Ark Invest Has Filed for a Closed-End Fund that Invests in Private Equity

Ark Invest’s Cathie Wood, known for her investments in publicly traded disruptive and innovative companies, is branching out and creating a fund that invests in private equity. ARK filed documents for the fund with the Securities and Exchange Commission (SEC) late last week. The ARK Venture Fund (The Fund) will invest in disruptive, innovative companies that Ark CIO and ARK analysts believe should grow exponentially. The reasons for investing in these private companies is similar to the public securities held in ETFs managed by Ark, but The Fund will not be an ETF. Instead, The Fund will be registered as a closed-end fund that won’t focus on public securities. Other primary differences include the participant’s long holding period. And, unlike Ark’s other funds, not all that can invest in The Fund could otherwise copycat Ark’s investments by acquiring like holdings; this is because of restrictions placed on who can participate in private offerings.

|

THE FUND

The Fund is a non-diversified, closed-end management investment company that is registered under the 1940 Act. The Fund is structured as an “interval fund” and continuously offers its Shares. The Fund was organized as a Delaware statutory trust on January 11, 2022. The principal office of the Fund is located at 200 Central Ave., St. Petersburg, Florida 33701 and its telephone number is 212-426-7040.

The Fund’s investment objective is to seek long-term growth of capital. The Fund invests primarily in domestic and foreign equity securities of companies that are relevant to the Fund’s investment theme of disruptive innovation. The Adviser defines “disruptive innovation” as the introduction of a technologically enabled new product or service that potentially changes the way the world works. Under normal circumstances, substantially all of the Fund’s assets will be invested in equity securities, including common stocks, partnership interests, business trust shares, other equity investments or ownership interests in business enterprises and Private Funds. The Fund’s investments will include micro-, small-, medium- and large-capitalization companies. The Fund’s investments in foreign equity securities will be in both developed and emerging markets. The Fund may invest in foreign securities (including investments in American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”)) and securities listed on local foreign exchanges. |

From: SEC Reg. File 811-23778 (February 3, 2022)

Fund Details

Unlike open-end mutual funds and ETFs, a closed-end fund can’t create or redeem shares as investors decide to invest or redeem shares. Ark doesn’t plan to list its new Venture Fund on a stock exchange for public trading. Investors may cash out each quarter as The Fund purchases 5% of the outstanding shares, according to the SEC filing. This makes the new fund fall into the category of an “interval fund” because it has scheduled redemption periods. In addition to the restricted sell periods, investors may not be able to liquidate all of their holdings if many other investors are also looking to redeem shares since the amount of shares to be repurchased will only be 5%.

The nature of the underlying investments and the investor restrictions are more closely aligned than other ARK funds. This is because disruptive and innovative investments usually take time to play out, and tend to be volatile in the shorter term. It also reduces the need for The Fund to maintain a larger than desired cash (liquid) position. As it is not a fund to be actively traded, the managers can focus more on performance without having to cater to redemptions at inopportune times.

Preventing investors from selling their shares whenever they want reduces pressure on the fund to keep low earning cash available, or to sell

its holdings when prices are low. The fund is designed primarily for long-term investors and not as a trading vehicle, according to the filing. The more known cash flow will also make it easier for the fund manager to invest in illiquid or less liquid securities, such as those of private companies. According to the filing, the Fund also allows the manager to use leverage to help boost returns.

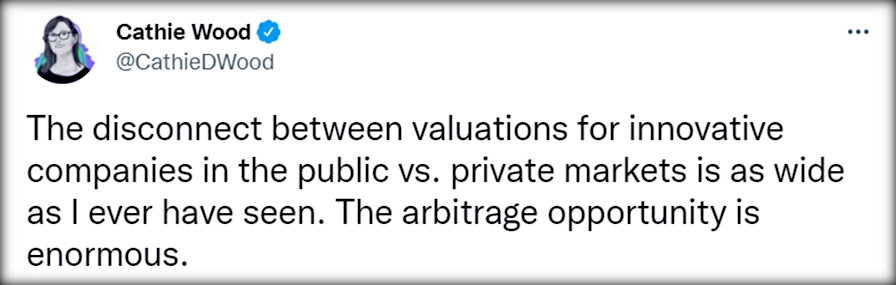

Twitter@CathieDWood January 18,2022

Purpose

Wood has noted she has seen that innovative companies have been given much higher valuations in the private market than in the public markets, where the risk of volatility is reduced. She believes there is an enormous opportunity to be found within the valuation differences.

The Fund allows participation for most retail investors and carries a minimum investment of $1,000. Private equity deals are often only shown to institutional investors and accredited

individuals. Most retail investors don’t check to see if they qualify to participate in these deals.

Take-Away

The ARK family of funds is growing to include a closed-end fund with restrictions on redemptions. The known redemption periods with maximum aggregate amounts investors may cash out could allow for management to better fine-tune their holdings. Alleviating the need to be liquid when the markets are down, or invest inflows when markets are up, could benefit fund performance.

ARK expects the Venture Fund will be open to investors two quarters after it is launched. The redemptions will be paid at net asset value, according to the filing.

Managing Editor, Channelchek

Suggested Reading

Why Michael Burry has Better Opportunity Than Cathie Wood

|

Who Gets to Participate in Private Offerings

|

Understanding Family Offices

|

Alternative Investments and 401(k) plans

|

Sources

https://www.sec.gov/Archives/edgar/data/1905088/000110465922011382/tm225314d1_n2.htm

https://www.thestreet.com/investing/cathie-wood-ark-etfs-continue-to-lose-ground

https://www.schwab.com/resource/interval-funds-the-facts-and-the-risks.

https://twitter.com/CathieDWood/status/1483742793432547328

Stay up to date. Follow us:

|