Image Credit: Katheryn Mai (RCI Hospitality Holdings)

Where are Consumers Most Likely to Spend Their Leisure Budget?

Leisure stocks had a few false starts after the difficult time endured during the heart of the pandemic. While the group as a whole may have risen significantly since the initial lockdown-inspired sell-off, many leisure activities that keep people close to home are benefitting from completely lifted restrictions across the 50 states. World events being what they are, air travel, cruises, and business hotel stays are still not fully recovered. Rising costs of everything may also keep personal recreation to categories that don’t break the budget. This includes restaurants, theme parks, museums, and outings enjoyed by the whole family like bowling. It also could include doing something with friends designed for more for adult tastes.

Individual Stocks

Many of the investment articles written today conclude by pointing the reader toward an industry and then listing ETFs that are within that industry. On the one hand, an ETF adds diversification as the investor could gain exposure to over 100 different fund holdings. On the other hand, many sectors have subsectors that trade quite differently. As an investor, you may feel bullish about one or more subsectors, and not as enthusiastic about the others. An ETF, by design, could also expose you to subsectors you’re less than bullish toward. This is why many advisors and self-directed investors shun the ease of picking a fund and instead build their own portfolio. They can weight it more heavily toward their own market expectations. The changes to industries during the pandemic and now post-pandemic in many instances, make a solid case for stock selection over fund selection.

While at NobleCon18 in April, I attended two management presentations by public companies that fell solidly in the leisure, (play-at-home) category. Both caught my attention because they were financially strong with feasible plans for growth. They were both 100% open for business with little to suggest that this would change.

The first is the largest owner of family bowling outlets in the U.S., and the other owns sports bars and adult entertainment nightclubs. I knew very little about the inner workings of either business but found the presentation

by RCI Holdings (RICK), and the presentation

by Bowlero Corp. (BOWL) eye-opening in that these were not businesses that would have been on my investment radar. Yet, if one believes that consumers have a pent-up demand for leisure activities but they are less likely to travel, then each of these may continue to benefit as post-covid investments.

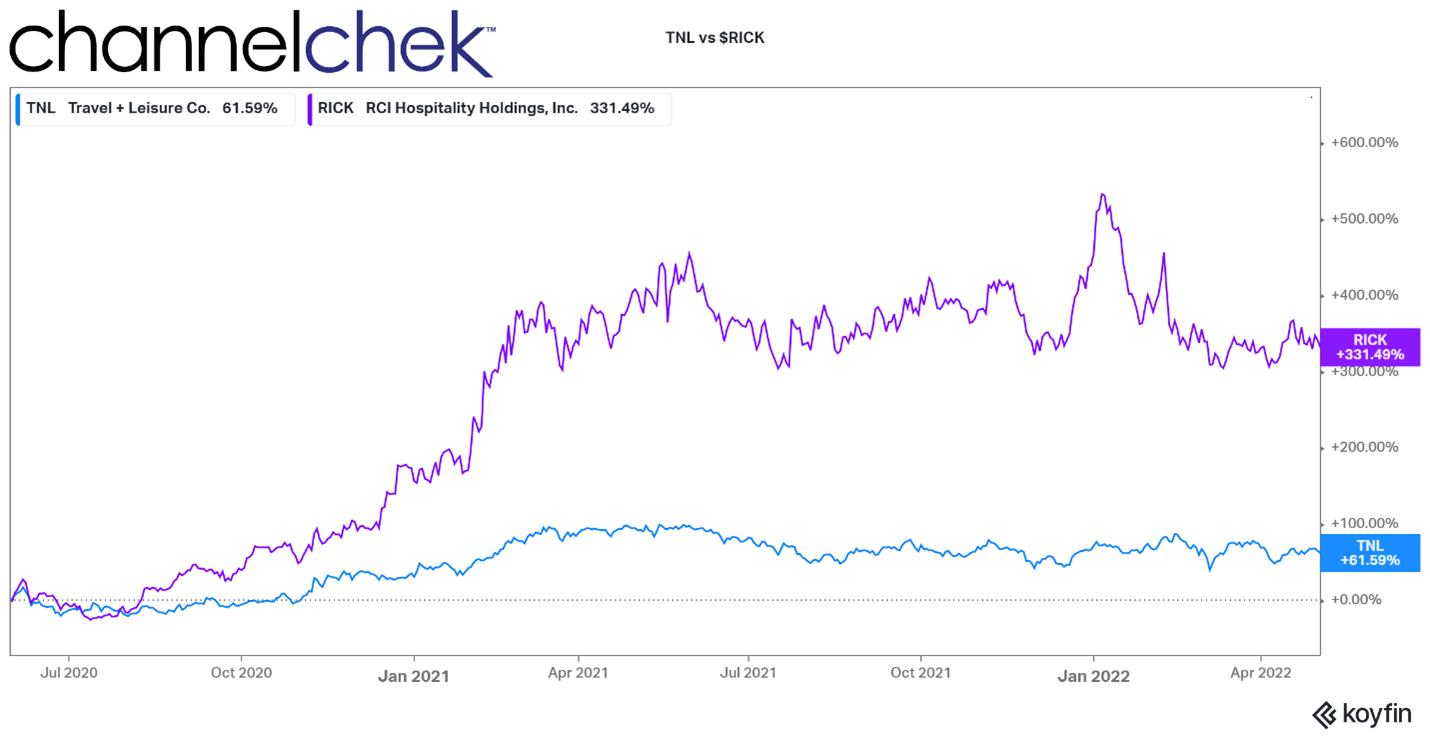

Source: Koyfin

Using the performance of ticker symbol $TNL as a proxy for travel and leisure, we find that while RICK, which represents a small sector of leisure began to climb relatively quickly in mid-summer 2020, it is now still trading at the level it was a year ago. The entire travel and leisure sector has also been trading sideways, but 270% lower than RICK, while the market overall has been pushing lower this year.

Eric Langan CEO of RCI Holdings gave the audience of investors a presentation on his company, (a video replay is available below). RICK is divided into two business units, Bombshells Sports Bar Restaurant, and their adult entertainment nightclubs that include such names as Rick’s Cabaret, and Scarlett’s.

The company is growing its hospitality, property development, finance, and free cash flow. In his presentation, Langan explains what they target for cash flow and how they put it to use to continue growing and producing higher cash flows.

Their nightclub sales were up 55% last year and according to the presentation, not all clubs were even open until the second half of 2021. One of the interesting nuances of the business is that there are barriers to entry in the adult entertainment world. Typically the owner has to be grandfathered at the state or local level as governments are typically hesitant to issue new licenses. This RICK in an ideal position to acquire existing clubs, with known track records to overlay their club management expertise and systems.

In the Sports Bar segment, the company owns the real estate, this helps in financing. The franchise Bombshells is approved in all 50 states. A restaurant build-out could cost $6 million or more — they are always looking for locations.

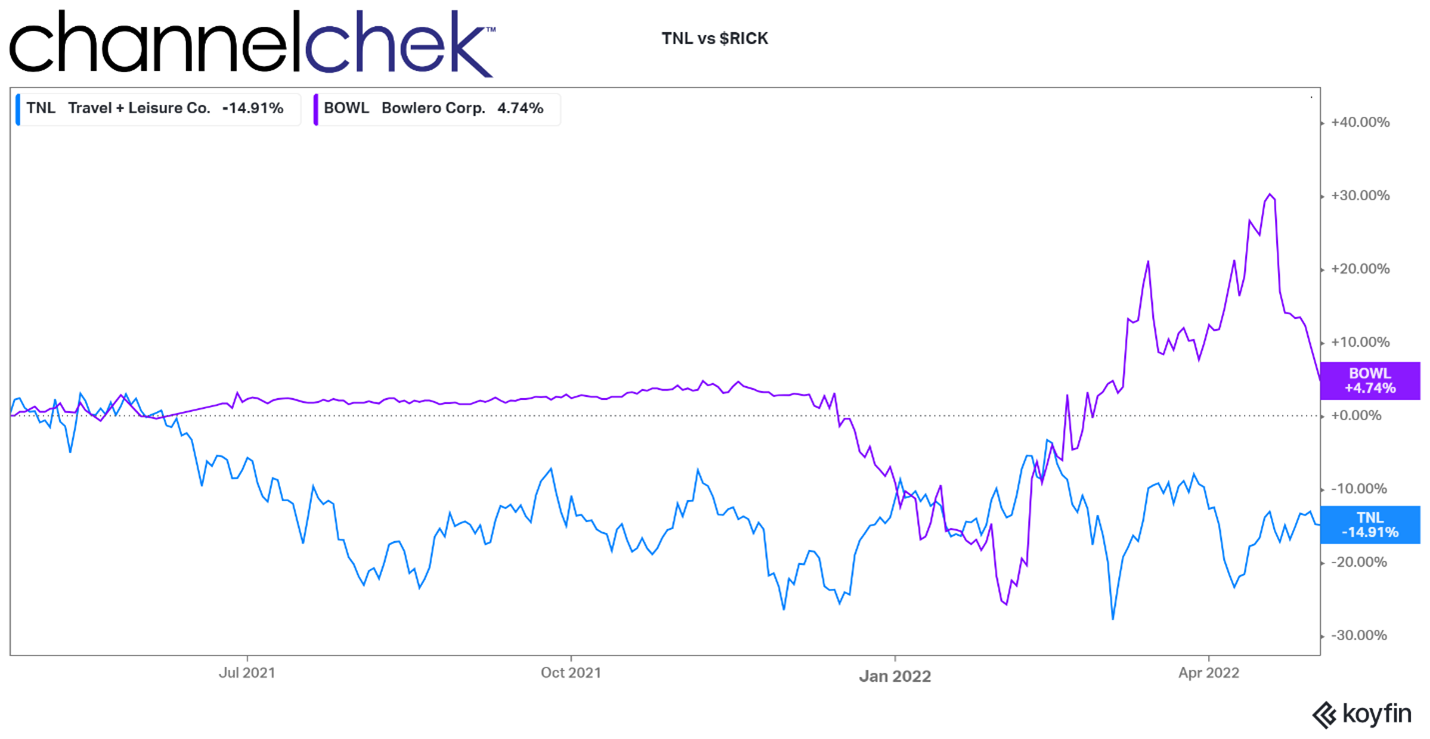

Source: Koyfin

Tom Shannon, CEO of Bowlero spoke about his company, (a video replay is available below). BOWL went public via SPAC in December 2021. He discussed how two-thirds of the revenue of their outlets has no cost of goods sold. The company controls 8% of the U.S. market share of bowling centers. He explained this opens ample opportunity to expand as most of the other 92% are mom and pop owned. BOWL can acquire them, give them a facelift and still be more efficient and profitable with their proprietary systems.

Bowlero also owns the Pro-Bowlers Association. While the PBA Tour adds $1 million to earnings, he says it saves them $10 million on marketing, as they get exposure and growing enthusiasm for bowling through the tour.

There are many other interesting aspects of this company that is best explained by the company, for a link to the video replay, scroll down to watch.

Take-Away

Over the past couple of years, there was the pandemic-related move toward stay-at-home tech, while hospitality, leisure, and travel were dead. There is now pent-up demand for leisure, those activities could include more stay-near home recreation as there are still reasons that individuals and businesses may keep travel plans to a minimum. For this reason, a pure leisure ETF would only provide a portion of the exposure to near-home recreation.

Reviewing stocks, reading the research on Channelchek, and reviewing company presentations could provide actionable ideas, not just in leisure, but in other investment sectors as well.

Managing Editor, Channelchek

Suggested Content

RCI Hospitality Holdings (RICK) NobleCon18 Presentation Replay

|

Bowlero (BOWL) NobleCon18 Presentation Replay

|

Stay up to date. Follow us:

|