The Power of Small Companies Highlighted in Today’s Biopharma Announcements

Business headlines surrounding Silicon Valley Bank and its customers may take some time to fade from the front page. In the meantime, looking past them, there are some positive news and developments. Two news items involve announcements by biotech/pharmaceutical companies this week. One is a deal you don’t have to dig too deep to find, Pfizer (PFE), the pharmaceutical behemoth, is looking to acquire Seagen (SGEN) for $43 billion. The second is a smaller deal and has been crowded off many newsfeeds. Provention Bio (PRVB) is expected to be purchased by Sanofi (SNY) a large French-based pharmaceutical company.

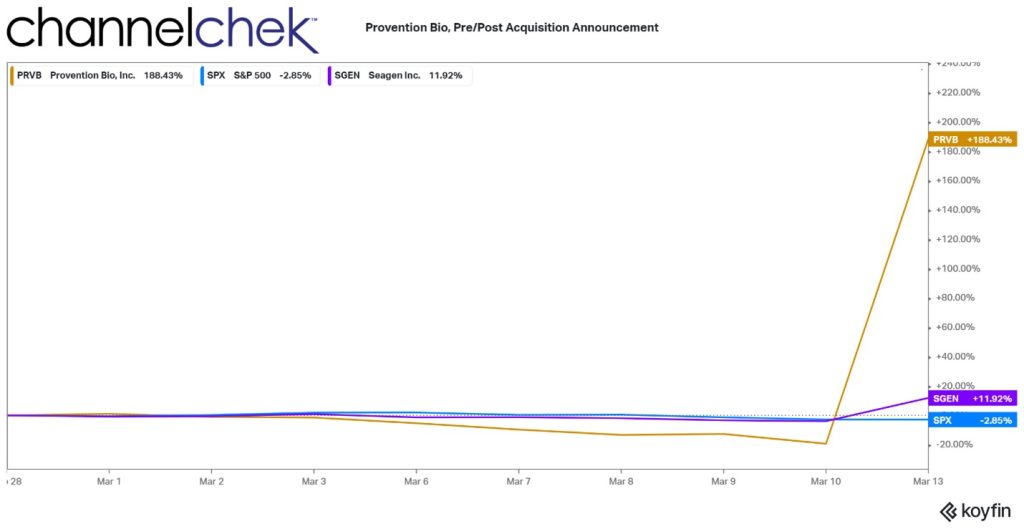

Seagen shares increased 17% in the first hour of trading after the Pfizer announcement, shares of Provention were up 258% the same morning after the Sanofi announcement. Below is a chart of the month-to-date performance of the two that are to be acquired.

The Power of Flying Below the Radar

Seagen is a borderline household name and has been a known acquisition target for some time. Just last July, Merck offered 40 billion for the company, this known interest in the company has kept the price elevated. Shifting the focus on the power of smaller, less talked about companies, they often have more potential for larger gains because they are less known. And while the numbers ($43 billion vs $2.9 billion) don’t make for compelling headlines, the numbers in the graph above demonstrate the impact can be far more compelling to investors.

The Provention Bio Deal

Sanofi and Provention Bio, a U.S.-based, publicly traded biopharmaceutical company focused on preventing autoimmune diseases, including type 1 diabetes (T1D), entered into an agreement for Sanofi to acquire Provention Bio, Inc., for $25.00 per share in cash.

Under the terms of the agreement, Sanofi will begin a cash tender offer to acquire all outstanding shares of Provention Bio.

The actual completion of the tender is subject to standard conditions, including the tendering of a number of shares of Provention Bio, Inc. common stock that, together with shares already owned by Sanofi or its affiliates, represents at least a majority of the outstanding shares of Provention Bio, Inc. common stock.

If the tender offer is successfully completed, then a wholly owned subsidiary of Sanofi will merge with and into Provention Bio, Inc., and all of the outstanding Provention shares that are not tendered in the offer will be converted into the right to receive the same $25.00 per share in cash offered to Provention Bio, Inc. shareholders as part of the offer. Sanofi plans to fund the transaction with available cash. Subject to the satisfaction or waiver of customary closing conditions, Sanofi expects to complete the acquisition in the second quarter of 2023.

Worth Noting

The largest pharmaceutical companies developed huge cash “war chests” during the pandemic era. While they are prudent and tactical when deciding to grow through acquisition, the earnings on much of their cash stockpiles relative to inflation may be erosive to the pool’s purchasing power. Additionally, many small pharmaceutical and biotech companies that are developing tomorrow’s next wonder drugs are short the cash they need to drive their R&D to the finish line, and then to market. It’s presumed these companies are quietly being reviewed for a possible fit by big pharma. Big pharma’s current patents are also being eroded by time as each day they approach patent expiration. This is added incentive for these large companies to be actively looking for future merger and acquisition targets.

Smaller companies, for their part want their progress and potential more known. It is only through being known, and the more broadly the better, that investors of all types understand the work they do and the potential along with the risk they hold. These companies often hire the service of impartial, highly credible equity analysts to provide details of the pipeline and the successes and challenges of the company. This company-sponsored research provides investors with a third-party window into the company. The window is, at times, as basic as the idea that investors need to know enough about the existence of a small company to want to own shares. Greater investor interest typically increases liquidity which could help the company continue moving forward and developing its products.

Channelchek houses quality company-sponsored research. For Life Sciences company-sponsored research covered by FINRA licensed Sr. Analyst Robert LeBoyer visit this link. For Healthcare Services Sr. Analyst Gregory Aurand visit this link.

Managing Editor, Channelchek