Unbalanced Hype in the Markets Surrounding the “Unknowable” Could be Costly

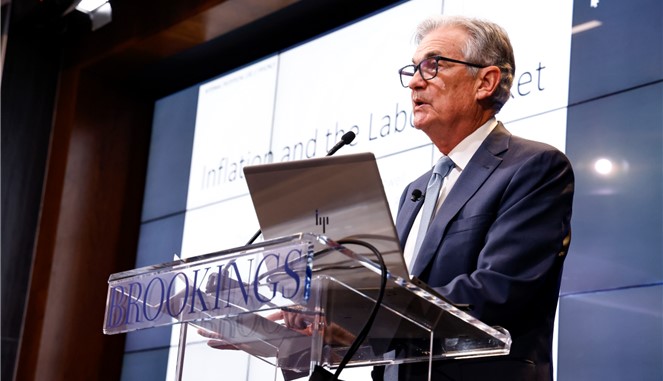

“It’s not knowable” if there will be a recession in 2023, said Fed Chair Jerome Powell recently. A month earlier, after the last change in monetary policy, he said it is easier to go too far and bring the economy back than to do too little and then have to then tame stronger inflationary pressures. The most recent CPI number shows a trend that policymakers want to see, but it likely is not a number the Fed will pivot off of. After all, for the Consumer Price Index (CPI) to rise by 6.5% YoY means that cost increases experienced by consumers are running more than three times higher than the Fed’s stated target. Of course, the rate increases have not had time to work their way into the system; they haven’t even fully worked their way into the interest rate markets.

An Alternative Way to Look at Tightening

Relatively speaking, a hypothetical decline in your investment account by 2% last month may be an improvement in performance if it had been down 3% the month before. But if your need to meet your goals is a positive 8%, then you still have a lot of work to do in order to consider yourself successful. The same for the Fed policymakers. US dollar buying power is losing ground, just not as quickly as it was. And since the inflation rate is also subject to what savers and investors call ‘the miracle of compounding’ and the jobs market is strong, the Fed has motivation and room to keep pulling money from the system and raising interest rates – the sooner, the better based on Powell’s statements.

And it may be that they are willingly driving the economy into reverse to stop service costs from rising as quickly, and bring inflationary wage increases lower. Workers, after all, have not reacted to the possibility of a recession. They still feel at ease leaving their employers at a very high pace, and the layoff rate is still near a record low. To demonstrate, the economy added 223,000 in payroll employment in December (well above the 200,000 forecast — and the unemployment rate came down to 3.5%, below the 3.7% forecast. This may not seem high compared to the gains just after the pandemic opening, but it is quite steamy.

Take Away

The financial news has been full of ‘pivot’ headlines for months. When it comes to the “unknowable,” it is important to remind oneself, as an investor, that very few things are a done deal until they happen. The big picture is the bond market has not priced itself in a way that fully reflects the Fed tightening of short-term rates. This represents difficulty for the Fed, and the Fed is looking for slower economic growth.

Throughout 2022, the big question while consumers faced increasing prices was whether the Federal Reserve would push the economy into decline. Their intent, after years of excessive stimulus, is to slow economic growth to bring inflation down. The Fed hiked interest rates seven times during 2022, its aggressive tactics caused some to worry about job losses and a recession. With an inflation rate that Powell thinks is more than three times too high, investors must consider that the Fed has different goals than investors but the same as consumers. We are all consumers, we’re not all investors.

As a final note, what the year brings is unknowable. There are always stocks going up, going down, and tracking sideways. A 2% inflation rate is easier to beat in terms of performance as an equity market investor than a 4% or 6% level. What the Fed will do, they likely don’t know for sure themselves; our job, that of investors, is to not get caught up in hype. And the markets and the media are breeding grounds for hype.

Paul Hoffman

Managing Editor, Channelchek