federal securities laws could provide investors significant protections. With this, crypto ETF offerings appear to be on the horizon; what might their structure be, and how might they be better than investing in crypto coins?

Portfolio Position

As with other asset classes, an ETF pegged to the price of Bitcoin or other cryptocurrencies would be one way for brokerage account owners to transact easily. As an added benefit, customer broker statements could be consolidated. The positions can be held as part of an overall portfolio, including retirement savings without the need for a separate digital wallet. This would take some of the “difficulty” level out of owning a crypto asset, and it is likely that investor adoption would be as quick as other new ETF classes.

What Would be in the ETF?

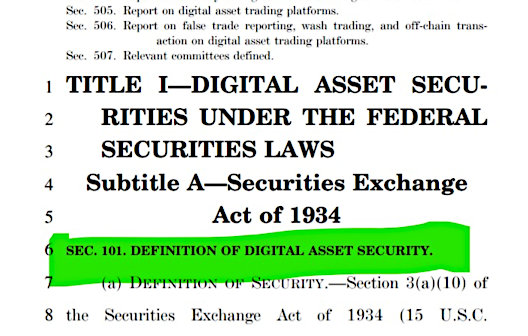

Following the path of other non-equity ETFs such as gold, a Bitcoin/crypto ETF could be created in two different ways. The first is with the underlying coins owned directly by the trust (or corporation) that underly the ETF. The other is the ETF mimicking the exposure and price movements of the assets by holding futures contracts that are impacted by price expectations and demand, (similar to many commodity ETFs). The SEC has been cautious thus far in regulating the crypto world. The new SEC head has been clear that digital assets are now in the process of being defined and categorized.

Chairman Gensler’s Crypto History

Gensler was appointed when Biden took office. Prior to becoming the Chair of the SEC, he taught cryptocurrency and blockchain technology at MIT. He also ran the Commodities Future Trading Commission (CFTC), which maintains general anti-fraud and manipulation enforcement authority over virtual currency cash markets, it is looked at as a commodity in interstate commerce. He understands crypto and realizes it has a place going forward.

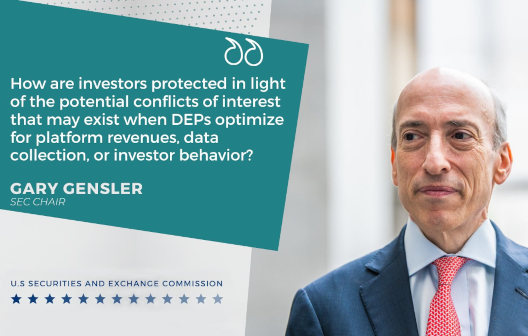

Strengths Weaknesses of What’s Held

Like most ETFs and Mutual funds using futures, a Bitcoin futures-based ETF would need to register under the 1940 Investment Company Act. This congressional act regulates the formation of investment companies and their activities. It would require fund managers to disclose more information and comply with stricter rules. From an investor’s standpoint, this can be seen as more eyes watching and protecting them against fraud or extra oversight that adds to management costs. Also, the Bitcoin futures derived ETF could offer additional protection because trading them requires investors, in this case, the fund, to put down cash on margin as collateral.

Futures prices generally track the underlying assets, but there’s always slippage, this slippage is usually greater for more volatile assets (like cryptocurrencies). A futures-based ETF also needs to regularly roll into the next contract. When the longer contract is trading at a higher price, this can be a drag on fund performance. Another drawback is ETFs can’t close to new money if they become burdensomely large (mutual funds can). If Bitcoin behaves in a way that causes a stampede of investors to want out at the same time, there could be liquidity issues. As with other traded securities, there could also be a trading halt on some exchanges.

Despite some of the above concerns, expectations are that if a Bitcoin or cryptocurrency ETF is approved, it is likely to be of the futures variety. SEC Chair Gensler has described the physical market this way, the “Wild West” that’s rife with “fraud, scams and abuse.” This categorization of physical crypto trading, from a person who knows enough to have taught crypto at the highest level, and previous head of the CFTC, says a lot. The extra level of scrutiny the CFTC provides along with margin to maintain the funds may push him to prefer the non-coin holdings. At least initially, while the market is in his mind prone to scams and abuse.

Take-Away

Cryptocurrency ETFs are expected to one day exist. While many stock market investors look toward blockchain stocks to gain exposure to digital assets, others would like to more directly gain exposure to the asset class with a Bitcoin fund or other cryptocurrency fund as a holding in their securities brokerage accounts.

The new SEC Chair is no stranger to cryptocurrency and seems amenable to finding a way to allow crypto funds. He is, however, well aware of his regulator’s role in protecting investors. There are two options, and many asset classes have funds comprised of both. Holding the coins, or creating the behavior of the coins using futures/options contracts. Based on the SEC Chairs’ own words, he doesn’t sound ready to allow outright purchases of coins in ETFs just yet.

Suggested Reading:

The Wells Notice to Coinbase May Be the Tip of the Regulatory Iceberg

|

What’s in the Surprise Cryptocurrency Bill?

|

SEC Investigates Digital Engagement Practices in Broker Apps

|

Contango, ETFs , and Alligators

|

Sources:

https://en.wikipedia.org/wiki/Exchange-traded_fund

https://www.cftc.gov/sites/default/files/2020/06/2020-11827a.pdf

https://www.barrons.com/articles/sec-gensler-bitcoin-etfs-51631305928

https://www.investopedia.com/articles/mutualfund/07/etf_downside.asp

Stay up to date. Follow us:

|