The Asset Allocation Role of Microcap Stocks

Investments in microcaps and even the smaller end of small-cap stocks have historically received less attention than mid-cap and large-cap companies. Noteworthy reasons for this include less scalability for large fund managers; also, microcaps often have less coverage on the research side. Another impactful oddity is that many worthwhile small companies lack a position in the “investment style box.”

Scalability, research and analysis, and not fitting neatly into the recognized style box all depress interest, awareness, and understanding of companies. Astute, individual investors can take advantage of the less talked about microcap sector and at the same time add diversification that could help key measures of performance.

Scalability

Imagine you’re an equity portfolio manager and have found the “secret sauce” to stock picking. You’ve backtested to 5 years with a $100,000 portfolio and the results have averaged 60% winners with a 42% average gain, and the losers and breakeven trades average just a 6% loss. With these results, your firm seeds an account with $10,000. and you now begin to test your methodology with live “ammo.” The methods driving your results include a mix of using trusted third-party fundamental analysis on small company stocks, then a common chart setup to find an entry point. After six months, your results aren’t quite as favorable relative to benchmarks as they had been, but still well ahead of the major market indexes.

The money management firm you work for has been reviewing your results and has now decided to create a fund around your investment style. They market the microcap fund heavily and over time, with very good performance, it attracts a few hundred million in assets.

With each large inflow to the fund, you find fewer opportunities because your original tested methods had a smaller universe, basically being nimble with large dollar amounts is more difficult. Even worse, whereas scaling into a position over the course of a few days with $2,000-$5,000 allowed decent price execution, doing the same with $75,000 – $250,000 or more tends to lift the stock price to the point where the trade may no longer be feasible if the size is available at all.

Unlike markets where having more to spend gives you price preference or negotiation power, with smaller, less liquid companies, small investors have an advantage. Your $10,000 “test” account with a 5% limit per name was able to outperform consistently. The exact same methods but with 100x the assets or more have watered down the success rate dramatically.

This is why there aren’t hundreds of funds run by large companies in this sector. The supply and demand issue would be too challenging. And since the big firms are the ones that push to get on TV to discuss their performance while they bombard you with paid ads, it is their products and stock picks that get far more coverage. This doesn’t mean there aren’t very successful small and microcap money managers, they don’t often get invited on to a major financial TV show as they aren’t big advertisers or even in need of adding hundreds of millions to any one of their portfolios.

Available Equity Research

The firms that do manage funds and portfolios that specialize in smaller companies rely on their understanding of the company fundamentals. This is another reason individuals may not be taking full advantage of smaller companies – the average investor simply doesn’t find much information written on them, and most investors aren’t capable of digging into the firm’s business model, their financials, or inviting themselves to meetings with management.

So, an asset management firm with in-house analysis can find stocks that are necessarily overlooked by large funds because of scalability, yet the stocks that represent great value can achieve outsized performance. They are the players with “better” information and opportunity.

Fortunately for those transacting for smaller pools of money or even themselves, if they understand the value of investing in less correlated (vs. S&P 500) assets, they can now find well-presented research from veteran analysts with bulge-bracket firm pedigree. This top-tier analysis, coupled with low or no-cost brokerage trades, makes small company stocks well worth considering for a prudent portion of an overall asset mix.

Style Box

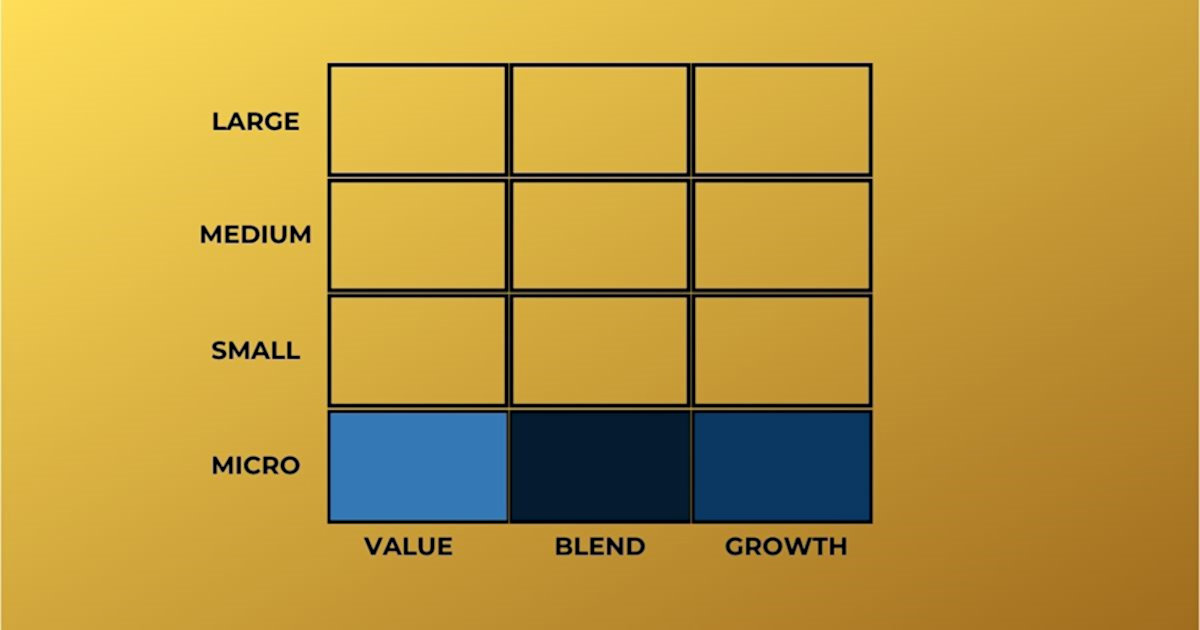

Since 1992 Morningstar and others that adopted the style box grid have taught investors to think of nine different categories of stock market investing. At the time Morningstar served those evaluating mutual funds, so the simplicity of boiling it down to a few columns made investor choices easy. However, the reduced complexity is oversimplified and ignores important sectors that can’t easily be scaled up into large mutual funds. There is a reason people are always encouraged to “think outside the box,” for many, it isn’t natural to look beyond what is put in front of them. If we round the style box up to a dozen options we could allow investors to visually see how they could improve diversification.

Fortunately, much of this is changing as self-directed investors become more sophisticated and begin to recognize that unless they’re allocating tens of millions of their own money, the case for microcap investments, both as a standalone asset class and for the role it can play as a less correlated allocation is compelling and worth considering as research becomes more widely available.

Take-Away

Individuals and small money managers aren’t being exposed to an option that may well suit them. The reasons are that media coverage is far less, the effort to uncover opportunities may be a bit higher, and they may be mentally stuck inside of a style box that was designed to serve the mutual fund industry. Resources available for people to manage their own portfolios have grown alongside technological advances. Not all resources are of the same quality, but top-tier equity research and execution of trades now can be found without a cost to individuals.

Channelchek is a resource for exploring opportunities in the small and microcap space. With a growing list of companies covered by top-tier analysts, it is worth regular visits to the website to help find ideas to enhance and diversify your portfolio outside of the very dated box.

Managing Editor, Channelchek

Suggested Reading:

|

|

Money Supply is Like Caffeine for Stocks

|

IRA Investments and Small-Small Cap Stocks

|

|

|

Small-Cap Names in a Big Crypto Market

|

Managing Investment Portfolio Risk

|

Source:

https://en.wikipedia.org/wiki/Morningstar_Style_Box

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|