Image Credit: Marco Verch (Flickr)

Safe Haven Comparison During Downturns, Bitcoin vs. Gold

The jury is still out on whether bitcoin is a safe haven portfolio holding versus more traditional assets like gold, bonds, or even real estate. The world’s first cryptocurrency would seem to meet the criteria that would make it a logical non-correlated asset. These include independence from central bank policies, being a store of value, and it has an established deep market, but it has not been put to the test. Bitcoin history is too short; there are not many data points from which to assess expected future behavior.

Correlation to Stocks

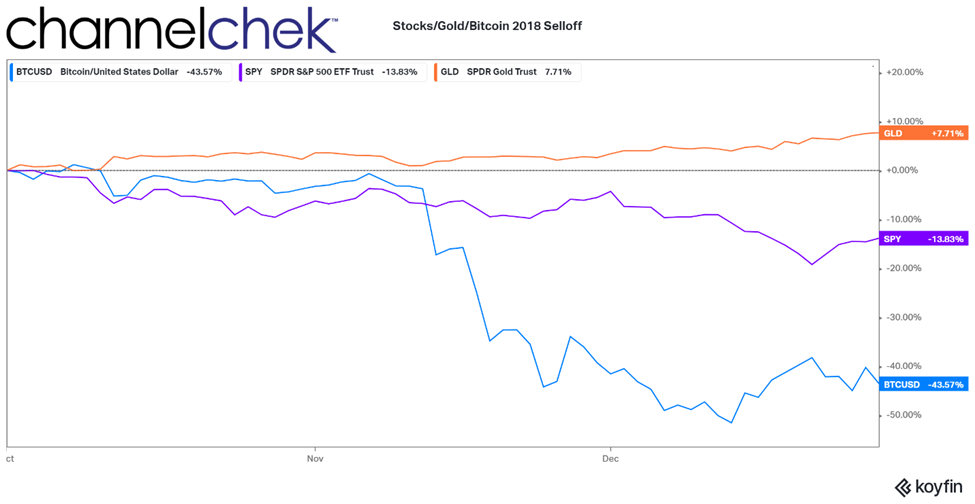

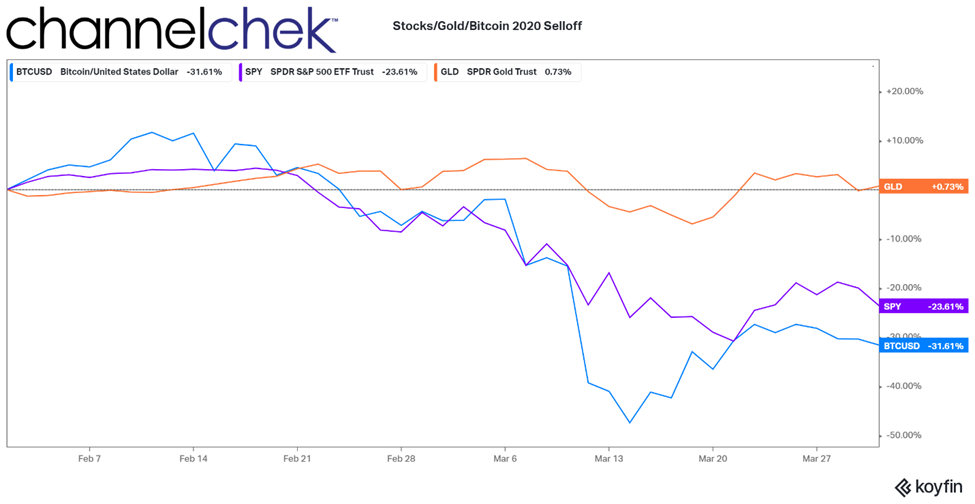

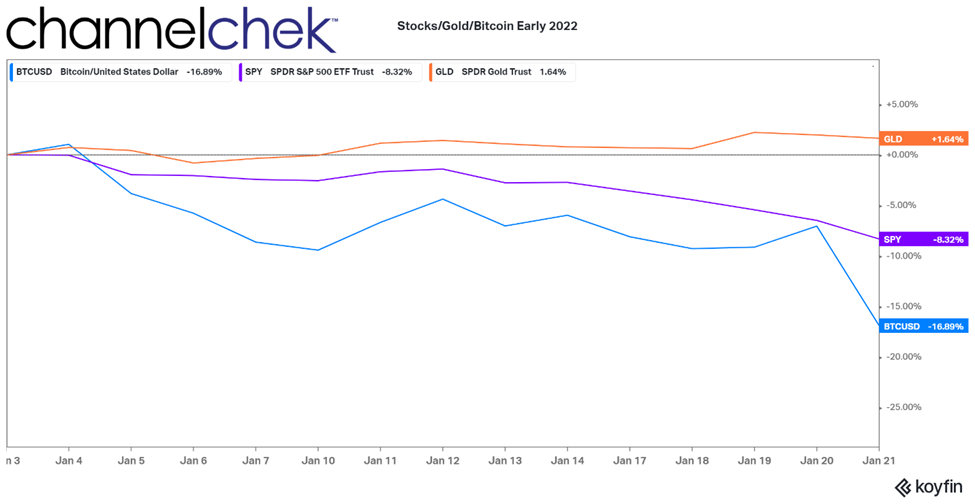

Recent history does provide some insight as to whether bitcoin or gold is more effective during extreme market weakness. The following three charts provide a helpful visual of the comparative performance of bitcoin, gold, and the S&P 500.

The chart above is of the last three months of 2018. The market sold off sharply November through December in reaction to a U.S. trade war with China, the slowdown in global economic growth, and concern that the Federal Reserve was raising interest rates too fast. The price movement shows that when the market sold off over 13% in just three months, bitcoin moved in the same direction and suffered more than three times the loss (43%). Portfolios holding assets that closely tracked the price of gold were able to mute the negative performance of the equity portion because during this period gold moved higher by more than 7%.

A little more than a year later, the markets sold off in reaction to the novel coronavirus that placed uncertainty in every aspect of people’s lives and every corner of the economy. This second chart shows that when the market sold off by more than 23% for different reasons than in 2018, bitcoin again moved in the same direction and exceeded equities losses. Gold during this time remained virtually unchanged. This provided portfolios holding the asset class less of an impact from the movement of stocks, bitcoin, or any other asset held.

The stock market started off 2022 reacting to a change of thinking on how long the Fed would keep monetary policy extremely accommodative. Through January 21st, stocks are down 8%. Once again following in the same direction. Bitcoin has fallen by more than twice that of equities. For its part, gold is up over 1%, having the effect of providing a safe haven for equity investors that bitcoin did not provide in either this down period or any of the other two that came before it.

Take-Away

Diversifying a portfolio means that you spread risk by holding assets that move independently based on their own factors. A non-correlated portfolio doesn’t swing for home runs, it aims to win by performing more consistently over time. The question of whether bitcoin or younger cryptocurrencies help diversify a portfolio will be answered better as more experiences present themselves over time.

The statistical evidence available today suggests that gold investments as an uncorrelated asset are superior to bitcoin by a wide margin based on the very few times the market has sold off sharply since the birth of cryptocurrencies.

Managing Editor, Channelchek

Suggested Reading

Will Gold Continue to Outperform in 2022?

|

Capturing More Performance with Gold Prices Rising

|

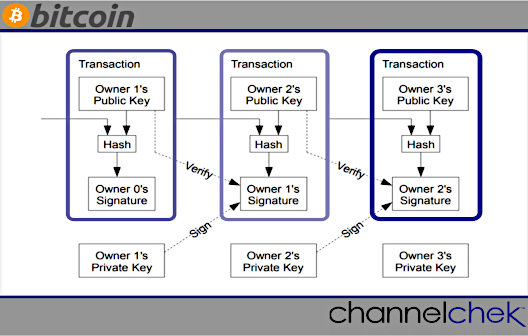

Has Bitcoin Lived Up to its Original Vision?

|

Cryptocurrencies in 2022, a View from Academics

|

Sources

https://www.wellsfargo.com/financial-education/investing/why-diversify-your-portfolio/

https://www.investopedia.com/terms/s/safe-haven.asp

https://www.sciencedirect.com/science/article/pii/S1544612320304244

Stay up to date. Follow us:

|