Adam Aron Explains the Reasons Share Conversion and Issuance is Good for APE Shares

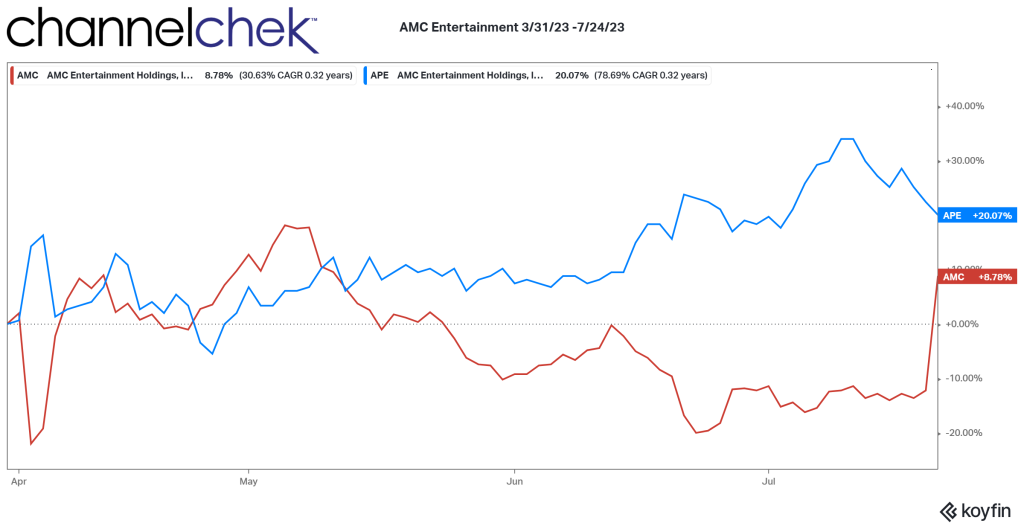

Meme stocks are getting attention again as the movie Dumb Money is set for release in late September, GameStop (GME) is implementing a strategy to use its stores as fulfillment centers, and AMC Theatres (AMC) has a court ruling on its APE shares that has added significant volatility, including a 67% upward spike after hours on Friday July 21. The AMC story is involved and likely to cause wide swings until resolved as investors wrestle with guessing what a new ruling means for the company’s financial strength, and whether the judge’s decision could be overturned on appeal or through shareholder approval.

The main source of the ongoing dramatic moves in AMC stems from its proposed APE shares conversion. These preferred shares were provided as a dividend with a 1:1 conversion feature. If/when converted to regular AMC shares, they will dilute the regular shares. When issued, APE shares were considered a brilliant financing mechanism and method to determine if any fraudulent units were used to create a naked short.

In late July a judge blocked the proposed settlement on AMC Entertainment Holdings stock conversion plan that would also allow the company to issue more shares. The stock had been depressed in anticipation of the additional shares that would have been created. With the thought that additional shares won’t be entering the market, common shares (AMC) soared, and preferred shares (plummeted).

The Delaware chief judge Morgan Zurn said in her ruling that she cannot approve the deal, which would provide AMC common stockholders with shares worth an estimated $129 million. The company was sued in February for allegedly rigging a shareholder vote that would allow the entertainment company to convert preferred stock to common stock and issue hundreds of millions of new shares. The investors who sued alleged AMC had enacted the plan to circumvent the will of common stock holders who opposed the company diluting their holdings.

Without the proposed settlement, common stockholders and preferred shareholders would end up owning 34.28% and 65.72% of AMC, respectively. Under the ruling, common stockholders and preferred shareholders would own 37.15% and 62.85%, respectively.

Judge Zurn wrote that while the deal would compensate common stockholders for the dilution, they had no right to settle potential claims by holders of preferred stock in this way. The settlement received more than 2,800 objections from shareholders, a level of interest Zurn called “unprecedented.” She said “AMC’s stockholder base is extraordinary,” adding many “care passionately about their stock ownership and the company.”

But what appears short term to be good for common shares, may actually weaken the financial position of the company over time according to AMC’s chairman. In an open letter, AMC chairman Adam Aron wrote, “What may not be clear to AMC’s shareholders is that if the company is unable to convert APE shares, AMC will be forced to issue significantly more APE shares to cover its upcoming cash requirements.”

Aron explained AMC is burning cash at an unsustainable rate and warned that an inability to raise capital could force the company into bankruptcy. Selling more shares would enable it to pay down some of its $5.1 billion in debt. These financial matters are further complicated by the writers and actors strike which according to Aron could delay the release of movies currently scheduled for 2024 and 2025.

Managing Editor, Channelchek

Sources:

https://twitter.com/CEOAdam/status/1683215965608189954/photo/1

https://courts.delaware.gov/Opinions/Download.aspx?id=346020