Image Credit: The Noun Project (Flickr)

Investors are Not Alone Interpreting Surprise Stock Moves and Future Direction

During periods of rising stock market prices, investors often overreact to positive news on a company while ignoring negative. Similarly, when markets are faced with an ongoing negative mood, investors are quicker to hit the sell button. When Investors all try to rush through the gate at the same time, either buying or selling, creates a sharp move that typically shows it was overdone and reverses at least somewhat. There is no guarantee of a reversal or so-called bounce, but anyone involved in the market has seen it often enough to know it happens; knowing where the high or low will be before any turnaround is what makes investing or trading tricky.

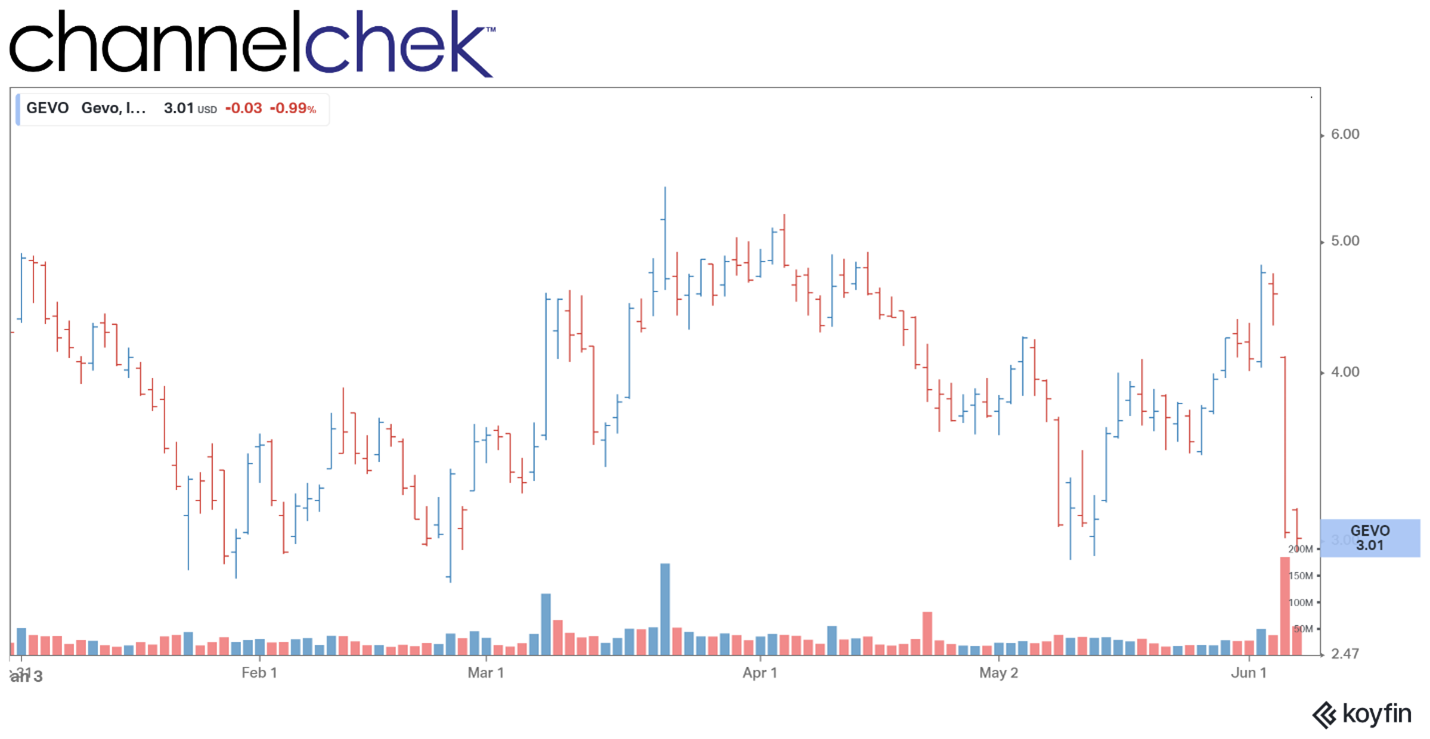

On Monday (June 6), investors observed that Gevo (GEVO), which is popular among renewable liquid hydrocarbon fuel investors and ESG rated stocks, reacted negatively to an announced capital raise. The raise involved issuing shares rather than non-equity or other non-dilutive alternatives.

The specifics of the agreement with various institutions is to sell 33,333,336 shares of common stock at a $4.50 per share, the approximate previous closing price. The shares would also have warrants exercisable at $4.37 per share. The offering is expected to provide $150 million in proceeds to the company. The bulk of the raise can be considered for investment as projects, including the Net Zero-1 Plant that will break ground this year are expected to cost $900 million.

On the day of the announcement, the company stock dropped over 30%, and despite newer news items related to Gevo, including Japanese Airlines entering into a contract to purchase fuel, or the collaboration with Google Cloud to enhance Gevo’s bio-fuel analysis by helping to measure and verify the efficacy of its biofuels via full lifecycle sustainability data tracking, investors are not yet showing that they are impressed.

Source: Koyfin

There are more companies that are not mentioned by the primary news outlets than those that are. When one of these companies makes an announcement and the discussion is sparse, it may be time to evaluate your own thoughts, maybe crunch your own numbers, and peruse research reports from those that know the company extremely well and are experts in the industry. This is how value can, at times, be uncovered. While everyone else is reading the same rehashed headline, digging into an expertly written research note by an analyst that covers the company can help shed light on what others may be missing. Or to validate or invalidate one’s own understanding of pros and cons.

Gevo is a company with equity research coverage by analysts at Noble Capital Markets, this research is published and downloaded by institutions via expensive subscription services such as Bloomberg terminals and Factset, these services aren’t practical for the average individual investor. But the same research is also available at no cost to subscribers of Channelchek.

A research report on Gevo was published and emailed this morning to Channelchek subscribers.

Time will tell if the sell-off was and is an overreaction. But the stock is currently trading at $3.03, down another half percentage point from yesterday’s close after falling over 30%. In the research note titled: Stock

Hit Hard on Equity Offering, Michael Heim, CFA, Senior Research Analyst wrote, “The shares of Gevo will most likely be volatile over the next few years until plants have been constructed and are generating cash.” He continued, “Investors should maintain a long-term perspective and focus on construction progress and not short-term stock price volatility. As such, we see recent weakness as a buying opportunity and maintain our Outperform rating and $16 price target.”

The research note contained other information and thoughts not found in traditional media and not permitted in an SEC-registered company press release. Further, previous research reports on the company are also available for deeper insight.

Take Away

Once again, time will tell where Gevo, or any other stock that has made a sharp move, is trading in a month, a year, or even five years, but having another set of expert eyes and knowledgeable insight helps an investor sort through any big reaction to news that is sparsely reported on by financial outlets that tend to focus on the same dozen companies. They simply don’t dig into smaller stocks that are moving.

Managing Editor, Channelchek

Suggested Content

Green Jet Fuels Succeed in a Couple of More Huge Milestones

|

Hydrogen About to Take to the Skies

|

Lithium Battery vs. Hydrogen Fuel Cell Vehicles

|

Is the Move Toward ESG Funds and Sustainability Fading?

|

https://www.channelchek.com/company/GEVO/research-report/3699

https://investorplace.com/2022/06/gevo-stock-plunges-on-150m-securities-offering-news/

Stay up to date. Follow us:

|