Image Credit: "thöR (Flickr)

Reconciling Marijuana Revenue with Marijuana Company Losses

What if the world’s largest cannabis producer by sales is also among the marijuana businesses with the largest losses? Should it concern investors in this newly sprouted sector that the company they are waiting on to grow is growing sales, but net profit is always red? Many investors are now scratching their heads and checking their patience with the largest company in this sector.

Tilray, the largest cannabis company by sales, reported revenue rose to $168 million for the quarter ended August 31, 2021. This is over $50 million higher than the year-earlier period. At the same time, the company reported its quarterly net loss widened to $34.6 million, approximately $13 million more compared to a year ago.

Income Statement Highs and Lows

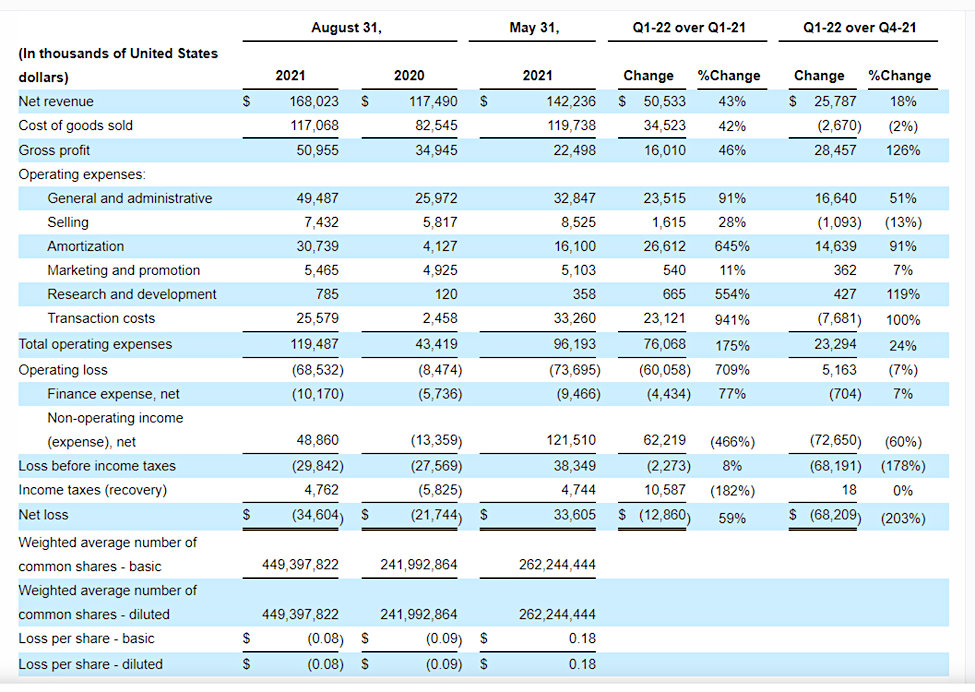

If you look at a company’s Income Statement, the top line is Net Revenue, it’s sometimes labeled “Sales” or “Net Sales” As the entry title suggests this is all incoming money from goods sold, and it’s before all costs. How much of this is left after expenses determine “Net Profit” which is reported on the below example using Tilray’s Income Statement as Net Loss.

Tilray income Statement (as reported October 7, 2021)

Below the net revenue number is Cost of Goods Sold; these upfront raw material costs are immediately subtracted from revenue. Expenses include running the business, selling expenses, depreciation costs (amortization), marketing costs, product development, and in this case also include a high Transaction cost. After deducting all expenses, just before the double line, the statement provides the company’s “Net profit”, or in the above case Net Loss. For Tilray, this number is a negative $36,604,000.

What’s More Important,

Revenue or Profit?

The first step toward profit is revenue, so revenue is very important — if a company isn’t growing revenue while the market for its product is growing, they are falling behind in market share. In rapidly growing markets, it is not uncommon for there to be more investment in building the business infrastructure, which could include expensive transactions to buy assets in other markets or verticals.

As a longer-term investor, you want management to have a vision that takes advantage of expected realities. A recent example was this past Monday when Tesla reported. The market saw another industry that was non-existent before 2008 have its largest producer turn a profit. Tesla, since it was just a seed in Elon Musk’s mind, had not turned a profit selling cars until last quarter. In many ways, the EV industry is like the cannabis industry. The potential for the future looks extremely promising, but only for those that grow big enough, fast enough to survive the competition.

The lifecycle stage of an industry is a key consideration on whether investors should be concerned with negative bottom lines. It’s expected that fundamentals in terms of more open markets and easier transactions that the cannabis industry will experience growth well beyond its current pace. With this, companies in the sector are expected to have big improvements in revenue every year but operate at a loss. They are investing aggressively to lay the groundwork for the future.

As an investor, your main question is whether you have confidence in the industry, and do you have confidence in the way the company is investing in their future for the stockholders.

Understanding and agreeing with management’s vision for the company and whether or not they are delivering on that vision provides the best answer as to whether an investor should be concerned that a company hasn’t reported a positive net profit.

Source: Press release dated October 7, 2021

-Tilray CEO explains building momentum growing market base.

If investors understand the company’s strategy and vision and believe that it will eventually reach an inflection point to become sustainable, and increasingly profitable, then the stock will attract more attention and could outperform even if earnings are negative.

Take-Away

Losses for young companies in fledgling growth industries are common. Investors should have different expectations at the early part of any industry’s lifecycle. Negative earnings on their own can be deceiving. Realistic future potential is why most investors get involved. You want forward-looking, visionary management. Investors in companies at this stage often rely more on cash flow statements for corporations investing in themselves that show strong revenue growth. Weak cash flow may create difficulties for management, whereas one might be able to discern a positive economic reality if there is solid cash flow.

Investors not in tune with the fundamentals presented in a company’s quarterly report may look to see if there are well-qualified equity analysts covering the company they’re interested in. Channelchek is a no-cost resource for research and analysis from top-ranked equity analysts covering growth industries.

Future Research Analysts

Each year Noble Capital Markets, Channelchek, and generous sponsors hold the Channelchek College Equity Research Challenge.

We invite students to compete for high cash prizes awarded to the student and the student’s college – plus an offer for an internship at the largest company-sponsored research provider in the U.S.

Who can compete?

You don’t have to be a finance, accounting, or major in a related field to understand that up to $7500 for you, and an additional $5,000 to your school can be quite helpful. If you are fully matriculated and interested, you likely qualify.

Suggested Content:

Schwazze – C-Suite Interview with CEO, Justin Dye (video)

|

Driven by Stem – Virtual Road Show Replay (video)

|

Sources:

https://www.investingdaily.com/analyst/scott-chan/#archives

https://en.wikipedia.org/wiki/Tilray

https://www.newcannabisventures.com/cannabis-company-revenue-ranking/

Stay up to date. Follow us:

|