The RCEP Agreement Aligns Large Consumers and Producers of Energy While Excluding the U.S.

The Regional Comprehensive Economic Partnership agreement (RCEP) includes the world’s largest crude oil importer (China) and the largest liquified natural gas importers (Japan, China and South Korea). It also includes some of the largest oil and LNG exporters (Australia, Indonesia, and Malaysia). Increased energy trade activity among members leaves out the largest energy exporters; the United States, Saudi Arabia, and Russia.

On November 15, 2020, representatives of Australia, China, Japan, the Republic of Korea, New Zealand, and other countries signed the Regional Comprehensive Economic Partnership (RCEP) Agreement. RCEP will eliminate tariffs and quotas on over 65% of goods traded among the signing countries. It’s viewed as a significant step in stimulating the world’s economy which will counter a slowdown from the steps each country has taken related to COVID-19. The RCEP agreement covers a market of 2.2 billion people and 30% of the world’s GDP. India, an original participant in the deal negotiations, withdrew from the pact but is considering rejoining. The United States, representing the world’s largest economy, was not a participant in the agreement.

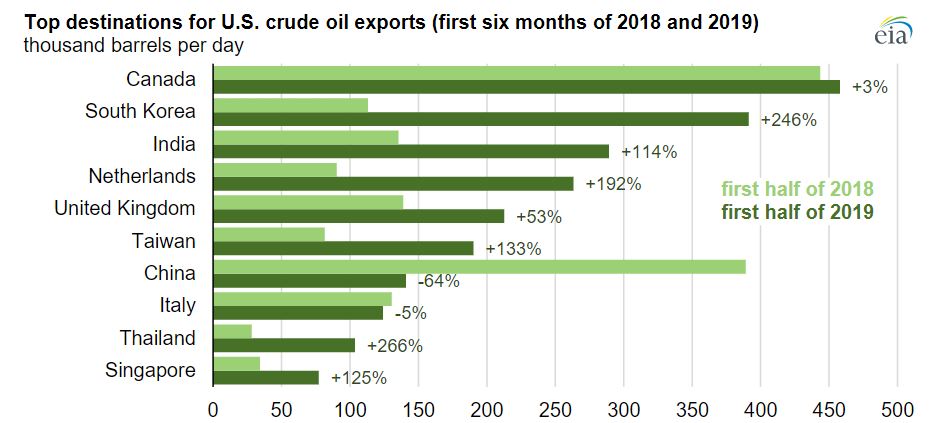

The agreement is viewed as negative news for U.S. oil producers. The U.S. has become the largest exporter of oil within the last few years. Most of U.S. domestic oil goes to Canada, with South Korea a close second. China was poised to become the largest importer of U.S. oil, that changed when tariff wars decreased trading activity with them. If Indonesia and Malaysia increase exports to China, South Korea, and Japan in response to the minimal tariffs, then U.S. oil exports may suffer.

Source: EIA

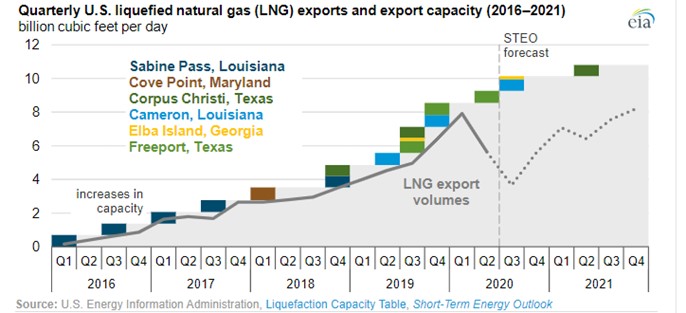

The U.S. natural gas market could be hurt even more than the oil market. In the last few years, companies have been building terminals to export domestic liquid natural gas (LNG). These terminals cost billions of dollars to construct and require decades of trade to reach breakeven. Much of the LNG exported from the United States is routed to Asian countries. As the graph below shows, the country’s ability to export LNG has increased 1000% over the last five years but is running below full capacity because of the pandemic. If Australian LNG exports to China, South Korea, and Japan increase in response to lower tariffs, U.S. LNG exporters could be hurt by even more idle capacity.

Domestic energy producers are already feeling a strain due to decreased demand resulting from the pandemic and the resulting economic slowdown. Companies are working hard to reduce costs to remain competitive. Several have merged to reduce overhead. Others have cut drilling budgets. A further reduction in demand for oil and LNG from Asian countries would further exacerbate the problem.

Suggested Reading:

Are we headed to Another Oil Collapse?

Contango and the Known Risk to ETFs

Do You Know a Student Who Could Use $7,500 for College?

Tell them about the College Challenge!

Source:

https://finance.yahoo.com/news/world-largest-trade-pact-could-150000944.html, OilPrice, November 30, 2020

https://asean.org/asean-hits-historic-milestone-signing-rcep/, ASEASN.org, November 15, 2020

https://compressortech2.com/u-s-lng-exports-down-by-half-in-2020/, CompressorTech, June 23, 2020