Clearer Future for Low-Carbon Investments

U.S. Automakers just committed to producing fuel cell electric, plug-in hybrid, and battery-powered EVs at a level where they would be 40% to 50% of sales eight years from now. In a joint statement, Stellantis (manufacturer of Chrysler/Jeep), General Motors, and Ford pledged voluntary compliance with targets set to be defined Thursday (August 5) by the Biden administration, which has committed taxpayer and other government support.

Roughly Half of all

New Cars Sold Next Decade

The car manufacturers said their actions “represent a dramatic shift from the U.S. market today.” While the automakers’ commitment is for alternate fuel vehicles to comprise 40% to 50% of sales, the U.S. President is expected to sign an executive order this week setting a voluntary target of 50%.

How a “voluntary” “order” is administered may be made more clear when presented. The order is believed to be non-binding for the manufacturers.

Cost of Non-Binding

Support

The infrastructure that will be needed in fewer than ten years is immense. EV charging stations, hydrogen distribution or point of sale manufacturing, and cleaner electricity to provide for both. The Detroit big three car builders said the aggressive EV sales goals could only be met with billions of dollars in government incentives, including consumer subsidies.

Separately, Hyundai supports the 2030 40%-50% EV sales goal. Toyota, which had always officially preferred a hybrid model, said in a statement, “you can count on Toyota to do our part.”

Investor Opportunity

In a June 17 press release, consulting firm AlixPartners forecasted investments in electric vehicles by 2025 could total $330 billion. As of now, electric vehicles represent about 2% of total global vehicle sales. Biden has, to date, called for $174 billion in government spending to boost EVs, including $100 billion in consumer incentives. A new bipartisan Senate infrastructure bill includes $7.5 billion for EV charging stations but no money for new consumer incentives.

Your Investment Portfolio

With hundreds of billions being reallocated and transferred to fulfill these aggressive goals, the opportunities for investors seem high.

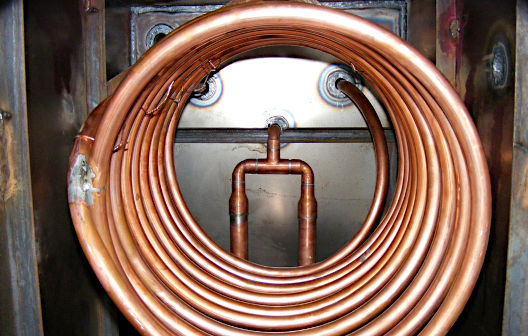

At the most basic level, this immense undertaking will include a need for more raw materials. Among mining stocks, investors in copper producers could be big beneficiaries as the metal is needed to distribute electricity from generation to charging stations, and also within vehicles. Silver which is used to build solar panels could also see more industrial demand. Lithium, cobalt, and other rare earth metals currently used to manufacture batteries will also be in higher demand. Although wind and solar power generation is expanding, it is not expected to create enough reliable energy. Therefore, companies that produce uranium could also benefit from increasing demand as more nuclear plants go online.

Direct manufacturers of necessary components would also benefit. Renewable Energy Magazine predicts $60 billion worth of batteries will be needed to meet the coming growth. This places lithium-ion high on the list of component manufacturers. According to USA Today, there are 42,000 charging stations in the U.S., but only 5,000 are considered “fast charging.” In comparison, there are 150,000 gas stations (according to API.org). There are large and small companies building charging stations; it may not come as a surprise that more than a few of them are recognizable companies that are better known for selling gasoline. Hydrogen fuel cells are currently a better solution than lithium-ion for distance or heavy cargo travel. Refueling, however, is even more challenging than recharging a battery. Manufacturers of fuel cells include start-ups and large industrial conglomerates. As with charging stations, the manufacturers that are going to see an erosion in one product while growth in another may not pay off to investors as significantly as smaller more focused companies. The technology to produce pure hydrogen and do it affordably and with low or no emissions is still in its infancy. Recent reports suggest existing gas mains can be used as part of a distribution system, owners of these lines would lose one product and gain another. Onsite hydrogen production may turn out to be the winning technology, to solve this piece of the puzzle.

Car manufacturers themselves will get an influx of taxpayer-funded subsidies. Additionally, if consumer adoption of new vehicles is high, sales may be rampant over the next decade. Conversely, if the infrastructure is behind the car makers’ timeline, buyers may wait, and automakers could find buyers unwilling to buy either the old technology or the new.

Take-Away

With change, there is opportunity. When government spending is involved, the opportunities could be even greater. The promise by car manufacturers to have 40%-50% of their sales electric by 2030 is a huge change in a very big industry an industry that touches many others. Even if partially fulfilled, many companies and fledgling industries will do well. Smaller, more focused companies have the greatest potential to “be the next AAPL.”

It’s easy to find and explore smaller companies in all the various industries affected by going to the company search bar here on Channelchek.

Suggested Reading:

Recipe for Higher Uranium Prices

|

Un-hyped Hydrogen Investments

|

The FOMC and Senate Help Copper Advance

|

Lithium-ion Battery Recycling Heats Up

|

Sources:

Stay up to date. Follow us:

|